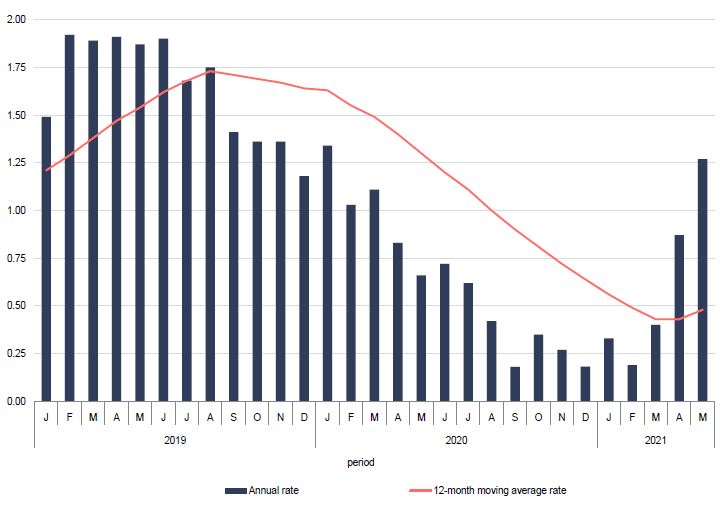

Inflation as measured by the Retail Price Index increased by 1.27 per cent in May, up from the 0.87 per cent measured in April, with food prices responsible for the largest upward impact.

Meanwhile, the largest downward impact was recorded in the transport and communication Index.

In a National Statistics Office news release, the 12-month moving average for inflation was revealed to stand at 0.48 per cent, the first increase registered since August 2019.

The RPI measures monthly price changes in the cost of purchasing a representative basket of consumer goods and services, and is closely linked with the Cost-of-Living Adjustment (COLA) increases and periodic rent payment adjustments.

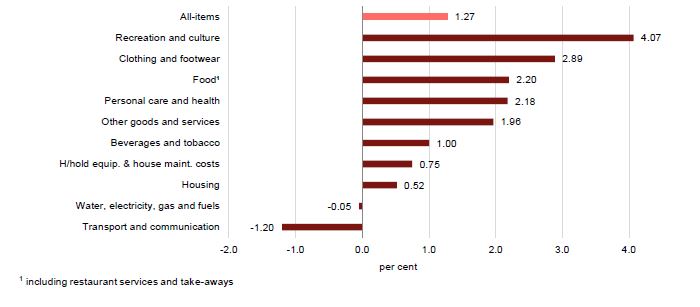

The highest annual inflation rates in May 2021 were registered in recreation and culture (4.07 per cent) and clothing and footwear (2.89 per cent).

On the other hand, the lowest annual inflation rates were registered in transport and communication (-1.20 per cent) and water, electricity, gas and fuels (-0.05 per cent).

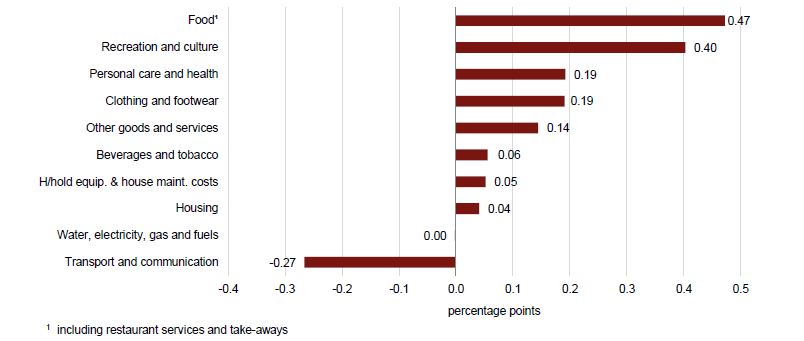

Annual inflation is impacted by the changes in inflation in different economic sectors, taking into account both the weight and the annual rate of inflation of the group.

In May 2021, the largest upward impact on annual inflation was registered in the food index (+0.47 percentage points), largely due to higher prices of fruit.

The second and third largest impacts were measured in the recreation and culture index (+0.40 percentage points) and the personal care and health index (+0.19 percentage points), mainly on account of higher private school fees and hairdressing services respectively.

On the other hand, the downward impact on annual inflation was registered in the transport and communication index (-0.27 percentage points), mainly reflecting lower prices of fuels.

In May, the recreation and culture index registered the highest annual inflation rate of 4.07 per cent, of which sports-related equipment registered an annual rate of -2.22 per cent.

Meanwhile, educational fees and related expenses registered an annual rate of 21.82 per cent and other recreational articles and services registered an annual rate of 0.31 per cent.

The transport and communication index registered the lowest annual inflation rate of -1.20 per cent, of which transport registered an annual rate of -0.96 per cent and communication registered an annual rate of -1.93 per cent.

What is the difference between the RPI and the HICP?

A closely related measure of price movements to the Retail Price Index is the Harmonised Index of Consumer Prices (HICP), which also records inflation, and which has been relatively stable over the last months.

Both indices are compiled using a large and representative selection of more than 440 different goods and services for which price movements are regularly monitored.

Around 10,000 separate price quotations are used each month to compile the index.

The RPI captures private households only, whereas the HICP covers private households, institutional households (such as retirement homes) and foreign visitors to Malta.

The methodology underlying RPI and HICP is similar, yet unlike the RPI, where the sample of goods and services changes every time the weights are updated, newly significant goods and services can be introduced in the HICP framework on an annual basis.

Annual STI testing for non-EU massage therapists amounted to ‘slander,’ admit health authorities

Health authorities kept quiet about changes to the legal provisions

KM Malta Airlines announces extra flights and special fares for MEP and local council elections

To qualify for special fares, all travel needs to take place into and out of the same city

European Parliament adopts regulation making it easier for companies to be paid on time

The maximum credit term under the new Late Payment Regulation is to up to 120 days, for some sectors