Last week, Hili Finance Company plc published a Prospectus in connection with its fourth bond offering across the local capital market. Hili Finance is a special purpose financing vehicle for the Hili Ventures Group and all bonds issued by the company are guaranteed by Hili Ventures Limited. In turn, Hili Ventures Limited is the parent and holding company of the group with three main operating subsidiaries all having financial instruments listed on the Regulated Main Market of the Malta Stock Exchange, namely 1923 Investments plc, Hili Properties plc and Premier Capital plc.

In view of the sheer size of this group and the total bond issuance which will reach just over €350 million in the case of a successful offering in the coming weeks (accounting for 13 per cent of the entire corporate bond market in Malta), it is worth reviewing the group financial projections published for the next two financial years.

In essence, Premier Capital (the development licensee for McDonald’s Corporation in Estonia, Greece, Latvia, Lithuania, Malta and Romania) and 1923 Investments (mainly engaged in the sale and distribution of retail and consumer electronic products, primarily as the Apple premium reseller in Poland and Hungary) are the two most important segments of the Hili Ventures Group accounting for nearly 90 per cent of the total EBITDA of €125 million in 2023.

Without downplaying the importance of other segments of the group such as Hili Properties with a commercial property portfolio of over €220 million in various countries, an analysis of the fortunes of Premier Capital and 1923 Investments are the key drivers of future profitability of the group given their overall size within the group portfolio.

Within Premier Capital, which accounted for approximately 65 per cent of total group revenue and 71 per cent of EBITDA in 2023, the most important geographical segment is McDonald’s Romania. Premier Capital had 185 restaurants as at the end of 2023 and a total staff complement of over 10,000 people. Premier Capital believes that there is more room for development of the McDonald’s chain in Romania and Greece due to the relatively low penetration rate of restaurants per capita. In this respect, a further 10 restaurants are expected to be added to the portfolio during 2024 bringing the total to 195 restaurants by the end of the year with the majority (108) located in Romania.

Total revenues of Premier Capital are expected to surge by 10.7 per cent during 2024 to a record of €714.6 million reflecting strong growth in business in the majority of regions, particularly in Romania (+9.6 per cent to €383.2 million) and Greece (+22 per cent to €125 million). In 2025, Premier Capital’s revenue is expected to climb by a further 12.6 per cent to €804.4 million which will continue to account for 65 per cent of overall group revenue.

The EBITDA of Premier Capital is projected to increase by 16.4 per cent in 2024 to €103.7 million (with the EBITDA margin anticipated to rise to 14.5 per cent compared to 13.8 per cent in 2023). Although no information is available on the EBITDA contribution of Premier Capital in 2025, one can safely assume that this is also expected to continue to increase in line with the projected growth in revenue.

The contribution of 1923 Investments plc to overall Group revenues and profitability has increased materially in recent years reflecting the improved performance of iSpot (largest Apple products retailer in Poland). This is expected to gather further momentum as from 2024 following the acquisition of Cortland SP in Poland during 2023 for €42.3 million. Cortland was the principal competitor of iSpot and through this acquisition, an additional 16 Apple reseller stores were added to the portfolio of outlets bringing the total to 44.

1923 Investments contributed approximately 30 per cent of total group revenue and 17 per cent of EBITDA in 2023. Overall revenue of 1923 Investments is expected to surge by 26.2 per cent to €355.6 million in 2024 reflecting a full-year contribution of the Cortland acquisition as well as the additional contributions of at least two new Apple store openings in Poland.

EBITDA is anticipated to increase by 15 per cent to €25.2 million in 2024. In 2025, revenue of 1923 Investments is expected to rise by a more modest 4.9 per cent to €372.9 million thereby accounting for 30 per cent of overall group revenue.

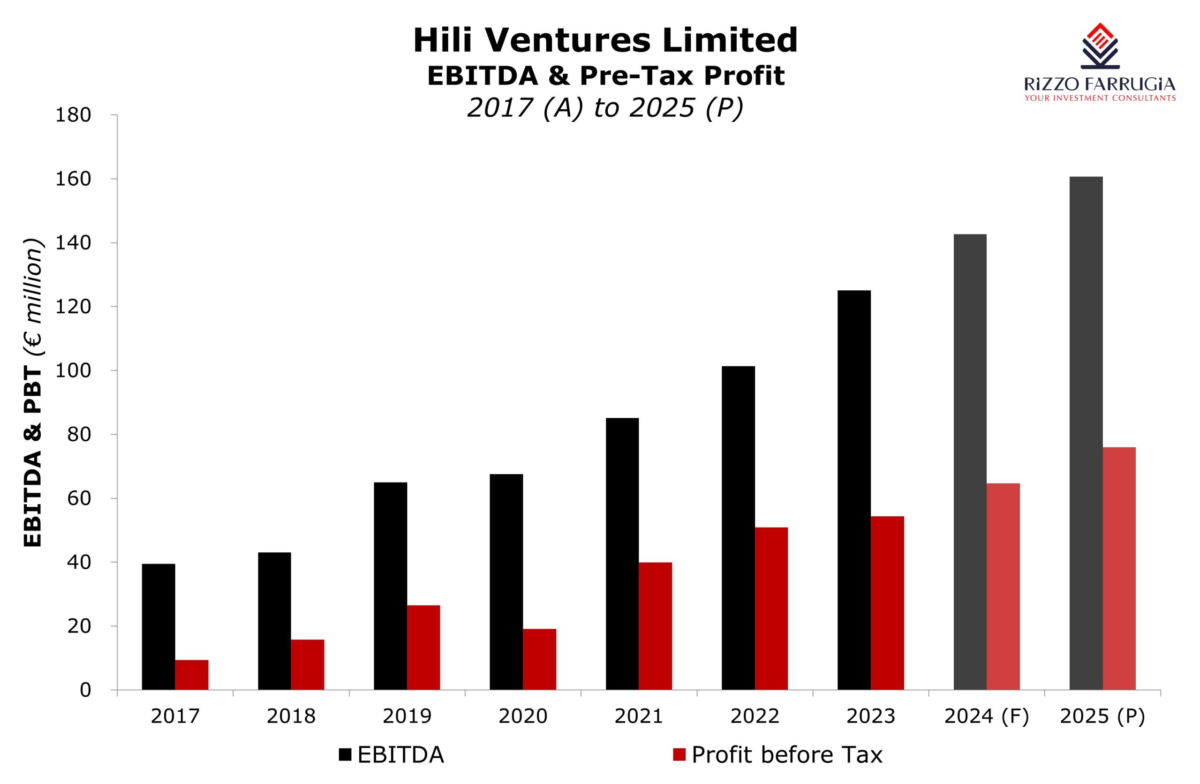

In aggregate, the Hili Ventures Group expects its total revenue to surge by 15 per cent to a record of €1.14 billion in 2024 and increase by a further 9.6 per cent to €1.24 billion in 2025. EBITDA is forecasted at €142.6 million (+14.1 per cent) in 2024 and €160.6 million (+12.6 per cent) in 2025.

As a result of this bond issue, the Hili Ventures Group will not be increasing its overall indebtedness. In fact, while €36 million is earmarked to refinance the maturing bond of 1923 Investments in the months ahead, the balance will be used to reduce bank debt originally taken to partly finance the acquisition of Cortland in Poland and the acquisition of shares in Tigné Mall plc.

In fact, bondholders should note that as a result of the growth in EBITDA expected in the near term, the interest cover is forecasted to improve to 4.7 times in 2024 and 5.5 times in 2025.

An interesting point worth mentioning is that Hili Properties anticipates to dispose of properties valued at just over €60 million by the end of 2025. Earlier this year, the company had already confirmed that it sold a retail complex in Latvia for €7 million. It is currently envisaged that the company will use part of these proceeds to repay the maturing bond of €37 million in October 2025.

This is one of the reasons behind the projected decline in borrowings of the Hili Ventures Group. An important debt metric for a bond issuer of this nature is the net debt-to-EBITDA multiple which is projected to improve to 4.1 times in 2024 and 3.3 times in 2025.

Hili Ventures registered extraordinary growth in its financial performance over recent years largely as a result of the transformative acquisition of McDonald’s Romania in 2016. In fact, among the companies listed or closely connected to the local capital market, Hili Ventures is the third most profitable company after Bank of Valletta plc and HSBC Bank Malta plc. Few observers may realise that the EBITDA generated by Hili Ventures in 2023 of €125 million surpasses that of both Malta International Airport plc and GO plc.

While in the past some local companies found it difficult to expand their business interests beyond the Maltese Islands, Hili Ventures is a clear case study of a successful expansion strategy. Although this is a Maltese company, the revenue and profitability of the group is primarily generated internationally thereby offering local investors an avenue to diversify country exposure away from Malta’s economy.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers).

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Revisiting the idea of privatising the Malta Stock Exchange

The involvement of international institutional investors is likely to result in a more liquid secondary market, notes Edward Rizzo

Further growth ahead for MIA

2025 was another record year for MIA, and 2026 will have the same fate

Observations from the equity market

Malta’s equity market remains subdued