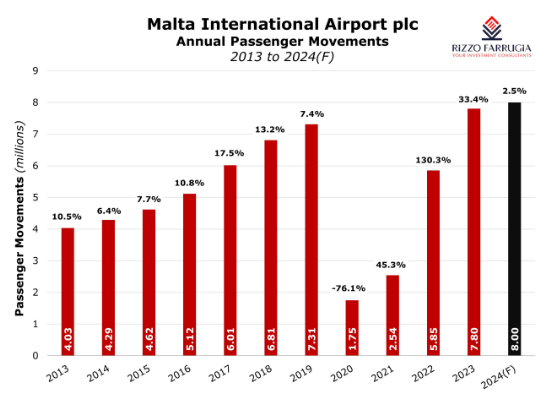

During last week’s press conference, the CEO of Malta International Airport plc Alan Borg described 2023 as a fantastic year. With an absolute record of 7.8 million passenger movements which represents a growth of 6.7 per cent over 2019 levels, few can contradict such a statement from the CEO.

The actual traffic results for 2023 are exactly in line with the latest projections published by MIA in early November. This was the second time that the company upgraded its forecasts during the year as a result of a much stronger-than-expected recovery in passenger volumes. At the start of 2023, MIA had initially anticipated 6.3 million passenger movements for the year but this was first upgraded to 7.2 million in early August and to 7.8 million in early November.

MIA’s CEO highlighted that passenger movements registered record levels on a monthly basis from March 2023 onwards despite increased air fares and the high levels of inflation. Mr Borg argued that the very rapid recovery in passenger traffic from the severe impact of the COVID-19 pandemic between 2020 and 2022 is testament to the resilience of the sector.

The growth of almost 500,000 passenger movements in 2023 compared to the pre-COVID record in 2019 is equivalent to the average monthly throughput during the winter season. In fact, almost 530,000 passenger movements were registered in both November and December 2023. Assuming such figures are maintained during the first three months of 2024, the airport operator will be registering substantial growth in Q1 this year compared to the slow start seen in the first two months of last year.

However, following the extraordinary growth in passenger growth between March and December last year which came about from substantial pent-up demand after three years of major disruptions due to the pandemic, the airport operator has a more conservative outlook for the rest of 2024 given the very high seat load factors generated in 2023 which peaked at over 91 per cent in August.

MIA is currently forecasting that overall passenger movements will amount to 8 million in 2024 which translates into muted growth of 2.5 per cent over the 2023 level. This should not come as a surprise following such a remarkable upturn for most of 2023. In fact, MIA’s CEO made reference to data from ‘Eurocontrol’ that indicates that passenger traffic across Europe in 2023 reached around 92 per cent of the 2019 levels. This shows the considerable outperformance of Malta with passenger volumes already surpassing the pre-COVID levels while other countries are yet to achieve the 2019 passenger traffic.

During last week’s press conference, MIA’s CEO also made reference to the 10-year trajectory of passenger traffic at the airport. Based on the projections of 8 million passengers in 2024, the airport operator would have managed to double its passenger throughput since 2013.

MIA is expecting another record financial performance in 2024. Last week the company announced that given the current traffic projections being envisaged for 2024 at 8 million passenger movements, revenues are expected at €126 million (compared to the estimated figure of €118 million for 2023), EBITDA is anticipated at €79 million (2023 estimate of €74 million) with a projected net profit of €42 million (2023 estimate of €40 million). In 2019, MIA had achieved a record financial performance with revenue of €100.2 million, EBITDA of €63.2 million and a net profit of €33.9 million.

Shareholders should note that while the 2023 passenger traffic shows a growth rate of 6.7 per cent compared to the previous record in 2019, the company’s revenue, EBITDA and net profit for 2023 is expected to be 17 per cent higher compared to 2019.

Likewise, the 2024 forecasts anticipate revenue, EBITDA and net profit at 25 per cent above the 2019 figures. Moreover, the company has maintained a high EBITDA margin of almost 63 per cent despite the evident increase in inflation over the years.

In 2023, the company resumed its policy of distributing dividends to shareholders semi-annually. At the time of the publication of the 2022 annual financial statements, a net dividend of €0.12 per share was declared which equated to a dividend payout ratio of 60 per cent when excluding the significant tax credit recognised in 2022. This dividend policy is exactly in line with that of MIA’s parent company Flughafen Wien AG (Vienna Airport).

In early August 2023 when MIA published its 2023 half-year financial statements, an interim dividend was also declared which matched the token interim dividends of €0.03 per share distributed prior to the pandemic.

Despite the major investment programme ahead, MIA has the financial capacity to maintain a 60 per cent dividend policy. In fact, the company confirmed in November that it held €76 million in cash and other short term investments as at 30th September 2023. In the coming weeks, MIA is expected to convene a Board Meeting to approve the publication of the 2023 annual report and concurrently recommend the payment of a final dividend for approval by shareholders at the subsequent Annual General Meeting.

Based on the latest financial forecasts published by the company in November in which it projected a net profit of €40 million for 2023, a 60 per cent dividend payout ratio would translate into a total dividend of circa €0.18 per share for the financial year. Following the net interim dividend of €0.03 per share already distributed last September, the upcoming final dividend to be paid after approval at the AGM should amount to €0.15 per share.

While the recovery in passenger traffic was very strong following the pandemic-induced shock and the financial performance was even more remarkable, these achievements have unfortunately not yet been reflected in the company’s share price. A debt-free balance sheet and a depressed share price are the right ingredients for the company to consider introducing a share buy-back programme similar to the strategy of many international companies that have strong financial capabilities. This is another way of further enhancing future shareholder returns.

Reinventing the single market: Strategic vision and bold reforms for Malta and Europe

Proposed reforms present significant opportunities and formidable challenges for our small island nation

The equity market in pre-COVID times

Investor sentiment has evidently failed to recover from the series of shocks since the start of 2020

Interest rate divergence ahead?

Inflation is falling faster than forecast in Europe, while exceeding expectations in the US