Malta’s electronics industry has grown into one of the most prominent players of the country’s manufacturing sector. Concerted national efforts to attract foreign companies to set up shop in Malta has paid dividends with some of the biggest names in advanced manufacturing of electronic components using Malta as a hub.

While it is challenging to isolate the electronics industry from the manufacturing sector as a whole, the industry has some of the country’s largest private sector employers.

Latest NSO figures indicate that in 2022, manufacturing was responsible for six per cent of GDP and three per cent of all FDI in 2021, however to what extent electronics are responsible for that share is difficult assume. Most recent available data is from 2010, when the electronics sector was responsible for almost 45 per cent of all value added in manufacturing.

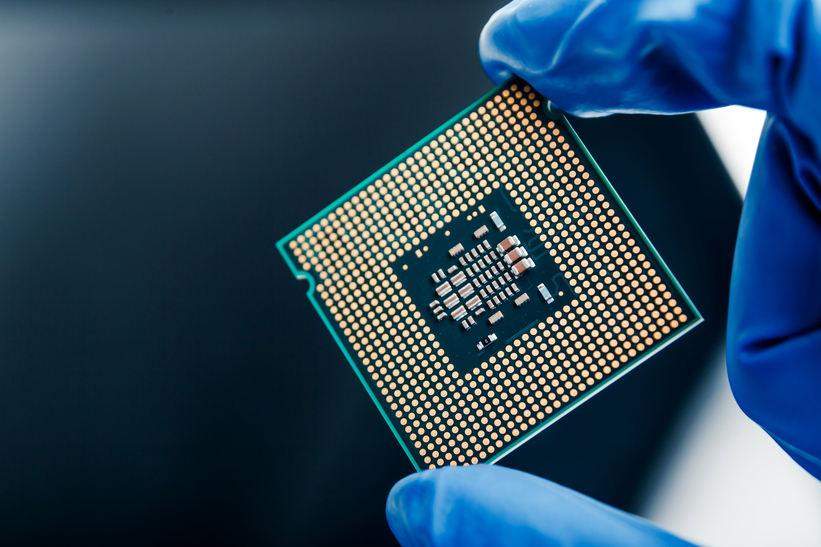

The electronics which are produced in Malta include, but are not limited to, semiconductor, MEMS sensors which are used by a range of appliances and printed circuit boards.

Major players

Over a number of decades, the country’s industrial estates have received a growing number of electronics manufacturers set up shop, developing an interconnected domestic web with a global reach, aided by the country’s strategic geographic location and plentiful workforce at the time.

One of the first electronics companies to have established in Malta was the multinational STMicroelectronics ltd, which expanded to the country in 1981, when it was still called SGS Microelettronica. In claims to employ over 1,800 workers in Malta making it one of the country’s largest employers, and operates the largest assembly and testing semiconductor plant in Europe from its site in Kirkop.

Another major company is Methode Electronics Malta Ltd, an American electronics company which established in Malta in 1997 after it acquired the local electronics company Merit Malta Limited.

The country boasts a selection of others electronics companies such as RS Components, BD Electronics, and Dedicated Micros ltd, among others, which export to a global market.

Chips shortage and energy price stability

In 2020, the world entered a global chips shortage as the demand for semiconductor chips exceeded supply leading to a ripple effect on consumer products.

The issue arose following disruptions caused by the COVID-19 pandemic which triggered issues in supply chains and logistics that affected global production of this critical component. The constrained supply was further exacerbated by a growing demand for in-home electronics with the rise of remote-work sparking demand for personal computers, and in-home entertainment systems such as video game consoles.

The situation was coupled with a growing demand for electric vehicles contributed to demand pressures, and the pandemic itself required resources from the electronics industry to be redirected to vaccine production, since the silicon use to make vials storing vaccines is the same as that used by semiconductor chips manufacturers.

This led to companies such as STMicroelectronics to boost investments in production capacity to keep up with demand.

Notwithstanding, the issue has been exacerbated further by the Russian invasion of Ukraine.

The invasion led to the European Union reacting against the aggressor with sanction packages and a commitment to reduce its commitment on its energy resources.

Russia retaliated by limiting the amount of natural gas it to the EU due to the member states’ support of Ukraine. This led to periods of unprecedentedly high prices of electricity across Europe, rising operational costs for manufacturers. However, Malta largely avoided this.

The Government had taken the decision to keep prices stable through a very generous subsidy, shielding both households and the private sector from any of the shocks with the use of public funds.

This may have given the domestic electronic industry a relative competitive advantage to other European countries, since they did not have to raise prices or reduce production.

While it is unclear whether the measure had any long-term benefit for the domestic electronics industry, FDI during the first six months of 2022 in manufacturing was more than what it was during the first six months of 2019, 2020, and 2021 combined.

The degree to which this is causational or simply correlational is yet to be seen.

Energy subsidies are expected to be maintained until the very least, the end of 2023, and with no off-ramp being publicly discussed, it’s possible that it might continue in 2024. However, the Government has been warned by the IMF that the current system is unsustainable in the long-term, and that an adjustment to how the subsidies operate is encouraged.

If the private sector, and specifically the manufacturing industry have to bear the brunt of higher energy prices, businesses might have to take energy-saving solutions more prudently to maintain a similar level of output.

Education & training

To support the growth of the electronics industry, there are several resources for individuals to get involved in the industry, with both MCAST and the University of Malta providing a range of courses in electronics, with diplomas and degrees in electronic and computer engineering.

Also with the lurch towards the fourth industrial revolution which is leading to further digitalisation and automation in manufacturing, ICT skills are also in demand.

The country’s major electronics companies also provide a broad selection of internships which provide useful handful experience.

Overall it’s a fairly accessible industry with a wide range of stepping stones provided by the country’s education institutions.

Future of the industry

Despite the country’s relative small size and population, the electronics industry has shown strong and steady growth with major companies demonstrating commitment in expanding their domestic operations.

The millstones around the electronic industry’s neck may be the lack of an available highly skilled workforce due to the country’s ever-worsening labour shortage, however, if policymakers take steps to tackle the issue from a skills shortage aspect it may spurt growth in the industry which appears ready to invest further.

The global chips shortage and re-orientation to shorter supply chains serves only to bolster the country’s opportunities for expansion with its position right in the middle of three continents, Europe, Africa and the Middle East.

If the pressing issues are addressed, then Malta would be in pole position to attract significant FDI in electronics and expand its industry’s network.

MFSA flags ‘misalignment’ between objectives and public expectations of green loans

Green investment is nonetheless expected to balloon over the coming years

Super rare Ferrari Daytona SP3 spotted cruising along Malta’s roads

The car is currently being traded for a whopping €4 million

Mandatory skills pass for Maltese and EU nationals deferred for a year

The skills pass remains obligatory for third country nationals