Loans subject to a moratorium on repayments decreased in January, but the drop was the smallest in the last five months as the accommodation and food services and wholesale and retail sectors extended their moratoria in the face of continuing low levels of economic activity.

The data emerges from the latest issue of the Central Bank of Malta’s Economic Update, which noted that the total value of loans subject to a moratorium on repayments in January edged down further when compared with December, decreasing for the fifth consecutive time since March 2020.

However, this drop in loans subject to a moratorium was the smallest in the past five months. When compared with a month earlier, the largest declines in value and volume terms were observed among households and in the real estate sector, which were partly offset by an increase in loans extended to the accommodation sector and the sector comprising wholesale and retail trade.

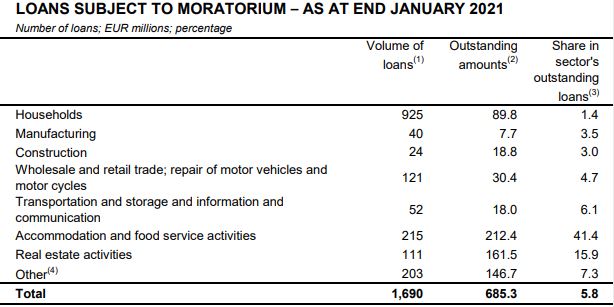

The drop, of €10.6 million, left a total value of €685.3 million, or 5.8 per cent of total outstanding loans to Maltese residents, spread over 1,690 loans.

The largest number of loans covered by moratoria was held by households, with the sector accounting for 54.7 per cent of the total volume of loans subject to a moratorium.

However, the outstanding value of loans subject to a moratorium of Maltese households fell to €89.8 million, or 13.1 per cent, of the total value of loans subject to a moratorium, equivalent to 1.4 per cent of outstanding household loans.

Meanwhile, the accommodation and food services activities sector held €212.4 million in loans subject to a moratorium. This is the sector most affected by the containment measures and, indeed, 41.4 per cent of the loans held by this sector were subject to a moratorium by the end of January.

The real estate sector held €161.5 million in loans subject to a moratorium, or around 23.6 per cent of such loans – equivalent to 15.9 per cent of the sector’s outstanding loans.

Moreover, as at end January, the wholesale and retail trade sector held €30.4 million in loans subject to a moratorium, making up 4.4 per cent of loans subject to a moratorium, or 4.7 per cent of loans held by the sector.

The facilty for a moratorium on bank loan repayments was introduced in response to the outbreak of COVID-19, as during the subsequent containment measures several businesses and households were faced with liquidity challenges.

The facility was extended in mid-January, bringing the total number of months a moratorium is effective to nine.

This week, Finance and Employment Minister Clyde Caruana announced more measures to alleviate the burden of loan repayments through the COVID-19 Guarantee Scheme, whereby businesses can leverage Government guarantees to receive State-subsidised loans for their working capital.

The definition of working capital has now been broadened to include loan repayments, with businesses now able to re-finance a portion of their debt with more advantageous rates.

db Group reports turnover of almost €100 million and record profit as it opens bond issue to public investors

This coincides with the launch of a €60 million bond programme to support the Group’s continued expansion

Celebrating success: stories from the team behind Finco Trust

The stories of Lee-Anne Abela, Kris Vella, and Maria Mamo reflect the values that continue to guide the firm forward

Malta’s public debt ‘very much in line’ with Eurozone rules – BOV Chair

The chairperson of Malta’s largest bank shrugged off the doubling in Maltese Government debt since 2019