The latest BOV Asset Management Investor Sentiment Index shows that investors have responded differently to the latest developments brought about by COVID-19, the US Presidency and the Brexit movement.

The current index reading now stands at 89.60, whilst the future sentiment index has reached 85.83, both indices showing significant declines since the last reading.

Conducted by MISCO International, the annual index is carried out through telephone interviews among local investors. The latest reading was the outcome of a sample of 602 respondents, of which 52 per cent were male and 48 per cent were female.

It was also noted that 38 per cent of these investors are within the 18-34 age group, indicating an increase in young investors.

A closer look at the Maltese investor’s profile as projected through these surveys shows that the Maltese investor continues to have a consistent preference for local investment while taking a more balanced approach to their risk profile. At the same time, a substantial amount of 31 per cent stated that they have a mixed investment strategy of both local and foreign investments.

“Since the last reading, most investors retained a risk-averse approach, but they are still seeking to attain both income and growth from their commitments,” stated Mark Vella, Head at BOV Asset Management. “Despite high levels of uncertainty and a lack of stability put on us by the pandemic, the importance of growth and ambition is still an integral part of the current investment profile.”

During a virtual breakfast meeting, Joseph Camilleri, Executive Head at BOV Asset Management said, “Now in its 5th wave, the Investor Sentiment Index serves as an informative tool for investors to make more informed decisions.” He continued to explain that such research projects enable entities to understand more of the local investor, address market gaps and seek innovative ways to gauge investor sentiment.

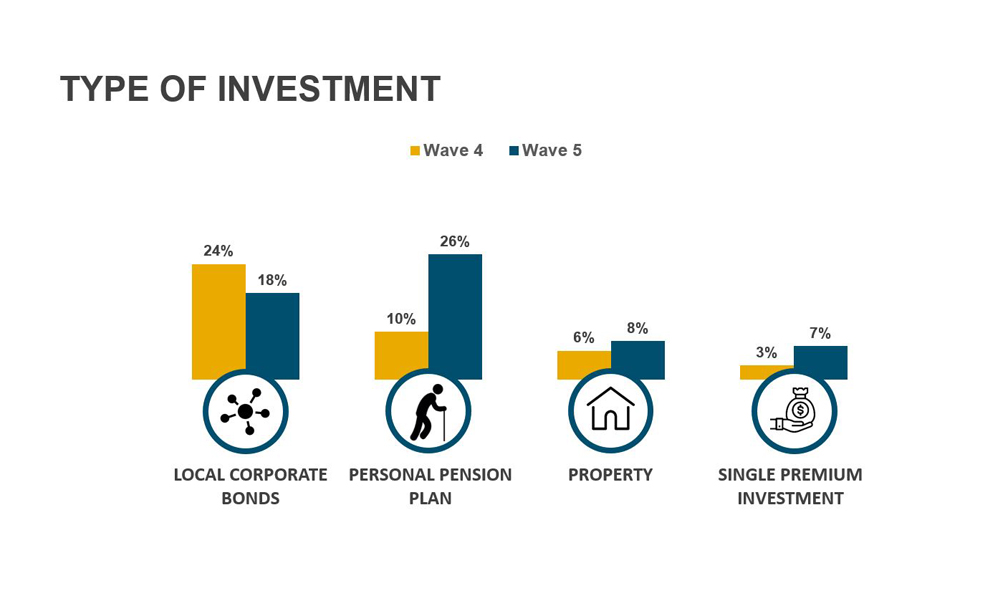

The latest results show that investments in Government stocks suffered a rapid decline of 11 per cent since the last reading, whereas more investors moved towards funds, investment grade bonds and high yield bonds. Moreover, there was an increase of 16 per cent in personal pension plans and a decrease of six per cent in local corporate bonds since the previous Investor Sentiment Index reading.

A proportion of 43 per cent of these investors have been investing for more than 10 years.

When asked about their preferred investment channel, the vast majority (64 per cent) of Maltese investors continue to choose banks, but still showing a downfall when compared to the 75 per cent from the last reading.

Various types of financial intermediaries were mentioned by 28 per cent, whereas 16 per cent of investors invest online or on their own, an increase by eight per cent since Wave four. A majority of close to 40 per cent consider property and government stocks as the best investment options.

Mr Vella remarked that although the future index is expected to decrease due to the challenges posed by COVID-19, some positive aspects can be taken from the latest Investor Sentiment Index.

“The Maltese Investor is evolving and becoming more prudent, as 34% of these respondents hold a monthly investment programme” said Vella. “It will be interesting to see how the local investor develops in a post-pandemic scenario, where the new normal and the impact of generational change could derive drastically different investment portfolios.”

General fear of travelling doesn’t justify free holiday cancellation, MCCAA warns

Malta Competition and Consumer Affairs Authority clarifies rights for travellers amidst concern over the Middle East war

Malta to host first Mediterranean forum on accessible hospitality

One panel will examine Malta’s potential role as a regional focal point for promoting accessibility in the hospitality sector

Merchant Shipping Directorate ‘providing full support’ to Malta-flagged vessels in Middle East

Malta committed to ensuring that its flag continues to represent safety and stability ‘even in challenging circumstances’