A slew of projects currently in the planning and development pipeline will increase the bed stock available in Malta to high-risk levels, with the number of tourist arrivals needing to almost double for the sector to see occupancy – and profitability – levels comparable to those seen in 2019. However, attracting such numbers is difficult, and will cause further stress on an overcrowded system that has already caused a drop in visitors’ satisfaction.

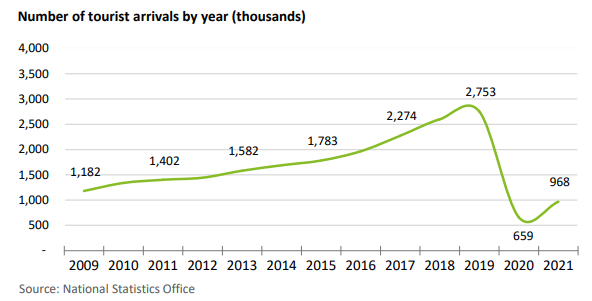

According to a carrying capacity exercise commissioned by the Malta Hotels and restaurants Association and carried out by Deloitte, Malta will need to attract 4.7 million tourists a year by 2027, each staying just under seven nights, to prevent oversupply of accommodation becoming a serious issue. This represents an 80 per cent increase over the 2.75 million arrivals recorded in 2019 – a record year for Malta’s tourism sector.

The study showed that even 2019 volume levels resulted in an undesirable level of stress on key limiting factors that impact both the tourism experience offered in Malta as well as the quality-of-life of residents.

Such limiting factors include the country’s broader infrastructure, particularly in regard to the sewage network in certain areas, broad environmental impacts concerning specific tourism hotspots as well as more indirect matters associated with the sector’s insatiable thirst for expat workers and resultant urbanisation pressures.

Stakeholders also noted that attracting additional volumes is increasingly difficult and results in higher marginal costs. Most notably, the advent of social media has established a more direct link between the individual tourism experience of each visitor and Malta’s market positioning.

Other limiting factors include airport connectivity and capacity, environmental targets, and labour supply.

Among the recommendations put forward is a call for “urgent action to address risks of existing imbalances”, with Deloitte warning that if left unchecked, these could “augur a period of low occupancy and sector profitability, which in turn could further threaten Malta’s financial and economic stability”.

Potential oversupply risks, the study notes, may also impact the property market as short-let private accommodation is easily transferable to the residential market, and a significant volume of vacant property may lead to property price corrections in the more serious scenarios.

The Maltese banking and capital market system are in turn significantly invested in both the property markets and in the tourism industry. As at the end of 2021, both sectors combined (but excluding Air Malta plc) accounted for 40 per cent of core banks’ loan book.

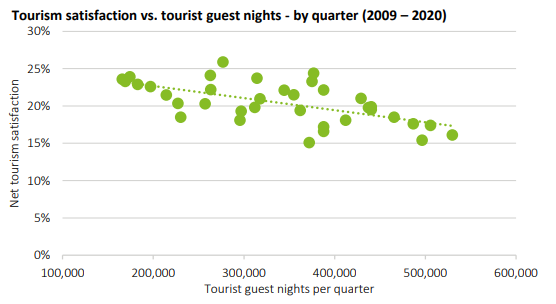

Stakeholders have raised significant concerns about overdevelopment and the uglification of the Maltese islands – concerns which are supported by tourism satisfaction surveys conducted by the Malta Tourism Authority (MTA).

“Worsening the situation with underutilised bed stock appears counter productive and runs contrary to MTA’s stated strategy for targeting improvements in the quality of the Maltese tourism offering,” the report states.

Concluding the event, Mr Andrew Agius Muscat, CEO of MHRA, confirmed that this study comes at an opportune time in which a discussion is warranted on safeguarding the future of this key sector for the Maltese economy.

“We are faced with a very challenging economic climate in which operators are still feeling the aftermath of the COVID-19 pandemic,” he said, “coupled with major disruptions due to inflationary pressures and increases in fuel and other charges across the board which could impact the purchasing power of our main tourist markets and increase operational costs”.

He concluded: “Therefore, we need to ensure that the industry remains sustainable in the medium to long term. This study clearly indicates the bottlenecks and the areas that need addressing. In the end most of the decisions necessary are political decisions which only government is in a position to take and execute.”

About the study

This study was co-financed by the European Social Fund, Operational Programme II – Investing in human capital to create more opportunities and promote the wellbeing of society – 2014-2020. Additional financial support was received through the NGO Co-Financing Fund 2022 of the Malta Council for the Voluntary Sector. It was conducted by Deloitte Malta and was presented by partners Raphael Alosio and Michael Zarb.

A detailed literature review and data analysis of key tourism indicators were further developed in interviews with several public and private sector stakeholders followed by several group workshops and follow-up consultations with specific entities. Contacted stakeholders included relevant ministries, public authorities, agencies, and local councils, as well as sectoral representative bodies and operators.

Gozo cargo ship can cut traffic and Ċirkewwa queues, say business groups

'A much needed investment'

Inbound tourism reaches nearly 3.8 million visitors in first 11 months of 2025

Inbound tourist arrivals were estimated at 304,620 in November alone

Farmhouse once used by 1798 Maltese rebellion leader goes on sale for €2.5m

It once served as the headquarters of Vincenzo Borg, one of the leaders in the Maltese uprising against the French