In last week’s article I explained a number of important achievements over recent months as international equity markets performed remarkably well despite multiple sources of uncertainty arising from both the macro-economic environment as well as the geopolitical situation.

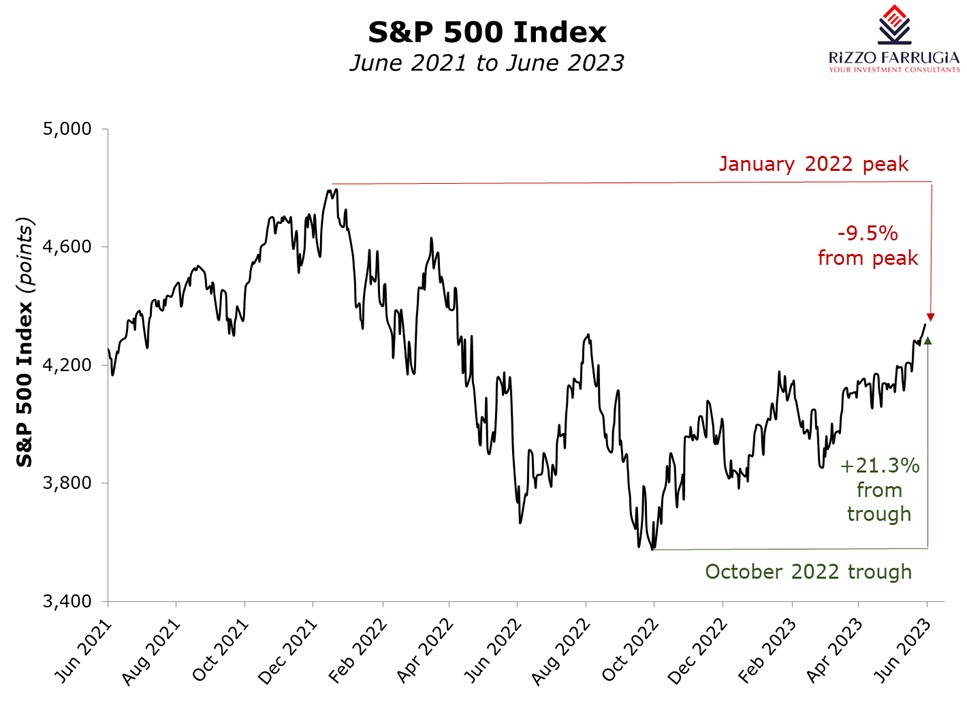

Incidentally, last Thursday, the S&P 500 index in the US reached another important milestone as it entered a theoretical bull market having recorded a 20 per cent jump from its low of 3,577.03 points on 12th October 2022. This brought to an end the bear market that began in January 2022. Statistics indicate that this ranked as the longest bear market since 1948. It lasted 282 days between 3rd January 2022 and 12th October 2022 and during this period, the S&P 500 index shed 25.4 per cent. Despite the duration of the bear market, it ranks as a mild downturn given the fact that the average bear market since 1929 resulted in a decline of 39.4 per cent.

Following the initial relief rally during the fourth quarter of 2022, the S&P 500 has gained just under 13.5 per cent this year mainly due to the fact that the economy has so far avoided a sharp downturn despite the consistent interest rate hikes by the Federal Reserve. Moreover, recent inflation readings have shown that inflation has come down significantly from last summer’s peak without higher interest rates triggering a sharp increase in unemployment.

Over recent weeks, the rally gathered momentum following the deal reached to end the debt ceiling crisis as well as growing optimism that the Federal Reserve will pause rate hikes during the scheduled monetary policy meeting taking place this week. The US equity market continued to perform positively at the start of the week with the S&P 500 index jumping to its highest level since April 2022.

Notwithstanding the 20 per cent gain in the index since the low of 3,577.03 points last October, the S&P 500 index has not yet reached a new high. In fact, the S&P 500 index is still circa 9.5 per cent below the record level of 4,796.56 points on 3rd January 2022.

This latest bull market is considered to have begun on 13th October 2022, a day after the S&P 500 closed at its most recent low. As such, theoretically, it has taken 164 days for the index to enter into bull market territory. Looking back at previous market rallies, one notes that since 1932, the average bull market has lasted nearly five years and delivered a 178 per cent gain.

There are mixed views from several market commentators on whether this fresh bull market will last or whether it will prove to be a short-lived rally.

One of the reasons behind the scepticism for the strength of this bull market is the fact that the current rally is primarily driven by gains in large technology companies. In fact, across many financial journals, these companies have been defined as the Super Seven’s most of which are benefiting directly from the AI boom. Nvidia, Tesla, Alphabet, Microsoft, Apple, Amazon and Facebook’s parent Meta Platforms are the companies that contributed to the current bull market. In fact, if you remove these companies from the S&P 500 and consider the remaining 493 companies forming part of the benchmark, then the index would not show any gains this year. Moreover, this can also be analysed through the performance of the tech-heavy Nasdaq Composite which is outperforming the broader US equity benchmark with gains of over 33 per cent from its 52-week low last October.

Since the start of the year, the share price of Nvidia is the star performer with a gain of 175 per cent helping it become the sixth largest public company in the world valued at over €1 trillion.

Tesla gained 131 per cent and Meta’s share price has so far jumped 117 per cent. Meanwhile, Apple, and Amazon are both up over 45 per cent while Alphabet is up almost 40 per cent over the past six months.

Apart from the Super Seven’s, two other companies forming part of the S&P 500 index also showed remarkable gains so far this year although they are much smaller in size to have a large impact on the overall direction of the market. Advanced Micro Devices, a semiconductor company also benefitting from the AI boom, is up 101 per cent and Royal Caribbean is showing gains of 92% following a stronger-than-expected demand for travel following the pandemic.

Furthermore, a key concern is whether inflation in the US will remain well-above the targeted level, as it raises the prospect that the Federal Reserve has not yet finished with its aggressive interest rate increases and will resume hikes in July following the widely-anticipated pause during this week’s monetary policy meeting.

Naturally, a key determinant of whether this bull market will be maintained will be upcoming interest rate decisions by the Federal Reserve. Many market commentators believe that the rally can be sustained if the interest rate hike expected in July will be the final increase of the monetary tightening cycle but this is all dependent on the inflation rate.

One particular investment bank that until recently was rather bearish on the future outcome of the market has now turned bullish by claiming the S&P 500 could climb to a new all-time high of 4,900 points within the next 12 months which would imply a gain of a further 13 per cent from current levels. This would be very much in line with similar trends in the past. In fact, after surpassing the 20 per cent threshold, the S&P 500 on average continued to rise over the next 12 months in 92 per cent of the time with an average return of 19 per cent.

As explained last week, it is always extremely difficult to time the markets to perfection. Few retail investors would have expected such a recovery in technology companies after such a dismal performance in 2022 given the prospect of further hikes in interest rates. Yet again, the unpredictable outcome over recent months indicates that if one invests in a portfolio of high-quality businesses at reasonable prices, this should generate very handsome returns over the long term.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers)

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Mobilising savings into investments

Malta’s equity market needs to grow in size and depth if it is to embrace the EU’s Savings and Investments ...

Reduction in free float

Lowering Malta’s minimum free float requirement to 10% could unlock new opportunities for the local capital market

A golden age for GO plc

GO plc’s Annual General Meeting revealed a bold shift beyond traditional telecoms, stronger-than-ever financials, and possible share buy-backs