The main focus across international financial markets over the past few weeks was undoubtedly centred on the serious developments across the global banking sector. As detailed in last week’s article, in early March two regional banks in the US, namely Silicon Valley Bank and Signature Bank, failed while on Sunday 19th March, Credit Suisse was forcefully taken over by its larger rival UBS Group AG after it became apparent that the demise of Credit Suisse (one of only 30 banks worldwide that are deemed to be “global systemically important”) would have caused chaos across the global financial system.

In fact, the Swiss Finance Minister highlighted that without the state-brokered takeover there could have been a global financial crisis since Credit Suisse would “not have survived Monday”.

As confidence remained very weak across the banking sector in the aftermath of the Credit Suisse takeover, there was intense speculation towards the end of last week surrounding the strength of Germany’s largest bank, Deutsche Bank AG. The cost of insuring the bank’s debt against default jumped on Friday morning causing a major sell-off across the entire banking sector. At one point on Friday, the share price of Deutsche Bank dropped 14 per cent before staging a partial recovery in the afternoon. In view of the sharp sell-off, the German Chancellor felt the need to intervene to stem the crisis by stating that “Deutsche Bank has fundamentally modernised and reorganised its business and is a very profitable bank”. He also added “there is no reason to be concerned about it.”

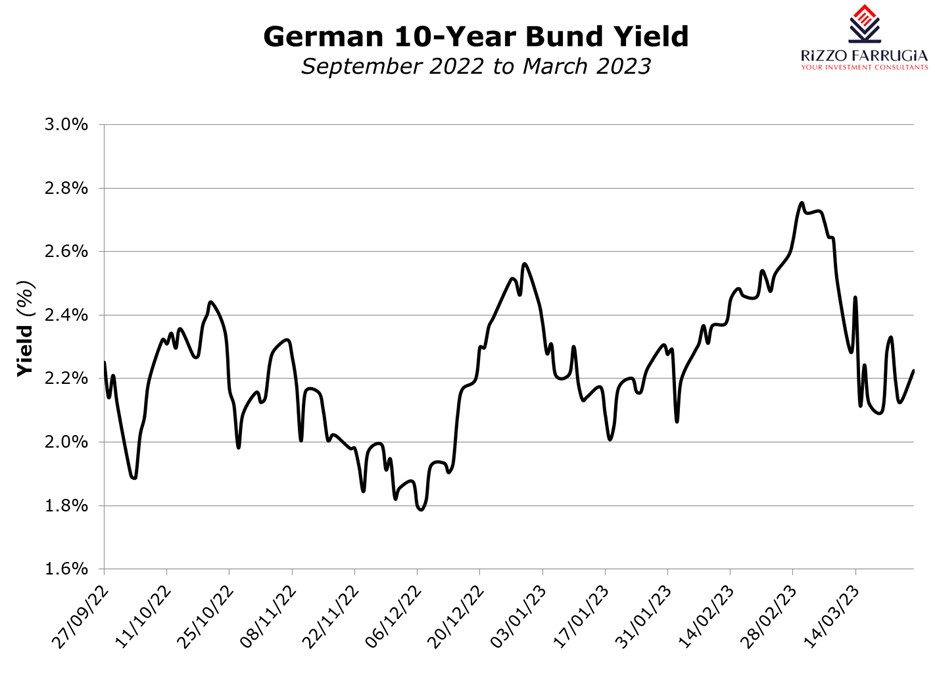

As equity markets and in particular banking equities had their fair share of volatility over recent weeks, the bond market also experienced periods of intense movements.

Sovereign bonds across most developed economies performed well as a ‘safe haven’ in view of the extremely weak sentiment arising from the banking crisis. In the eurozone, the benchmark 10-year German bond yield dropped from 2.75 per cent in early March to just above the two per cent level last week with a fair degree of volatility as developments unfolded from one day to the next.

In the US, the volatility across the bond market was very evident when tracking the movements in the yield on the two-year Treasury. As the crisis erupted in early March, the yield plummeted from above five per cent to just below 3.8 per cent representing a major rally in bond prices as a ‘flight to safety’ took centre-stage. Some market commentators noted that the plunge in the yield of two-year Treasury was larger than that at the time following the failure of Lehman Brothers in 2008 and also the 11th September 2001 terrorist attacks. Such a large decline in the yield in a few days indicates the extreme level of fear that spooked the markets since the shocks caused by the demise of the regional banks in the US and the takeover of Credit Suisse. Last week, as the contagion spread and the market began to doubt the fate of Deutsche Bank, the yield on the two-year Treasury dropped further to a low of 3.58 per cent but has since jumped above the four per cent level again as some confidence was regained.

Locally, the volatility in the bond market can be explained by the sharp daily movements in the price of the four per cent MGS 2043 bond which had been offered to retail investors at a price of 100 per cent (par) towards the end of February.

The price had initially declined to 98 per cent but rallied to almost 105 per cent on Monday 20 March in the aftermath of the Credit Suisse takeover.

In the midst of the dwindling confidence across the banking sector, the central banks in the US, eurozone, Switzerland and the UK pressed ahead with further rate hikes this month. Swift action by policymakers to deal with the crisis so far provides assurances to many financial analysts and economists that contagion can be contained. Meanwhile, the impact of tighter bank lending conditions strengthens the case that rate-hiking cycles are close to their peak.

The updated forecasts by the European Central Bank (ECB) indicate that economic growth across the eurozone will improve to one per cent this year with inflation falling to 5.3 per cent and dropping further to 2.9 per cent in 2024. In view of the persistently high level of inflation anticipated for this year, many economists expect the ECB to hike rates from the current level of three per cent to 3.5 per cent over the next three months and maintaining this level for the rest of the year.

In the US, the Federal Reserve is still widely expected to implement a further rate hike of 25 basis points in May and another in June to take rates to a peak of 5.5 per cent. There are however divergent views on the future decisions of the Federal Reserve with the closely-watched Fed Funds futures market implying cuts in rates from the second half of 2023 and an overall decline of 100 basis points by January 2024.

Bond markets will likely remain volatile in the weeks and months ahead. Movements in yields and bond prices (locally and internationally) will be centred around the sentiment across the global banking sector as well as inflation readings and interest rate decisions by the major central banks. The outlook undoubtedly remains highly conditional on confidence and stability across the banking sector as was evident during the extraordinary past three weeks.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers)

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Reduction in free float

Lowering Malta’s minimum free float requirement to 10% could unlock new opportunities for the local capital market

A golden age for GO plc

GO plc’s Annual General Meeting revealed a bold shift beyond traditional telecoms, stronger-than-ever financials, and possible share buy-backs

Another v-shaped recovery

Towards the end of 2024, most investment banks predicted that the S&P 500 index would continue its positive streak