The world’s major central banks are now all clearly in the early stages of a monetary easing cycle. Over the past couple of months, the US Federal Reserve, the Bank of England and the European Central Bank (ECB) have all cut interest rates for the first time in years.

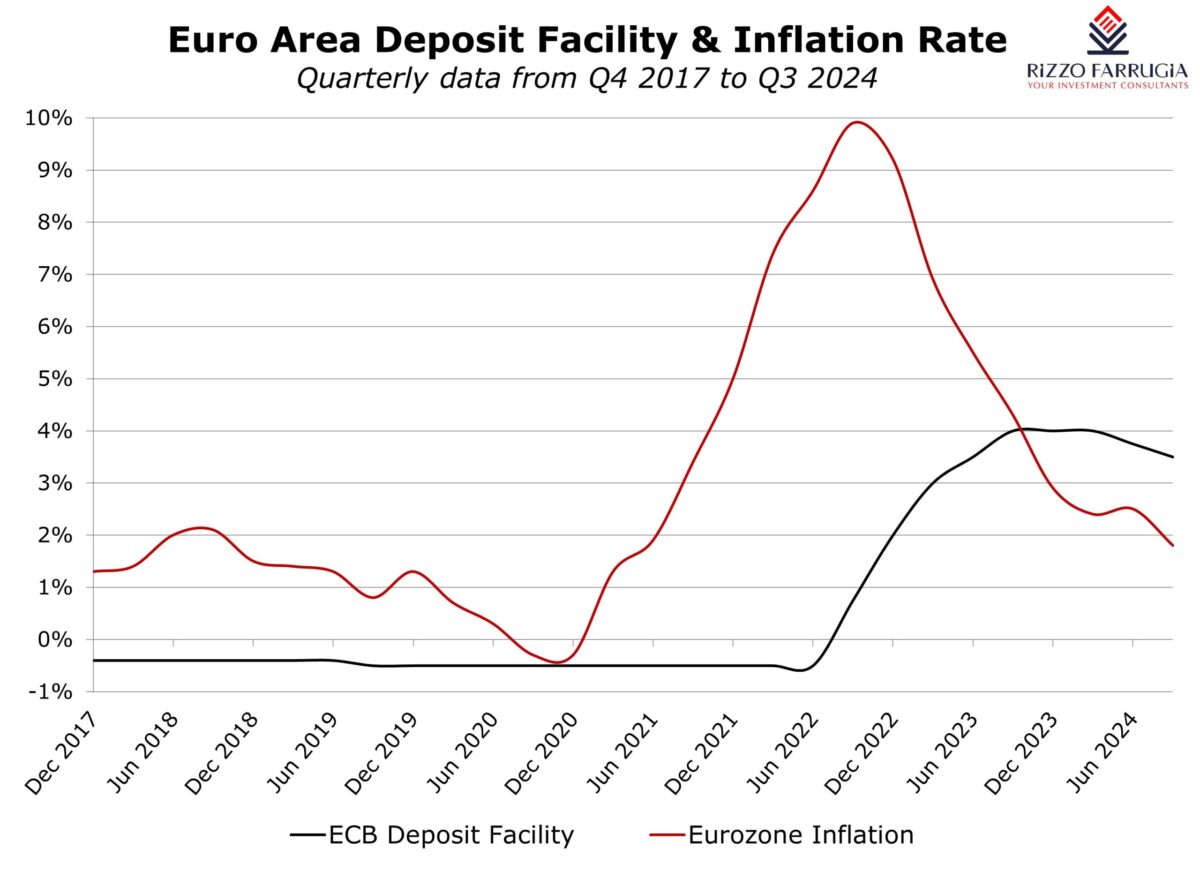

The ECB brought down the key deposit rate from four per cent to 3.5 per cent after two rate cuts in June and also in September of 0.25 percentage points (25 basis points) in both instances.

The Bank of England adopted one rate cut also of 25 basis points in August pushing the bank’s rate to five per cent.

The Federal Reserve waited longer than the Bank of England and the ECB to begin cutting interest rates. However, during its last monetary policy meeting in September, the Fed opted for a 50-basis point cut sending a very clear message to investors that rates are on their way down. In fact, earlier this week, the Chairman of the Federal Reserve indicated that if the economy performs as expected, two more rate cuts are likely by the end of this year.

Following the recent decisions by the major central banks and the publication of the latest economic data, it is amply clear that the interest rate cycle has indeed changed. While the future direction of interest rates is amply clear, the market’s focus has shifted towards how fast and how far each of the central banks will ease in the months ahead.

As bond yields across the world have now clearly peaked and are well-below their recent multi-year highs, investors therefore need to position their portfolios for an environment of lower interest rates. Investors mainly exposed to short-term bonds are facing reinvestment risk, namely the risk that an investor will have to reinvest the proceeds from a maturing investment at a lower rate than they are currently receiving. On the other hand, in an environment of reducing interest rates, longer-term bonds become more attractive, albeit with increased price volatility due to the uncertainty on the timing and extent of interest rate changes.

In the eurozone, the most recent economic indicators pointing to slowing growth and weak inflation data will probably lead to a further 0.25 percentage point cut by the ECB at its upcoming meeting on 17th October. In fact, a very recent report by a reputable international bank claimed that the ECB is expected to cut rates by 0.25 percentage points at every meeting from October 2024 until April 2025. If this were to materialise, it would reduce the ECB deposit rate from 3.5 per cent to 2.25 per cent over the coming months. This also mirrors recent comments by some top officials of the ECB who have confirmed their expectation of further gradual rate cuts “in the near future” and in the first half of next year.

For Maltese investors with exposure across the local capital market, the changes in the interest rate environment are already evident in the yields on the short-term Malta Government Treasury Bills as well as the longer-dated Malta Government Stocks. The yields on the three-month and six-month Malta Government Treasury Bills have dropped to below the three per cent level over recent weeks from 3.5 per cent and higher earlier this year and in the last quarter of 2023. Likewise, the upcoming 10-year MGS issue which was announced last Friday has a coupon of 3.25 per cent compared to an interest rate of 3.5 per cent during the previous MGS issue in July. As yields are declining, the prices of existing bonds have increased in value and in fact the price of the 3.5 per cent MGS 2034 which was issued at 100 per cent (par) in July has already increased to over 103 per cent. In a similar manner, the prices of all other Malta Government Stocks, especially those maturing in the long-term have experienced similar increases in prices.

Likewise, across the corporate bond market, the prices of most bonds have also edged higher. In the case of the bonds issued with a ‘high’ coupon over the past year, bond prices have jumped above their par value.

For example, the price of the 5.8 per cent APS Bank plc 2028-2033 bond rose to above 105 per cent and the 5.85 per cent AX Group 2033 bond jumped to 108 per cent. Meanwhile, some of the bonds issued a few years ago at the time of the historically low interest rate environment whose price had dropped to well-below 100 per cent as interest rates jumped in 2022 and 2023, have now started to recover towards their par value. A noteworthy example is the 3.5 per cent GO plc 2031 bond that had dropped towards the 90 per cent level and is now at 98 per cent. Likewise, the 3.65 per cent Mizzi Organisation Finance plc 2028/31 bonds had dropped to 85 per cent in October 2023 and has since rallied towards the 99 per cent level.

One of the key themes across the local and international capital markets over the past few years was the increased popularity of treasury management instruments (short-term sovereign and corporate bonds as well as money market funds) as a result of the surge in interest rates by the major central banks. Investors clearly took advantage of the spike in interest rates to generate additional income from the idle cash at bank. There are numerous articles across the international financial media speculating whether the recent change in the interest rate cycle will instigate a partial shift from short-term securities into longer dated bonds or into the equity market. Sizeable amounts of investor money are placed in such short-term securities or still lying idle in the banking sector so such a change in investor behaviour can lead to material implications across the bond market as well as the equity market.

In fact, a leading market commentator in the US has recently opined that the 50-basis point interest rate cut by the Federal Reserve last month could spark a continued rally in the US equity market leading to what he described as a market ‘melt-up’ similar to the situation in the 1990’s with share prices surging rapidly to unsustainable levels.

Despite the significant downturn in inflation over recent months, many economists also warn that rising debt levels and geopolitical developments could lead to a resurgence in inflation that could also alter the trajectory of future monetary policy decisions by the major central banks. Both US presidential candidates are proposing policies that could trigger higher levels of inflation that could affect monetary policy decisions by the Federal Reserve. On the other hand, should Donald Trump be elected as the new US President next month, this could lead to increased geopolitical uncertainty such as the prospect of a trade war, which may instigate the major central banks to accelerate rate cuts.

What is certain is that the decisions and statements by the major central banks in the weeks and months ahead will remain important determinants of movements across various asset classes.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers).

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Is ChatGPT losing its edge? Prof Alexiei Dingli on why the AI race is entering a new phase

The race is no longer about a single dominant tool, but about ecosystems, economics and long-term adaptability

Observations from the equity market

Malta’s equity market remains subdued

When is a financial ratio healthy?

Updated Financial Analysis Summaries for 2026 underline why leverage ratios remain a critical tool for investors