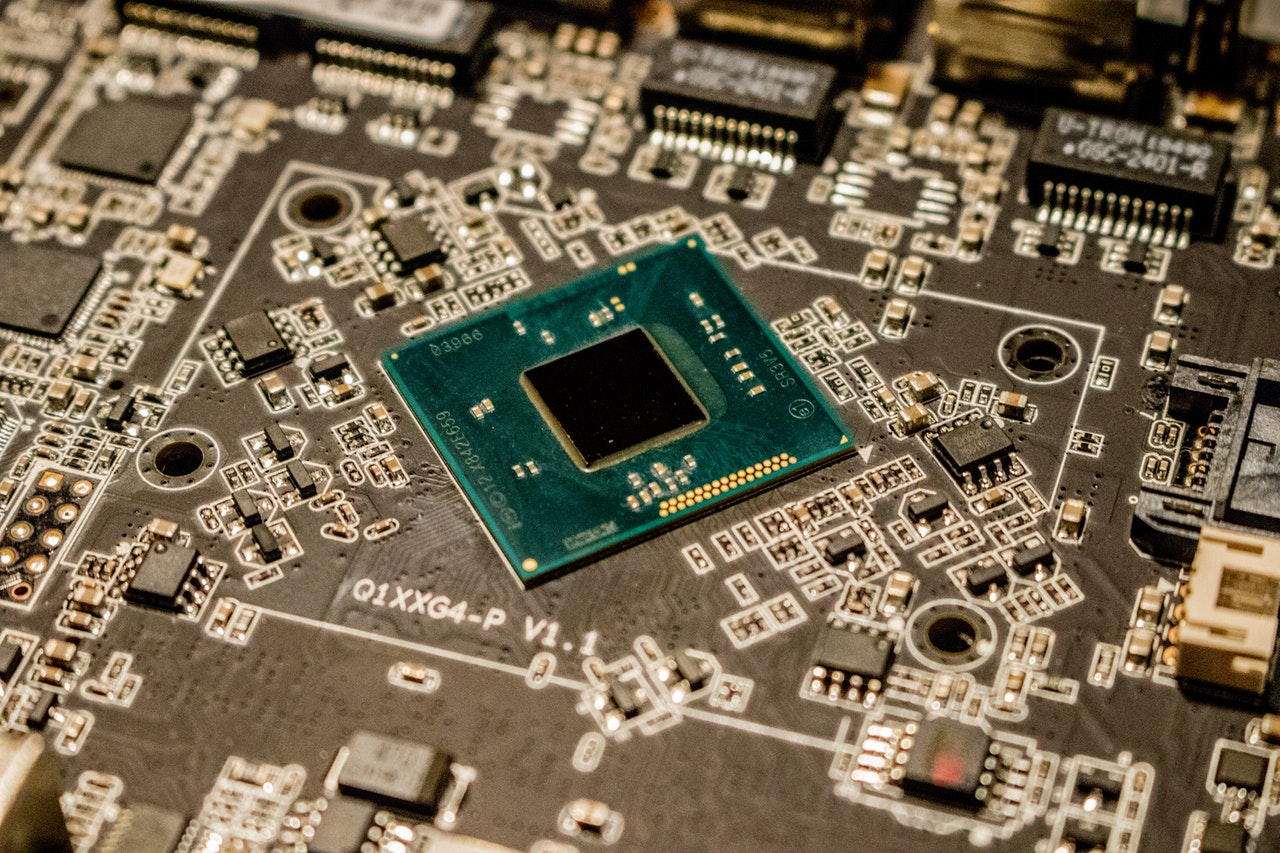

A global semiconductor shortage shows no sign of abating, with top companies slowing production and chip makers taking orders for late 2022 as worldwide manufacturing capacity is expected to remain well below record levels of demand.

Over the last days, top players in the automotive, machinery and tech industries have revealed the extent of the crisis, with Nokia CEO Pekka Lundmark saying, “It’s a fight out there.”

He was commenting on the difficulty in establishing secure supply of the hot item.

Due to the shortage, BMW was forced to cut shifts at its factories while Honda Motor announced a halt in production at three plants in Japan. Ford Motor meanwhile reduced its earnings forecast, and Caterpillar Inc warned that its production might not be able to keep up with the demand for construction machinery.

They join Apple, who warned that the shortage would wipe out $3-4bn in revenue in its third quarter, and Samsung which is already reporting decreased revenues and profits.

Chip manufacturers are announcing multi-billion investments to keep up with the demand while reporting blockbuster profits.

STMicroelectronics, which operates a factory in Malta, has announced a €2bn capital investment in its production capacity.

Presenting the financial results for Q1 2021, STMicroelectronics president and CEO Jean-Marc Chery said that ST had reacted fast to the shortage, “fully saturating our existing manufacturing capacity with the right product mix”.

The shortage results from a perfect storm of factors whipped up by the COVID-19 pandemic.

With people spending more time at home, both for work and for leisure, demand of electronics of all kinds shot up.

Meanwhile, the same shutdowns applied to factories, which had to halt production, leading to a backlog of production and to rapidly declining stocks.

The continued interest in electric vehicles in particular and automotives in general also contributed to the sky high demand, with electrification and digitalisation, the long-term trends driving automotive semiconductor content increase, cotinuing to accelerate in the first quarter of the year.

Mr Chery noted that bookings for automotive chips remains “well above” ST’s current and planned manufacturing capacity.

Chips are also used for both high-end and consumer industrial products, with increasing use in home appliances, motion control, power tools complemented by their demand for factory automation and renewable energy appliaction.

Additionally, ST reported that the use of chips in communications equipment and computer peripherals, saw continued adoption of 5G-related products as well as a sustained demand for PCs and especially notebooks and Chromebooks, as they continue the move from being shared household devices to individual ownership.

Finally, the rush to produce COVID-19 vaccines might have had a role to play, as the silicon used to make the vials storing the vaccines is the same as that used to manufacture chips, driving its price higher.

Inflation risk re-surging as tensions heat up between Israel and Iran

Oil and gold prices jumped after the latest strike by Israel

WATCH: Rare torrential rain in Dubai wreaks havoc and causes major disruption

Flooding hits shopping malls, destroying stock

Spain to end ‘golden visa’ scheme over property market impacts

While countries are slowly banning the practice, Malta remains firm in keeping the scheme alive