The Central Bank of Malta is actively involved in the Household Finance and Consumption Survey (HFCS), a co-ordinated research project led by the ECB which involves national central banks of all euro area countries and selected non-euro area EU member states.

The HFCS focuses on various aspects of households’ finances including wealth, income, employment, and consumption. The survey’s targeted reference population consists of all resident households in Malta and is conducted every three years.

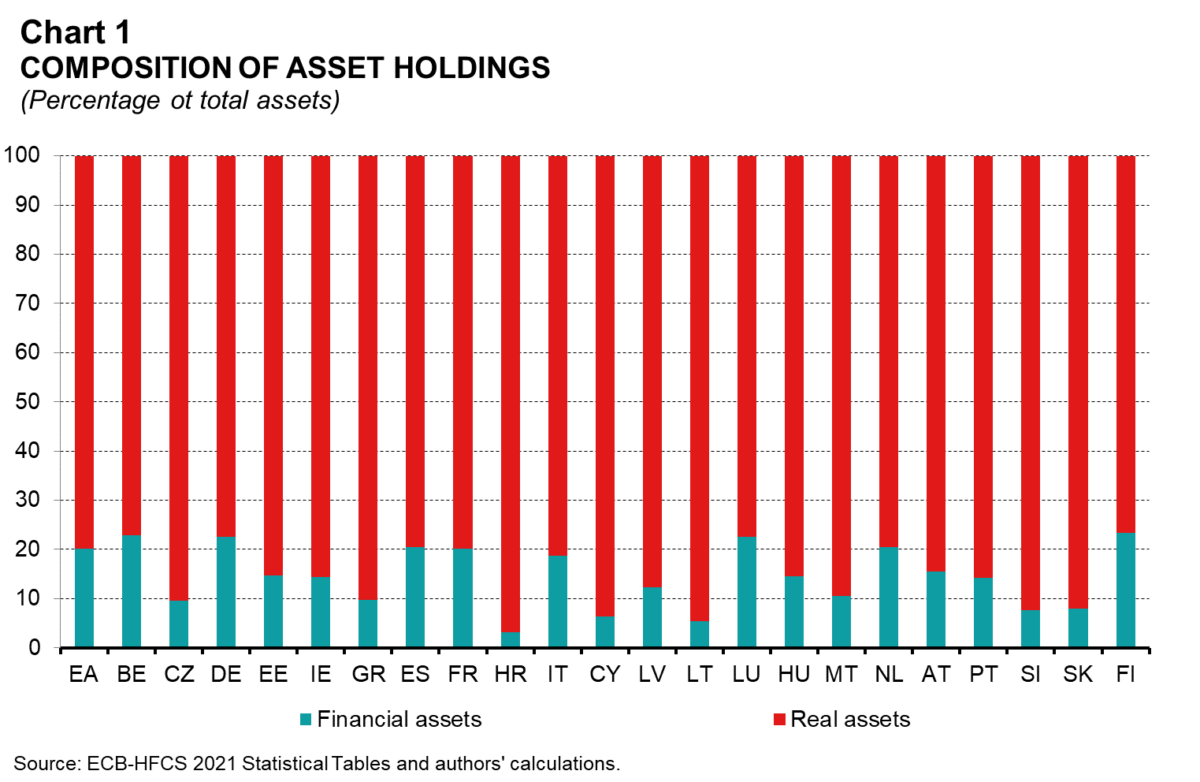

According to the latest survey, on average 79.9 per cent of euro area households’ assets consisted of real assets; in Malta this share stood higher, at 89.5 per cent. This means that the share of financial assets in households’ total assets stood at 20.1 per cent in the euro area and 10.5 per cent in Malta. The share of financial assets in total assets varied between 3.1 per cent in Croatia to 23.3 per cent in Finland. This comparative report finds that in 2020, the median Maltese household held €300,000 in real assets and €16,800 in financial assets; markedly more than the €153,700 and €15,000, respectively, held by the average euro area household.

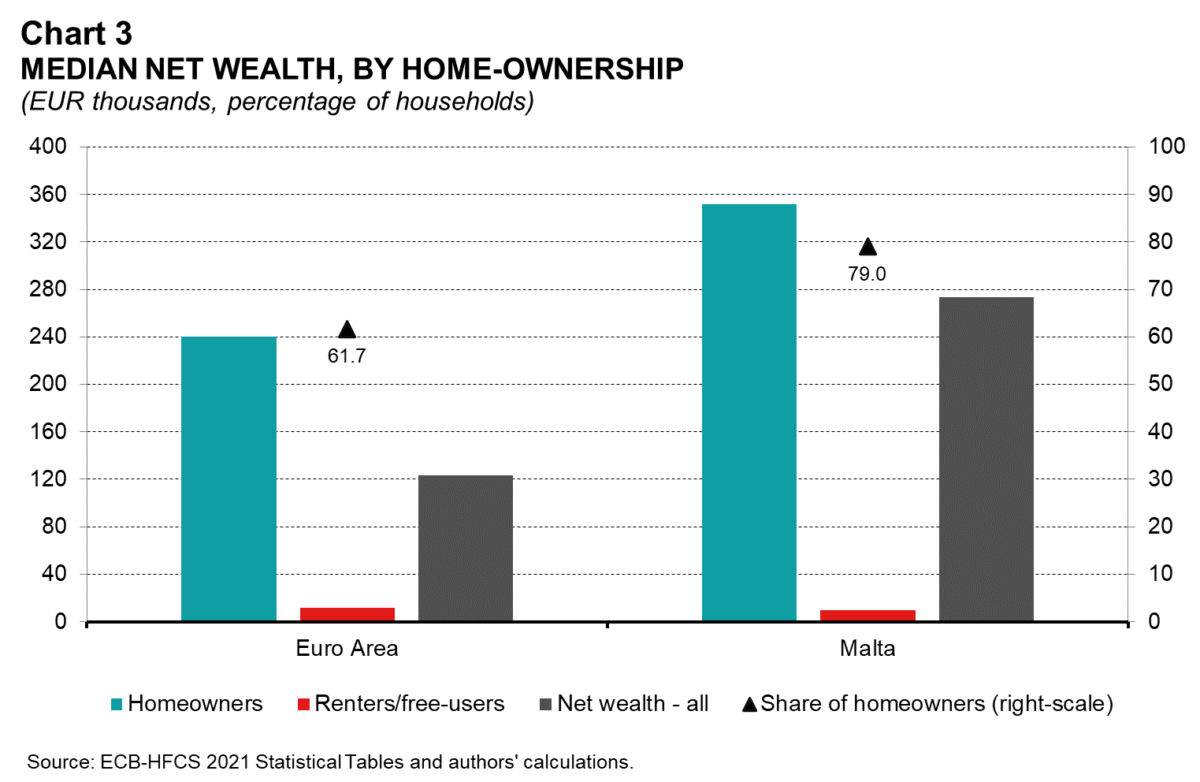

The homeownership rate in Malta stood at 79 per cent in 2020, of which 60.4 per cent of households were outright owners. The remaining 21 per cent of households were renters or benefiting from usufruct or rent-free agreements.

The homeownership rate in Malta is well above the average rate of 61.6 per cent of the euro area, where outright owners amounted to 40.8 per cent. This notable divergence between Malta and the euro area highlights the local preference to own property.

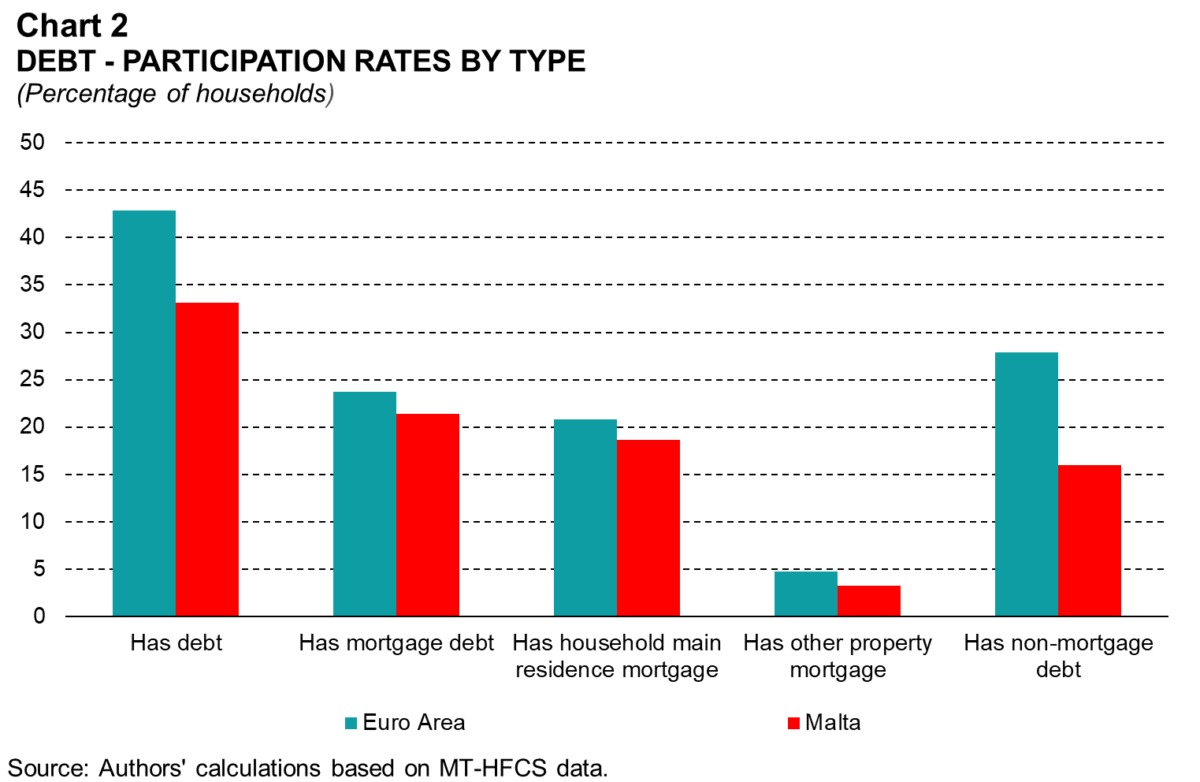

With regard to liabilities, 42.9 per cent of households in the euro area were indebted against 33.1 per cent in Malta. However, the median total liabilities of indebted Maltese households stood at €45,000, more than the €30,400 of the euro area households, reflecting a higher median debt level on properties other than the main residence. By contrast, median debt on main residence and non-mortgage debt stood lower than in the euro area.

Despite higher total liabilities, the debt-to-asset ratio indicates that Maltese households have a significantly higher share of assets to cover their debt. At the same time, the debt service-to-income ratio of all indebted households was lower in Malta (10.1per cent) with respect to the euro area average (11.0per cent).

The survey also finds that 6.9per cent of euro area households are credit constrained compared to Malta’s 4.7per cent, which implies that Maltese households find it less challenging to obtain credit. Malta’s figure was among the lowest reported by euro area countries.

Largely reflecting the higher prevalence of homeownership in Malta, the estimated median net wealth (real and financial) in Malta reached €273,600, more than double the euro area median value of €123,500. This divergence narrows when looking only at the median net wealth of homeowners, which stood at €351,800 in Malta and €239,900 in the euro area as a whole.

In the euro area, households who owned their main residence had a median net wealth value of €239,900, whereas households who did not own their home had a median net wealth value of just €12,000. Similarly, the median net wealth of Maltese households who own their main residence stood at €351,800, as opposed to only €10,000 for other households.

The estimated survey Gini coefficient for net wealth, which indicates where a country stands in terms of inequality, was one of the lowest in Malta at 0.55, substantially lower than the euro area’s average of 0.69.

The annual median gross income of Maltese households was estimated at €29,700, below the euro area’s €34,000. Lower income can be noted across all age cohorts, with the exception of the 16-34 age bracket, which stands almost in line with the euro area figure. Around 49 per cent of Maltese households disclosed that they are able to save part of their income and, over two thirds of Maltese households claimed that they are able to get financial assistance from relatives and friends in case of need, 10.2 percentage points more than in the euro area as a whole.

The overall annual median spending of households in the euro area on food consumption, including food consumed outside the home, stood at €5,400, ranging from €3,600 in Latvia to €11,500 in Luxembourg. Median spending by Maltese on food was estimated at €7,200 per household. Maltese households reported the third lowest spending on utility bills in the euro area.

Given the exceptional circumstances of the COVID-19 pandemic faced by countries in 2020, respondents were asked if the pandemic had impacted their finances. Among households with at least one active member in employment, the percentage of respondents reporting at least one type of adverse labour market change (lost job, kept job but with partial/full wage loss) in Malta stood at 34.8 per cent. In other countries, this ranged from less than 10 per cent in Slovenia to around 40 per cent in Spain and over 45 per cent in Portugal.

Devising an Equity Market Development Programme

The equity market suffers from chronically thin trading volumes especially in the aftermath of the pandemic

Funding national projects

How can capital markets be used to diversify the funding sources of long-term national development projects

Malta’s earnings season

The importance of enhanced transparency, shareholder developments at HSBC Bank Malta, and broader capital market reforms