Euro area household real consumption per capita and real income per capita increased by 12.1 per cent and 4.3 per cent respectively in Q3 2020 when compared with Q2, according to a Eurostat report on Thursday.

The EU’s statistics arm, Eurostat, has released data on non-financial sector accounts for Q3 2020.

The data, which comes from detailed seasonally adjusted quarterly European sector accounts, illustrates a promising quarter, with increased consumption and income illustrating some recovery after the economic devastation of Q2.

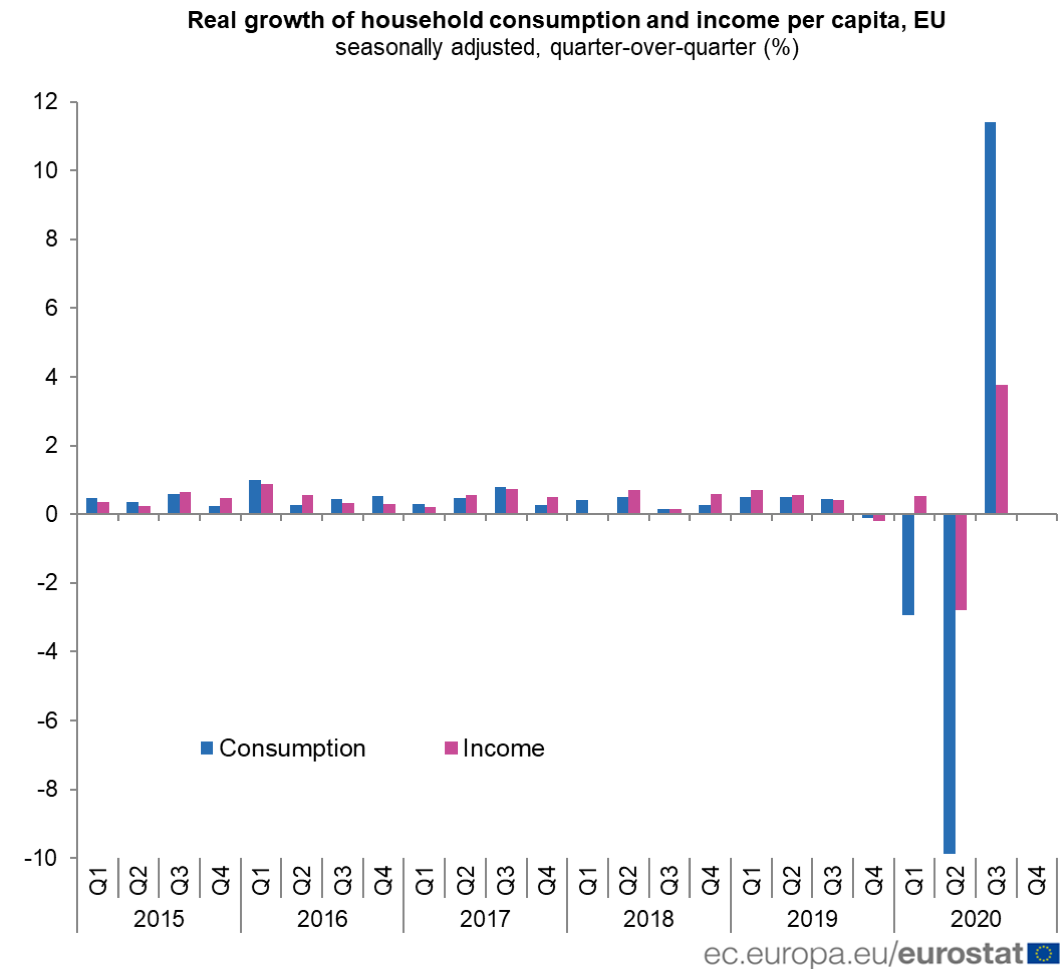

In the EU, household real consumption per capita increased by 11.4 per cent in Q3 2020, after a decrease of 9.9 per cent in the previous quarter.

EU household real income per capita increased by 3.8 per cent in Q3 2020, after decreasing 2.8 per cent in Q2.

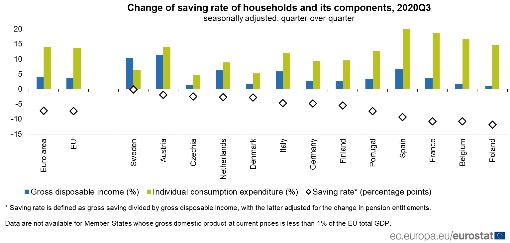

The increased real income reflects an increase in household gross disposable income, which increased by four per cent in the euro area, and 2.8 per cent in the EU.

According to the report, however, household savings rates decreased significantly in the euro area and the EU. The decrease in the saving rate, by 7.2 per cent in the euro area, and 7.3 per cent in the EU, is largely down to the rebound in consumer spending. In Spain and France, for example, consumer spending increased by 19.9 per cent and 18.7 per cent respectively.

The statistics reflect a fairly positive economic outlook in Q3 2020. Eurostat reports also show that unemployment dropped during Q3, with 22.1 per cent of all people who were unemployed in the EU during Q2 entering employment.

WATCH: Rare torrential rain in Dubai wreaks havoc and causes major disruption

Flooding hits shopping malls, destroying stock

Spain to end ‘golden visa’ scheme over property market impacts

While countries are slowly banning the practice, Malta remains firm in keeping the scheme alive

Xiaomi electric vehicles delivery might be delayed by four to seven months

The company introduced a special version of its new model and gifted fridges as part of its campaign