As Malta’s economy gets back on its feet amidst loosening COVID-19 restrictions and with significant Government support, local firms are looking to the future with their plans to invest and hire more people.

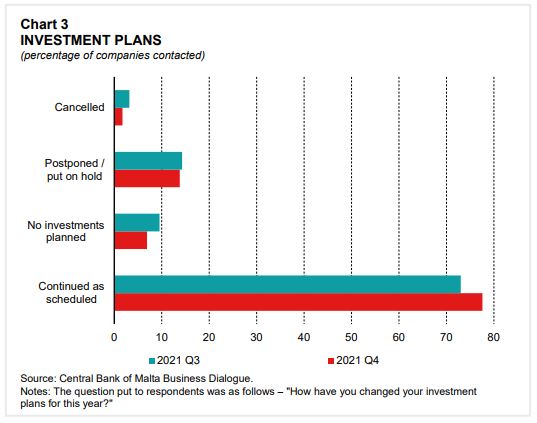

According to a survey conducted by the Central Bank of Malta among local businesses in the final quarter of 2021, most companies contacted (78 per cent) said they are moving ahead with their investment plans, a five percentage point increase over the responses registered in the preceding quarter.

However, some suggested that their investments were partly out of their hands due to the pre-commitment to projects planned far in advance or because work had already started.

Nonetheless, the results are a significant improvement over those recorded in 2020, when most firms interviewed had halted their investment plans due to the elevated level of uncertainty.

The share of companies that postponed or paused their investment plans remained unchanged at 14 per cent. Furthermore, only two per cent of the firms contacted cancelled their capital expenditure plans. These companies operate in the real estate and construction sector, which however also reported increased business confidence.

Finally, seven per cent of companies contacted in the last quarter of 2021 claimed that they did not have any investments planned, compared to 10 per cent in the previous quarter. All such firms operate outside the manufacturing sector.

Looking at investment plans by sector, 85 per cent of manufacturing companies contacted in the fourth quarter reported that they had continued with their plans while 15 per cent postponed their investments.

The share of firms reporting that investment plans have continued as scheduled was also high in the other sectors, with the lowest share, of 71 per cent, recorded in the services sector.

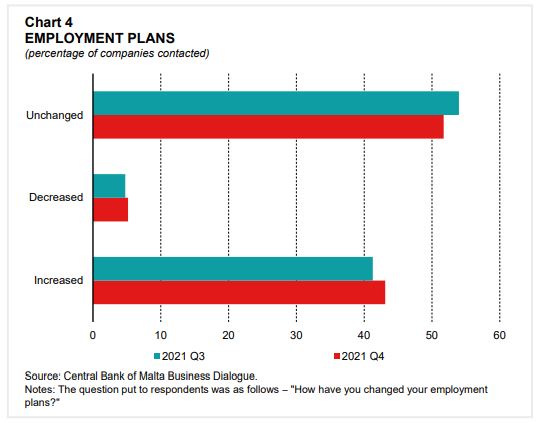

When asked about employment plans, the responses collected reveal a small increase in hiring expectations with 43 per cent of all firms interviewed planning to increase staff. This was slightly higher than 41 per cent in the third quarter, but significantly more than what was recorded in previous quarters.

The share of firms expecting to shed labour remained unchanged at five per cent.

These are mostly companies that are not replacing workers who voluntarily resigned. Accordingly, a net 38 per cent of respondents anticipate higher employment, marginally above the net 37 per cent recorded in the previous quarter.

The share of respondents that did not alter their employment plans decreased slightly to 52 per cent, from 54 per cent in the third quarter of 2021. This mainly relates to companies that are only recruiting for replacement purposes.

This overall picture conceals mixed developments across sectors.

A higher net share of firms planning to increase employment was recorded in the manufacturing and services sectors. Conversely, the net share of firms that plan to increase employment decreased in the real estate and construction and in the wholesale and retail sectors.

In particular, a net share of eight per cent of real estate and construction firms interviewed plan to increase their staff complement, sharply down from 57 per cent in the previous quarter.

This jars with reports that 2021 was a record year for property sales, which presumably would have resulted in more activity and work in the sector.

Similarly, the net share of firms within the wholesale and retail sector which replied that they plan to recruit stood at eight per cent, notably down from 33 per cent in the previous quarter.

On the other hand, there was a notable increase in the share of services firms that plan to increase the staff complement, with a net 65 per cent of services-oriented firms plan to recruit, sharply up from 35 per cent in the previous quarter.

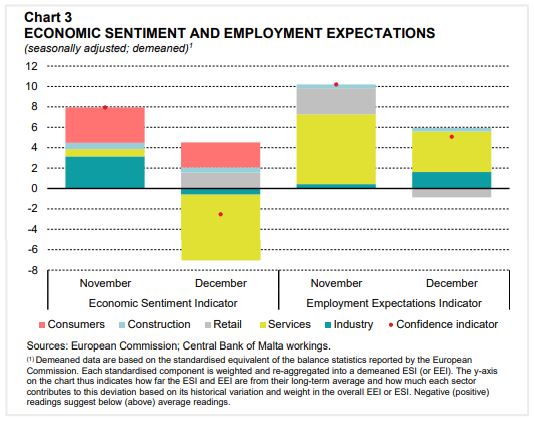

This surge in recruitment requirements reflects the recovery and increased optimism in this sector, said the CBM, although this seemingly contradicts findings from its recently published Economic Update for November and December, which stated that confidence within the services sector deteriorated sharply in December 2021.

This reflected firms’ assessment of the business situation over the past three months and their demand expectations.

In fact, there seems to be a decoupling of business confidence and demand for workers in the services sector, as is clearly shown in the below chart.

A higher net share of companies increasing employment was also recorded in the manufacturing sector.

Malta’s labour market remains a critical point of tension for businesses wishing to grow, with many finding that a historically low employment rate is preventing them from finding the right talent at the right price.

During the Budget 2022 speech, Finance and Employment Minister Clyde Caruana laid out a number of proposals to ease the staffing issue many businesses are facing, including incentives for student workers and reduced tax on overtime.

Malta’s online freelance workforce surges by 135% but still lags behind globally

According to a new report, Malta’s share of the global freelancers is now at 0.03 per cent

64% increase of people in employment since 2014, latest figures show

New data paints a clear picture of Malta’s expanding workforce over the last decade

Malta’s economic growth to remain strong in global context, but sectoral shifts raise productivity concerns

While Malta continues to outpace eurozone peers in GDP growth, sectoral data suggests a growing reliance on less productive industries