This is the second part of a two part series on inflation and monetary policy, penned by Central Bank Deputy Governor Alexander Demarco. For part 1, click here

Inflation in 2022 was mostly triggered by soaring food, energy, and other commodity prices, which then rapidly spread to various categories of goods and services that are consumed by citizens.

The FAO Food Price Index had jumped by 26 per cent in the first four months of 2022. However, afterwards it went into decline, with prices at the end of April 2023 just 1 per cent higher than the price level of 2021.

Similarly, the price of natural gas EU Dutch TTF skyrocketed from an average of around €33 per MWh at the end of June 2021 to around €253 in August 2022. Thereafter, such price embarked on a steep downward path, and by the end of April 2023 it fell to around €38, which is much closer to the price level of June 2021, though nevertheless is still some three times higher than pre-covid levels (end of December 2019).

Brent crude oil prices at end December 2019 (pre-COVID) stood at around $66 per barrel. It then jumped to around $120 with the outbreak of war in Ukraine in March 2022. However, since then, they have fallen significantly to $77 by the end of April 2023, which was nevertheless still around 17 per cent higher than the pre-COVID level.

These developments suggest that while most certainly input costs involving energy and food products have increased markedly in 2022, costs to producers of such products have fallen appreciably since the second half of that year, and therefore this should have some impact on prices of various goods and services. The fact that HICP inflation has been so high and prolonged suggests that apart from rising costs, inflation could be also driven by other factors, such as profit mark-up adjustments, as wage inflation both in Malta and the Euro area remained on average relatively benign after 2019, and well below overall HICP inflation.

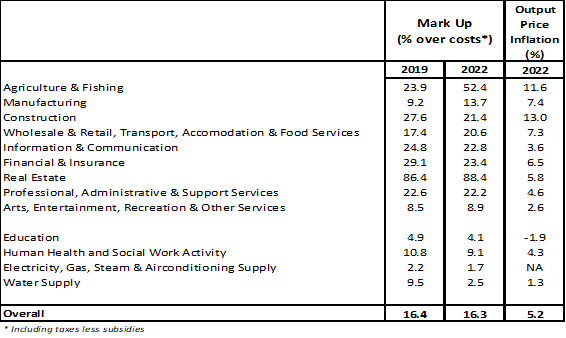

The attached Table, based on National Accounts data, shows that the overall estimated profit mark-up in 2022 in Malta was practically unchanged from that registered in 2019 (the last year before the pandemic). This would imply that higher intermediate costs were fully transmitted onto selling prices, and profits in euro terms increased with the rise in costs. However, at a sectoral level, Agriculture & Fishing, Manufacturing, Real Estate, and Wholesale & Retail Trades, together with Accommodation and Food Services (Hotels and Restaurants) reported an increase in their profit mark-up in 2022. These were also the sectors whose output price increased at a higher rate than the overall average of 5.2 per cent, as shown in the Table. With the exception for most firms in manufacturing and hotel accommodation, these sectors’ prices significantly impact the purchasing power of domestic residents.

One exception was the Construction sector, where despite a high rate of output price inflation, its profit mark-up declined, indicating that the rise in costs was not fully transmitted.

These developments suggest that monetary policy tightening is not only justified but needs to be also effective since there are elements in the high level of inflation that are being driven by sectors that rely on domestic demand, supported also by high bank credit growth to both households and business, particularly in real estate activity.

Fiscal policy also has an important role to play in the fight against inflation. Most EU governments have maintained a somewhat expansionary fiscal stance in response to the pandemic, and subsequently to implement various kinds of inflation mitigation measures. However, unless measures are timely, temporary, and targeted, fiscal measures can eventually become conducive to sustain demand and inflation. Given that global energy and food commodity prices have now retreated significantly from their peak, fiscal policy can shift to complement monetary policy, as had happened during the pandemic.

Adverse terms of trade shocks inevitably lead to welfare losses for jurisdictions importing goods, services, or commodities whose prices have risen. An uneven distribution of such losses between workers and businesses could lead to social tensions with undesirable consequences that would generate overall worse outcomes. Prudence by both businesses in adjusting mark-ups and trade unions in wage demands, as well as effective transmission of monetary policy by the banking sector, are all called for. Additionally, efforts aimed at increasing output and productivity through ongoing structural reforms in product and labour markets, together with appropriate and effective fiscal and monetary policies, are the best way to respond to adverse terms of trade shocks as those experienced in recent years.

*The opinions expressed in this article do not necessarily reflect those of the Central Bank of Malta.

Mobilising savings into investments

Malta’s equity market needs to grow in size and depth if it is to embrace the EU’s Savings and Investments ...

Reduction in free float

Lowering Malta’s minimum free float requirement to 10% could unlock new opportunities for the local capital market

A golden age for GO plc

GO plc’s Annual General Meeting revealed a bold shift beyond traditional telecoms, stronger-than-ever financials, and possible share buy-backs