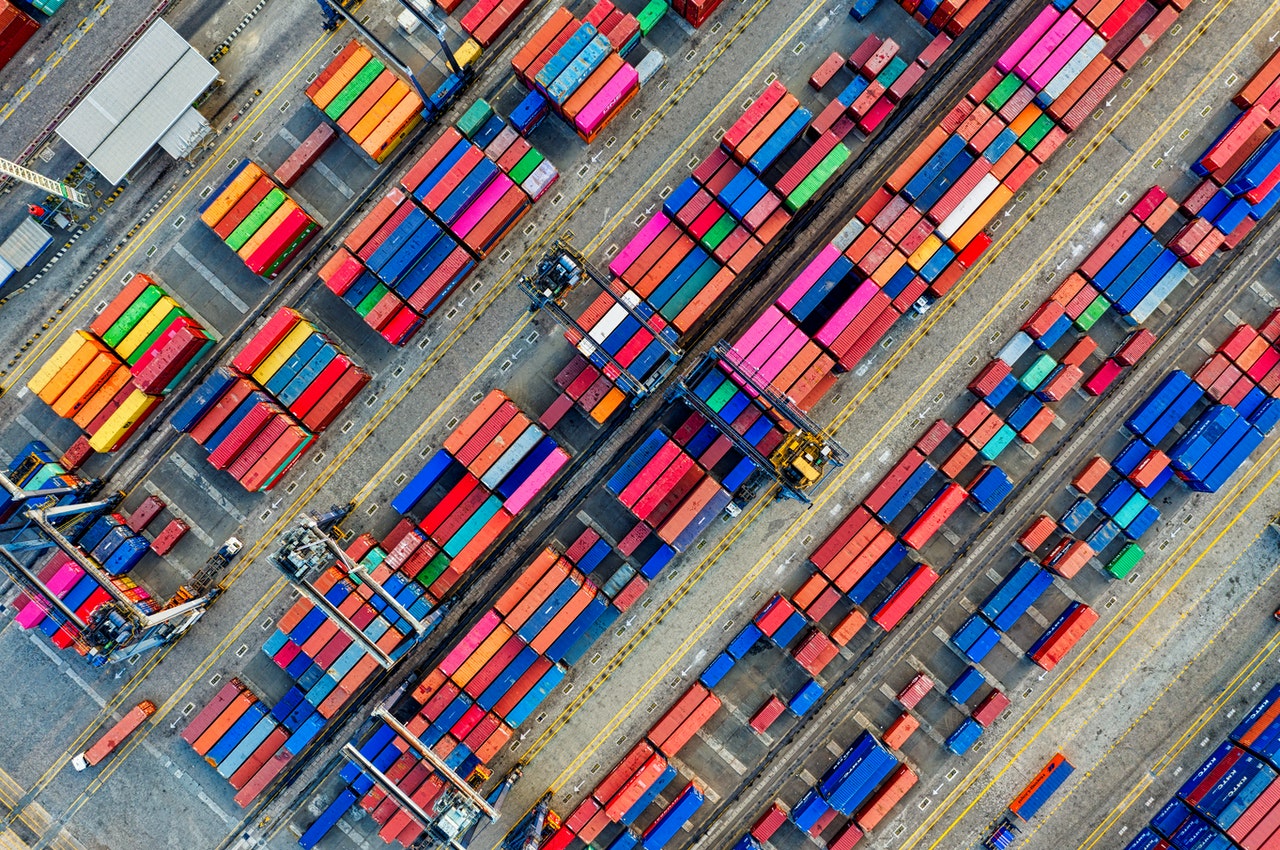

As the UK prepares to exit the EU on 31st December, and the chances of both sides striking a deal become increasingly slim, MaltaPost has published a presentation for how the UK’s changes to its import/export rules are likely to impact your business.

In order to prepare for full border controls on imports from the EU, the UK will introduce three key changes in the tax regime between the two sides.

It will become mandatory to provide electronic customs data, the low value consignment relief will be removed on commercial goods and a new VAT scheme will apply for commercial items valued between £0 and £135.

With regards to buying goods from the UK, from 1st January 2021, the UK will be considered a third-country and therefore, full customs controls will apply when purchasing goods from the region.

Check out MaltaPost’s full presentation here.

Unpacking Malta’s new American-style bankruptcy framework

The EU is reforming its insolvency rules to adopt some of the most beneficial elements of the US framework

More than half of all workplace deaths in last two years involved construction

No women died on the job in 2022 and 2023

Government shells out close to €70 million to national bus operator Malta Public Transport in 2023

Buses became free for residents in late 2022, leading to a hefty increase in the public subsidy