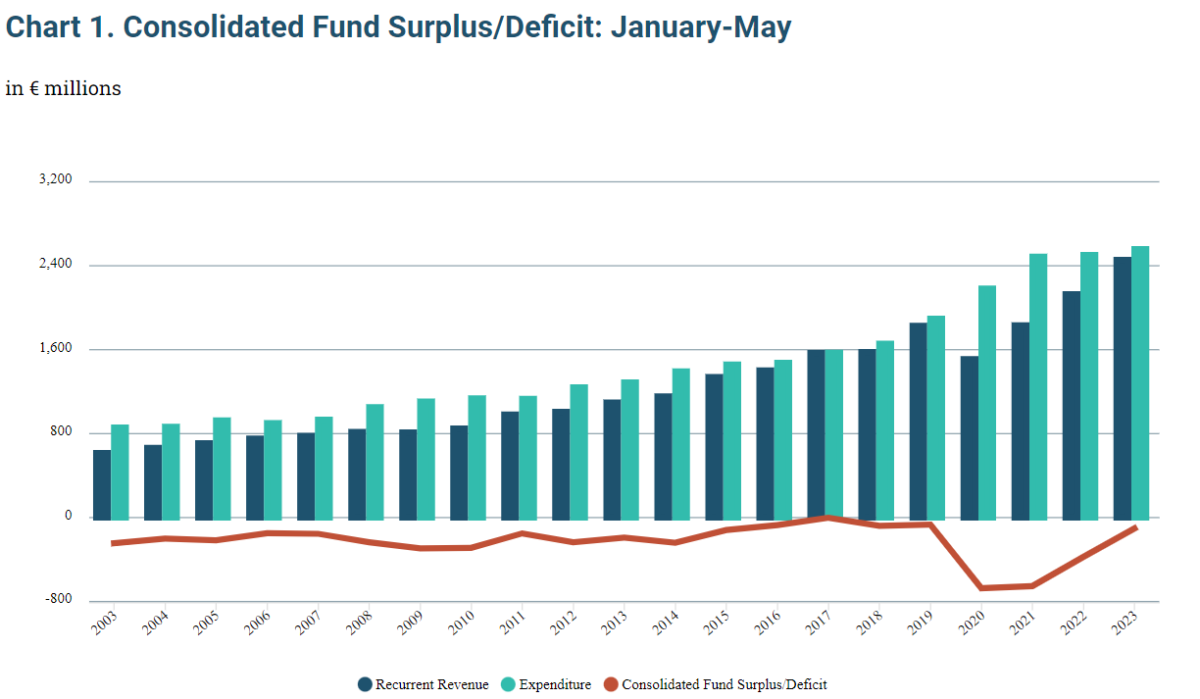

The Government of Malta’s finances have registered a deficit as of May 2023, following a brief surplus at the end of February. Despite growth in recurring revenues outpacing expenditure, it failed to bridge the gap entirely.

By the end of May 2023, the Government Consolidated Fund reported a deficit of €103.5 million, a decrease of €270.1 million from the €373.6 million deficit reported at the end of May 2022.

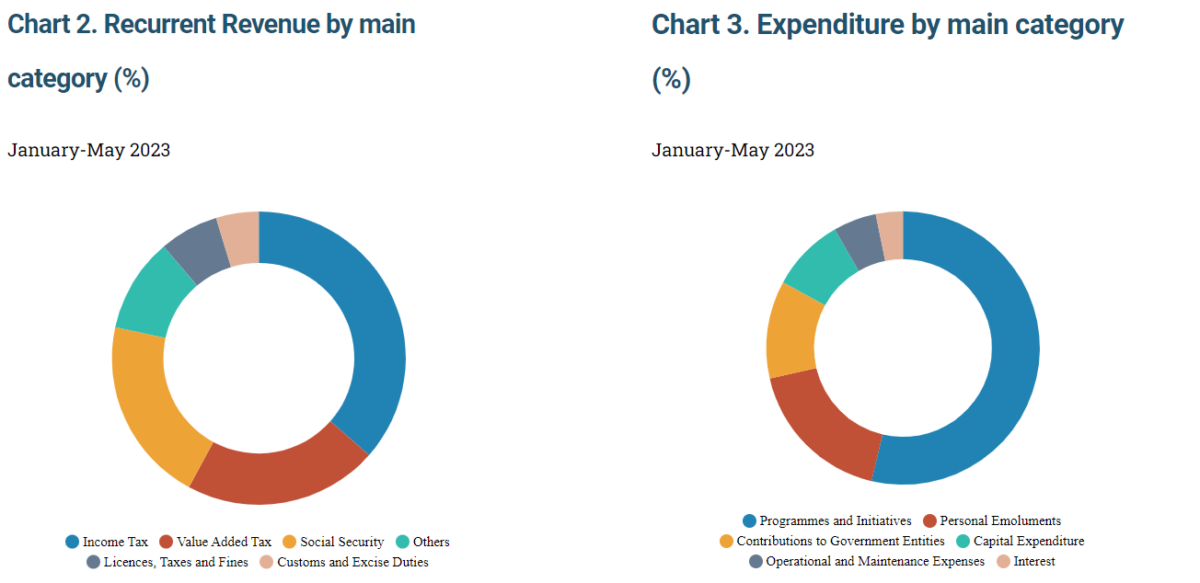

Between January and May 2023, recurrent revenue amounted to €2.455 billion, €325.4 million higher than the figure reported a year earlier.

The largest increases were recorded under income tax (€179.5 million), grants (€56.0 million), social security (€36.1 million) and value-added tax (€28.1 million).

On the other hand, the main drops in revenue were reported under Central Bank of Malta (€22.2 million) and dividends on investment (€2.6 million).

By the end of May 2023, total expenditure stood at €2.558 billion, €55.3 million higher than the previous year.

The main contributor to this increase was a €36.3 million rise reported under operational and maintenance expenses. Furthermore, increases were also recorded in contributions to Government entities (33.8 million) and personal emoluments (€22.0 million).

Conversely, expenditure in programmes and initiatives fell by €53.1 million.

The main developments in the category involved lower outlays towards COVID-19 assistance schemes (€107.5 million), economic stimulus payment (€48.2 million) and EU own resources (€42.1 million).

The drop in outlay was partially offset by increases witnessed under energy support measures (€66.1 million), social security benefits (€40.9 million), street lighting and other services (€9.8 million), tal-linja card (€9.4 million), temporary price stabilisation schemes (€8.2 million) and residential care in private homes (€7.5 million).

The interest component of the public debt servicing costs totalled €82.9 million, an increase of €12.8 million when compared to the previous year.

By the end of May 2023, Government’s capital spending amounted to €222.5 million, €3.5 million higher than 2022.

This increase resulted from higher expenditure towards property, plant and equipment (€10.2 million), national identity management systems (€4.8 million), digitalisation of health systems (€4.3 million), film industry incentives (€3.0 million) and upgrading of existing storm-water systems (€2.9 million).

On the other hand, expenditure towards road construction and improvements fell by €22.1 million.

At the end of May 2023, Central Government debt stood at €9.084 billion, an increase of €673.8 million when compared to 2022. The increase reported under Malta Government Stocks (€792.6 million) was the main contributor to the rise in debt.

Higher debt was also reported under euro coins issued in the name of the Treasury (€5.1 million). This increase in debt was partially offset by a decrease in the 62+ Malta Government Savings Bond (€100.0 million) and Treasury Bills (€14.1 million).

Finally, higher holdings by Government funds in Malta Government Stocks resulted in a decrease in debt of €9.7 million

BNF Bank and Mastercard partner to bring added value to Maltese customers

Collaboration enhances everyday banking through exclusive experiences, rewards, and innovative payment solutions

ĠEMMA launches new podcast series to make financial literacy accessible for all

New episodes will be released every two weeks and will be available across multiple platforms

Malta introduces new 15% tax regime for highly skilled professionals

Qualifying individuals are taxed at a flat 15% rate for an initial five-year period