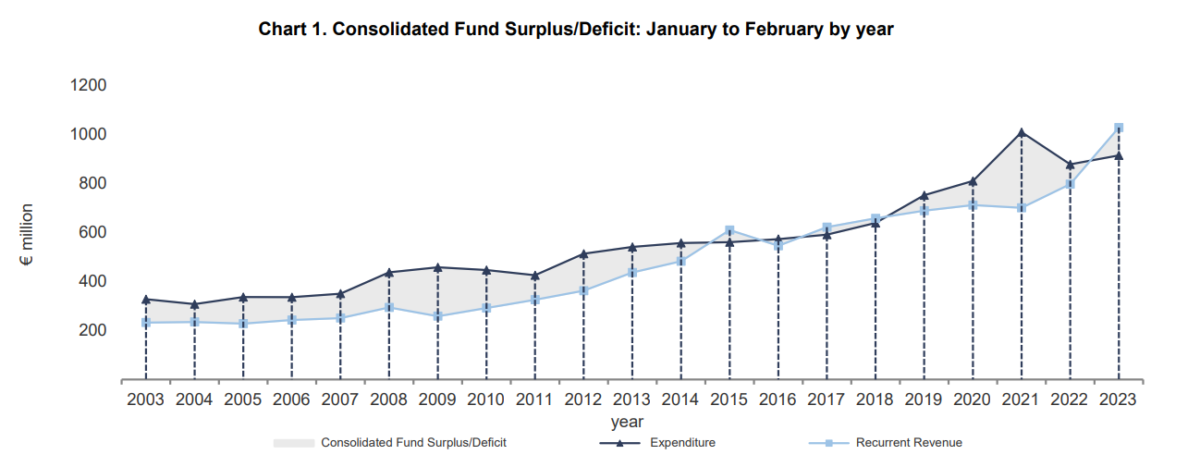

Malta’s Government achieved a surplus at the end of February 2023, as revenues reached a new high for the month. Total revenues increased by over 25 per cent compared to the previous month boosted by higher inflows of tax on income and wealth, indicating the normalisation of work activity after years of pandemic-related disruption.

By the end of February 2023, the Government Consolidated Fund reported a surplus of €114.2 million, an increase of a €194.9 million from the €80.6 million deficit reported at the end of February 2022.

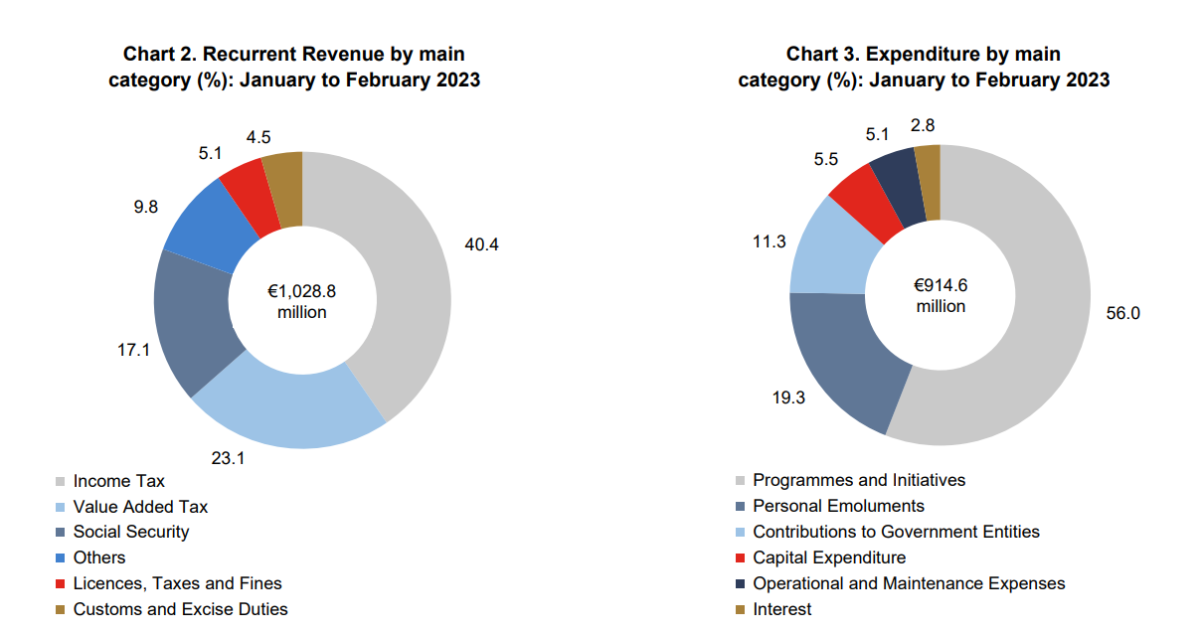

Between January and February 2022, recurrent Revenue amounted to €1.028 billion, 29 per cent higher than the €797.5 million reported a year earlier.

The largest increase was recorded under Income Tax (€155.4 million), followed by value-added tax (€31.7 million), grants (€30.1 million), miscellaneous Receipts (€6.8 million), licences, taxes and fines (€3.7 million), social security (€3.0 million), sales-services (€2.3 million), tents (€0.4 million), sales-others (€0.3 million) and reimbursements (€0.2 million).

On the other hand, lower revenue was reported under fees of office (€1.8 million), customs and excise duties (€0.7 million) and sales-goods (€0.1 million).

By the end of February 2022, total expenditure stood at t €914.6 million, €36.4 million higher than the previous year.

The main contributor to this increase was a €17.3 million rise reported under operational and maintenance Expenses. Furthermore, increases were also recorded under Programmes and Initiatives (€9.5 million) and personal emoluments (€9.5 million).

This rise in expenditure outweighed a decrease in contributions to Government entities (€0.2 million). The main developments in the programmes and initiatives category involved added outlays towards social security benefits (€13.2 million), medicines and surgical materials (€8.2 million), residential care in private homes (€7.9 million), street lighting and other services (€4.7 million), extension of school transport network (€3.7 million), chief medical officer medicines (€3.7 million), provision of spare capacity – electricity (€3.5 million) and Tal-Linja card (€3.3 million). This rise in Programmes and Initiatives was partly offset by a decrease under the COVID-19 pandemic assistance schemes (€39.0 million).

The interest component of the public debt servicing costs totalled €25.8 million, an increase of €2.7 million when compared to the previous year.

By the end of February 2023, Government’s capital spending amounted to €50.3 million, €2.3 million lower than 2022. This decrease resulted from lower expenditure towards road construction and improvements (€9.0 million). The drop in capital outlay was partially offset by increases witnessed under film industry incentives (€1.5 million), greening of public and private buildings (€1.5 million), information technology in Government schools (€1.4 million) and national identity management systems (€1.4 million).

The difference between total revenue and expenditure resulted in a surplus of €114.2 million being reported in the Government’s Consolidated Fund at the end of February 2023, a €194.9 million increase from the €80.6 million deficit witnessed in the corresponding period of 2022. This difference mirrors an increase in total recurrent revenue (€231.3 million), partly offset by a rise in total expenditure, which consists of recurrent expenditure (€36.1 million), interest (€2.7 million) and capital expenditure (-€2.3 million)

At the end of February 2023, Central Government debt stood at €9.28 billion, an increase of €886.4 million when compared to 2022. The increase reported under Malta Government Stocks (€781.2 million) was the main contributor to the rise in debt.

Higher debt was also reported under Treasury Bills (€237.5 million) and euro coins issued in the name of the Treasury (€5.3 million).

This increase in debt was partially offset by a decrease in the 62+ Malta Government Savings Bond (€99.9 million) and foreign loans (€0.1 million). Finally, higher holdings by Government funds in Malta Government Stocks resulted in a decrease in debt of €37.5 million

Top 5% of taxpayers responsible for one-third of all income tax paid in Malta

On the other hand, the bottom third of income earners pay just 1.7% of all income tax generated

The Malta Institute of Accountants prepares for its 2024 Anti-Money Laundering Conference

Held at the Radisson Blu, St Julians, this latest AML Conference promises to bring exclusive insights on new procedures

Eurozone interest rates to remain unchanged

The European Central Bank noted that price pressures remain persistent