The iGaming industry in Malta has grown from strength to strength becoming a globally renowned powerhouse. The nation’s bet to be at the forefront of the budding industry in the early 2000s paid off, with the country becoming a top choice for operators looking to get licensed.

One of the elements of success which contributed to Malta’s ascent into a natural home for the industry was its pioneering framework and favourable business environment for foreign companies due to the tax imputation system. Furthermore,

When the Malta Gaming Authority (MGA), formerly known as the Lotteries and Gaming Authority (LGA) was established in 2001, it became one of the first regulators of the iGaming industry in the world. This allowed businesses to legitimise their operations, building trust with their player base.

State of the Industry

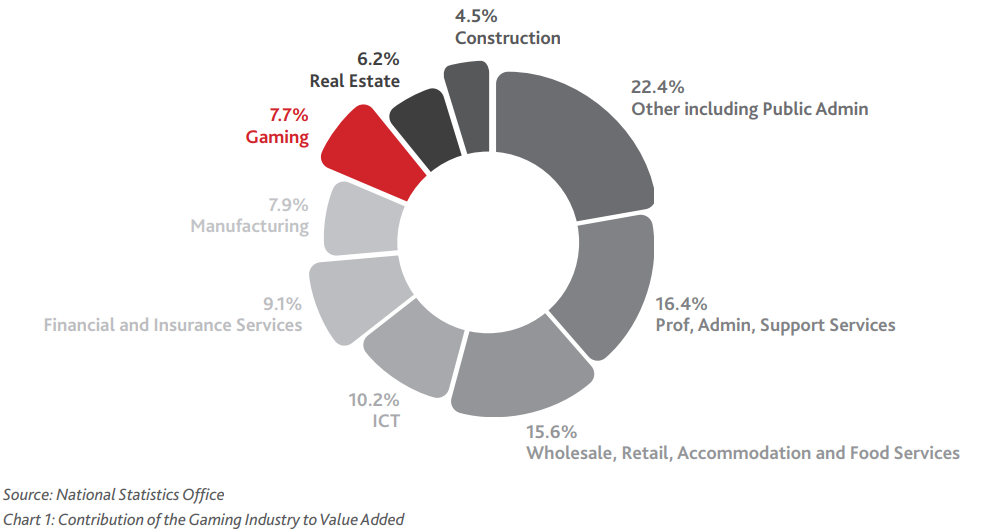

According to the MGA’s latest available annual report, in 2021 the industry was gross value added (GVA) generated by the gaming industry was estimated to be around 1.019 billion, representing 7.7 per cent of the economy’s total, almost as large as the rest of the financial services industry.

By the end of 2021, there were 341 companies licensed by the MGA, holding a total of 351 licences between them.

The industry is also always on the lookout for talent. By the end of 2021, the industry had 10,685 of workers, a 28.9 per cent increase over the previous year, and to date there’s no shortage of vacancies.

Industry stakeholders

The MGA is the sole regulatory of the country’s iGaming sector. Not only does it regulate online gambling, but also land-based casinos, slot machines, lotteries and betting offices. Since its inception it has built a strong international reputation and has become a preferred global remote gaming regulator.

The entity is run by a board of governors which are appointed by the Parliamentary Secretary for Financial Services & Digital Economy.

The board is supported by the work of the executive committee, which is responsible for the execution of the entity’s overall strategic vision and day-to-day operations.

It also involves an audit committee, supervisory council, commercial communications committee, compliance & enforcement committee and the fit & proper committee.

The MGA provides two types of licenses for iGaming:

- B2C gaming services licence

- B2B critical supply licence

The fit & proper committee was set up to decide which entities and personnel should be screened, when to conduct enhanced due diligence and whether or not licensees should continue doing business with a licence granted by the MGA.

Whereas the compliance & enforcement committee was set up in July 2019 in order to evaluate breaches of the Gaming Act and takes proportionate enforcement on a case-by-case basis.

The MGA is capable of issuing warnings, imposing administrative penalties, filing a report for criminal proceedings, and even suspending or cancelling licenses.

There is also the Financial Intelligence Analysis Unit (FIAU), which is responsible for the prevention of money laundering and financial terrorism in Malta. Due to the iGaming industry being particularly exposed to risk to ML/FT, the FIAU is actively involved in monitoring activities of licensed entities.

However, recent significant court ruling raised doubts about the capabilities of the FIAU. The constitutional court determined that the law which grants the FIAU the authority to investigate and impose fines violates the constitutional right to a fair hearing.

Consequently, certain provisions in the Prevention of Money Laundering and Funding of Terrorism Regulations and the Prevention of Money Laundering Act, which pertain to the imposition of administrative penalties, were declared null and void.

The judge presiding over the case instructed that the judgment be forwarded to Parliament for appropriate action.

GamingMalta is an independent non-profit foundation set up by the Government of Malta and the MGA. It is tasked with promoting Malta as a global hub in the industry. In recent years, it has also pivoted towards promoting Malta as a hub for the esports and video game sector.

Lastly, there’s iGEN (iGaming Executive Network), an association set up in 2018 which is made up of several iGaming companies based in Malta. The main issues that the association seeks to address are staffing shortages and banking issues, and the rising cost of rent.

Major challenges for the industry

Akin to the financial services industry, the past five years have been tremendously challenging for the iGaming industry, and while matters seem peaceful now, the industry is not necessarily in the clear yet.

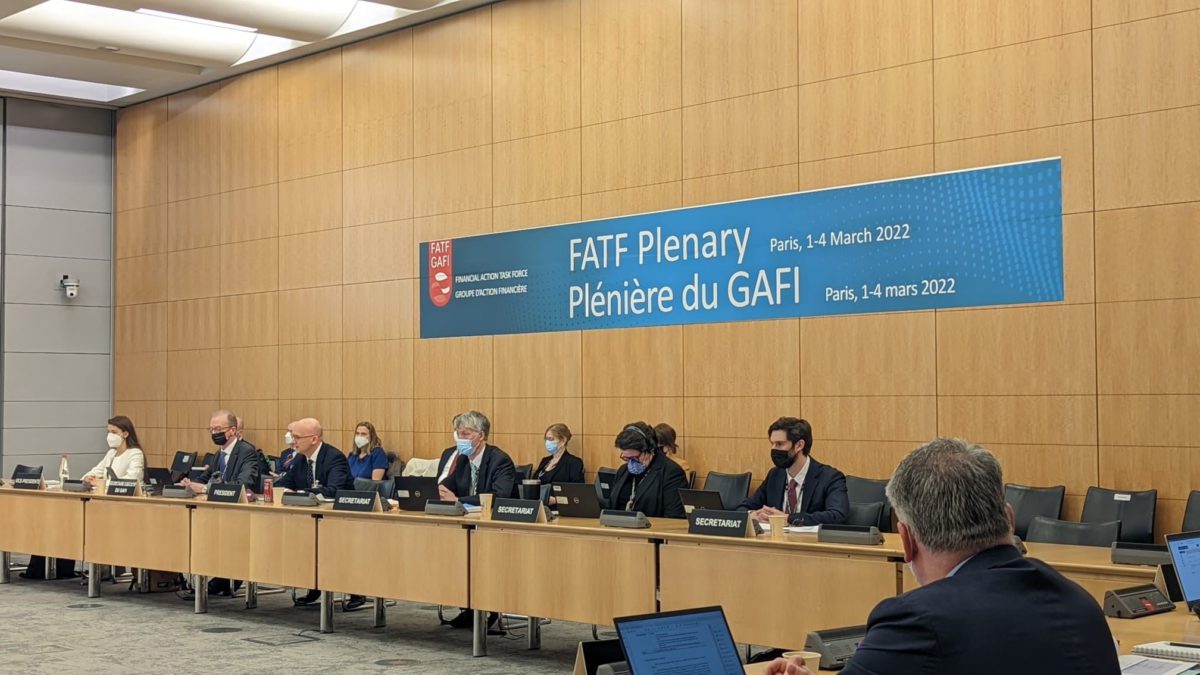

When Malta was placed on the Financial Action Task Force (FATF) greylist, it sent shockwaves across the iGaming industry. The FATF is an intergovernmental institution which is responsible for combating money laundering and terrorism financing. It sets global standards and evaluates jurisdictions to ensure compliance. If they fall short of their obligations, jurisdictions could be put on the grey list of the black list.

Malta was put on the grey list in 2021 following several years of domestic and international criticism over its handling of corruption cases and lack of action against Government figures who were mentioned in the Panama papers, and reports of tax evasion. Being put on the grey list categorised Malta as a "Jurisdiction Under Increased Monitoring"

Officially, the FATF flagged concerns over Malta's regulatory infrastructure to fight tax evasion, the level of information held on ultimate beneficial ownership and the legislative framework providing for the sharing of information with local and international financial intelligence units.

Fortunately, Malta was removed from the grey list within a year, following intensive implementation of reforms in its AML/CFT regime and the manner in which it pursues tax-based money laundering.

Diligent implementation of needed reform which took Malta out of the grey list prevented a potential exodus of firms involved in the industry.

However, the effects of the greylisting were not entirely gone. Despite being off FATF grey list, Malta's reputation was still scarred, and the ease of doing business with both local and international partners no different to when the country was still listed.

There are also upcoming changes to the country's corporate taxation system, which has historically been one of the draws for foreign companies setting up in Malta.

Malta, along with the rest of the European Union and OECD, have agreed to implement a 15 per cent minimum corporate tax rate for multinational companies with revenues surpassing €750 million.

While there may be less than a handful of companies in Malta which reach that threshold, it's possible that highly ambitious companies might think twice before relocating before to Malta.

In addition, the Finance Minister has said that the country will be moving away from the tax imputation system by 2025. The current system has allowed foreign companies headquartered in Malta to only pay five per cent corporate tax, instead of 35 per cent corporate tax (through a 6/7 tax refund scheme).

While it's too early to tell whether these conditions will impact the decision making of iGaming firms with their sights on Malta, it will definitely be on their minds.

Aside from an attractive tax regiment, Malta has fostered a strong iGaming ecosystem, with a significant pool of talent in a highly concentrated area

Education and events

The bustling iGaming industry is always in need of talent to join its ranks, which has led to an increase in opportunities to obtain industry-relevant skills.

There’s the iGaming Academy, which provides several industry-relevant courses, and also includes a training programme for MGA key function holders. There are also courses provided by the KPMG learning academy, ICE Malta and MCAST among other institutions.

Generally, individuals with a qualification and experience in finance, legal, AML/CFT, and computer science are able to integrate themselves well into the iGaming job market. Some companies even provide on-site training.

In fact, several iGaming firms provide both training programmes through their in-house academies, and internships.

Individuals looking to immerse themselves can also attend industry-centric conferences which take place year-round. Not only are they great networking opportunities, but they also allow for immersion into what the industry is made of.

If an individual is not keen on the technical skills, then fluency in a foreign language would also benefit anyone interested in getting involved in the lucrative industry, especially for content writing, customer care and video streaming jobs.

Future of the industry

The future of the iGaming industry appears to be concrete. It has held together through difficult times, and will likely do for the years to come if both the regulator and the businesses themselves tackle the challenges of the industry together.

The next big challenge will be the impact of the 15 per cent global corporate tax, and whether that will have an impact on the number of iGaming companies opting to establish in Malta, and whether any of the companies will move away ahead of that.

If you want to keep up to date with what is happening in the iGaming industry, you can also follow our sister outlet igamingcapital.mt.

Government shells out close to €70 million to national bus operator Malta Public Transport in 2023

Buses became free for residents in late 2022, leading to a hefty increase in the public subsidy

Opera Cloud PMS: The cost-effective property management system for any hotel size

Smart Technologies Ltd provides leading hotel PMS system, starting from just €6 per room per month

Inflation rate in Malta drops from 3.7% in January to 2.7% in March, nearing EU average – Government

The Government attributed the decrease in inflation to its initiative ‘Stabbiltà’