HSBC Bank Malta plc kicked off the full-year financial reporting season two weeks ago with the local banking group reporting its highest level of profits since 2016.

Although the profits generated last year totalling €57.3 million pre-tax were boosted by the sizeable reversal of expected credit losses (impairments) mainly attributable to the recovery on a commercial non-performing loan which was largely provided for in prior years, the key highlight of the 2022 financial year was the improvement in the net interest income during the second half of the year.

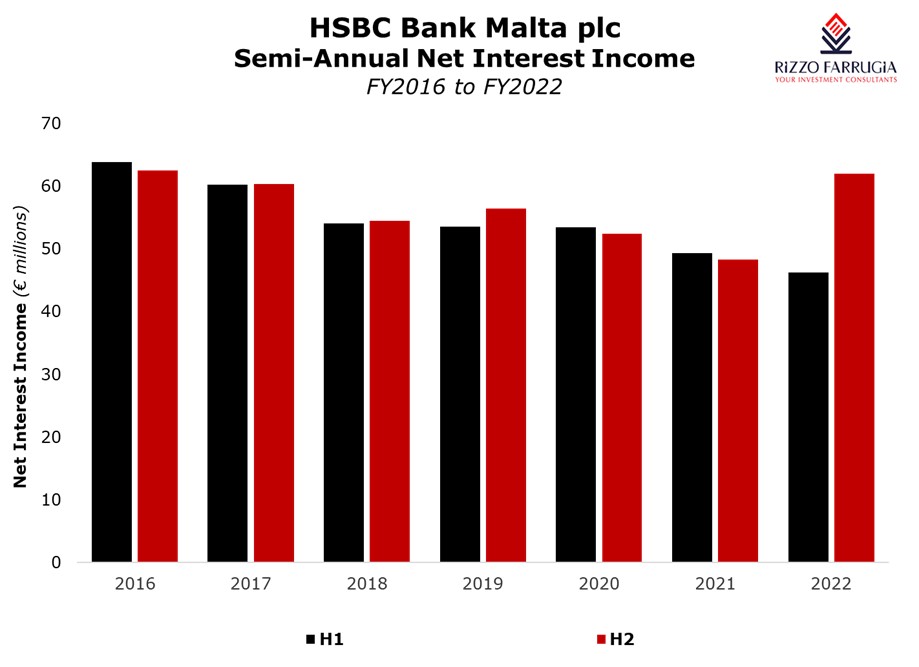

In fact, HSBC Malta’s net interest income, which is the core business for retail banks, amounted to €62 million in the second half of 2022 (the highest level of semi-annual interest income since 2016) and a significant improvement from the €46.2 million generated in the first six months of 2022.

This is reflective of the sudden change in the interest rate environment in recent months as the overnight deposit facility of the European Central Bank (ECB) improved from negative 0.5 per cent (until 26th July 2022) to positive two per cent as from 21st December 2022.

The prolonged period of historically low interest rates since 2012 presented a challenging environment for the entire European banking sector, especially for those banks with high levels of liquidity such as HSBC Malta. HSBC Malta’s loan-to-deposit ratio deteriorated from a peak of 79 per cent in 2009 to 57 per cent by the end of 2021 as a result of a consistent increase in customer deposits (rising from €4.5 billion in 2012 to just under €6 billion in 2022) while the loan book remained stable at circa €3.2 billion in part due to the de-risking strategy adopted by HSBC Malta and the increasing levels of competition. In view of the subdued interest rate environment (negative rates by the ECB since 2014) coupled with the increasing levels of liquidity, HSBC’s net interest income declined remarkably over the years (from a peak of €133 million in 2012 to below €98 million in 2021) leading to a sharp deterioration in profitability. In fact, pre-tax profits declined from €95 million in 2012 to below €27 million in 2021.

During the start of 2023, the ECB raised its deposit facility again to 2.5 per cent with effect from 8 February and the central bank is widely expected to increase this further to three per cent from next week (16th March 2023). This will automatically benefit all banks across the eurozone as surplus liquidity placed with the ECB will be repriced accordingly generating higher levels of interest income. On the other hand, however, this will also lead to a higher cost of funding for banks as is evident from the more attractive fixed deposits suddenly being made available by most banks in Malta.

The other interesting aspect of HSBC Malta’s announcement two weeks ago was the reduction in the dividend payout ratio to 35 per cent from 45 per cent the previous year. The bank explained that this reduced payout takes into consideration the adverse price movements on financial instruments (which negatively impacted the bank’s capital base by an amount of €23.2 million but which was not reflected in the income statement) as well as the additional capital requirements in the years ahead, including higher buffers to HSBC Malta’s concentration risks.

On the other hand, however, the absolute dividend being distributed in the weeks ahead of €0.0364 per share is the highest dividend since that in respect of the 2018 financial year and comes after a three-year period of very subdued distributions to HSBC Malta shareholders.

In recent years, HSBC Malta was one of the few companies to have consistently provided the market with quarterly key financial indicators. The financial highlights for the first quarter of 2023 that will be published during the month of May would be interesting in order to gauge the extent of the continued positive impact flowing into the bank’s financial performance from the additional interest rate hike in February 2023. Moreover, this should become even more evident once HSBC Malta publishes its detailed interim financial statements in summer. Since HSBC Holdings have already indicated that their half-year financials will be published on 1st August, then HSBC Malta will also issue their interim financials on the same day as has been the customary practice over the years.

The large upturn in the global interest rate environment represents a major challenge for several companies with high levels of debt which could also have implications for the banking sector through the need for additional bad debt provisions. However, the higher level of interest rates represents a tailwind for all eurozone banks including HSBC Malta following a very difficult period for the banking sector as interest rates were subdued for several years and regulatory costs spiked leading to very minimal shareholder returns. The 2023 interim reporting season next summer should therefore clearly show the overall beneficial impact of the new interest rate environment for the banking sector.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers)

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Interest rate divergence ahead?

Inflation is falling faster than forecast in Europe, while exceeding expectations in the US

‘Made in China’ shock 2.0

To rebrand the local economy, China is now investing heavily in what president Xi Jinping calls the 'three new industries'

Sharp upturn across equity markets in Q1

The stock market's repeated strong recoveries highlights the importance for investors to have a long-term time frame