Malta’s economic rebound from 2021 continued, demonstrating a strong post-pandemic recovery in 2022 as all remaining COVID-19 pandemic restrictions were eventually removed in time for the summer tourism rush and pent-up demand could be satiated.

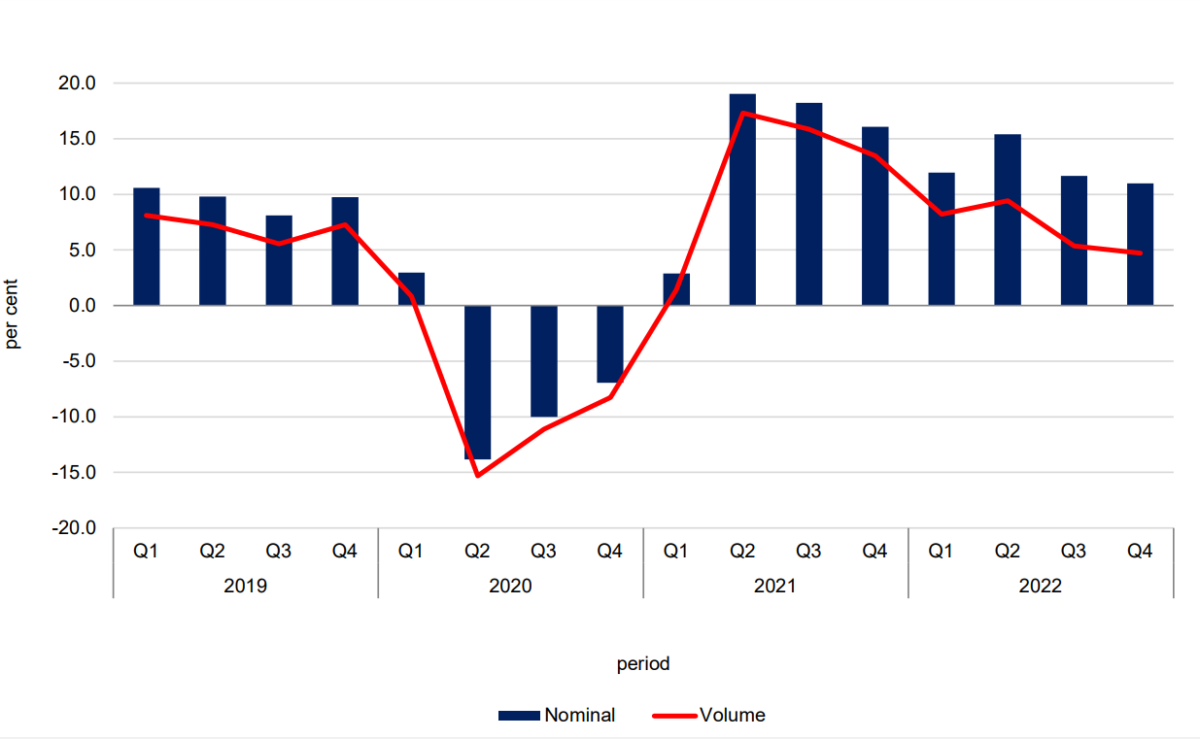

Provisional estimates by the NSO indicated that the Gross Domestic Product (GDP) for 2022 grew to 16,870.322 million, an increase of €1,868.4 million compared to 2021.

In volume terms, this represents a growth of 6.9 per cent, slightly above the Central Bank’s final projections of 6.8 per cent.

While in 2022 remaining COVID-19 restrictions were lifted, and the country was removed from the FATF greylist, it still had to contend with a turbulent economic environment brought on by painfully high rates of inflation and the impact of the Russian invasion of Ukraine.

The production approach

During 2022, Gross Value Added (GVA) rose by 13.7 per cent in nominal terms, and 8.1 per cent in volume terms relative to 2021.

The main drivers were economic activities linked to services, industry, agriculture and fishing, while growth was weighed down by the construction sector. Compared to 2021, the GVA grew by nine per cent for services, 8.5 per cent for agriculture and fishing, and 7.6 per cent for industry, whereas construction declined by seven per cent.

Growth in the services sector was mainly driven by accommodation and food services (81.4 per cent), benefiting significantly from the uplifted travel restrictions.

Despite the strong recovery, net taxes on products contributed negatively towards GDP, declining by 5.9 per cent in volume terms.

The expenditure approach

The expenditure approach is another method used to calculate GDP and is derived by adding final consumption expenditure of households, general Government, non-profit institutions serving households (NPISHs), gross capital formation (GCF) and net exports.

The contribution of domestic demand to the year-on-year GDP growth rate in volume terms was of 10.9 per cent, of which 4.7 per cent were due to final consumption expenditure, and 6.1 to GCF.

External demand registered a negative contribution of four per cent, with 10.8 per cent attributable to exports and 14.8 per cent explained by imports.

In 2022, final consumption expenditure witnessed an increase of 7.6 per cent in volume terms.

This was the result of increases in household expenditure, Government expenditure and NPISHs expenditure by 10.3 per cent, 2.4 per cent and 3.7 per cent, respectively.

Gross fixed capital formation rose by 30.4 per cent in volume terms. This increase was mainly attributable to investment in transport equipment.

Exports and imports of goods and services in volume terms rose by 6.4 per cent and 9.7 per cent, respectively.

The income approach

The third approach to measure economic activity is the income approach, which shows how GDP is distributed among compensation of employees, operating surplus of enterprises and taxes on production and imports net of subsidies.

Compared to 2021, the €1,868.4 million increase in nominal GDP was the result of a €643.9 million increase in compensation of employees, a €1,172.2 million rise in gross operating surplus and mixed income, and an increase of €52.2 million in net taxation on production and imports.

Gross National Income (GNI)

GNI differs from the GDP measure in terms of net compensation receipts, net property income receivable and net taxes receivable on production and imports from abroad.

Considering the effects of income and taxation paid and received by residents to and from the rest of the world, GNI at market prices for 2022 was estimated at €15,561.5 million.

Top 5% of taxpayers responsible for one-third of all income tax paid in Malta

On the other hand, the bottom third of income earners pay just 1.7% of all income tax generated

The Malta Institute of Accountants prepares for its 2024 Anti-Money Laundering Conference

Held at the Radisson Blu, St Julians, this latest AML Conference promises to bring exclusive insights on new procedures

Eurozone interest rates to remain unchanged

The European Central Bank noted that price pressures remain persistent