Treasury Bills and other money market instruments should be utilised solely for that portion of liquidity that truly may be required in the short term.

Ever since the change in the interest rate environment in the second half of 2022 following the extended period of unprecedented low to negative interest rates across the eurozone, various types of investors have been using the Treasury Bill market in order to start generating investment income on part of their idle liquidity held in banks.

Since the largest banks in Malta did not materially change their interest rates for depositors, the prospect of using the Malta Government Treasury Bill market became more appealing. However, despite the evident mobilisation of some of this liquidity into money market instruments, the amount of deposits within the banking system remains exceptionally high indeed which is leading to record levels of profits for the banks especially those which effected limited ‘pass through’ of interest rates.

I explained the mechanics of the Malta Government Treasury Bill market on a number of occasions since October 2022 when participation increased as the interest rate environment changed. Over the past 18 months, the weekly auctions attracted consistent demand from the investing public.

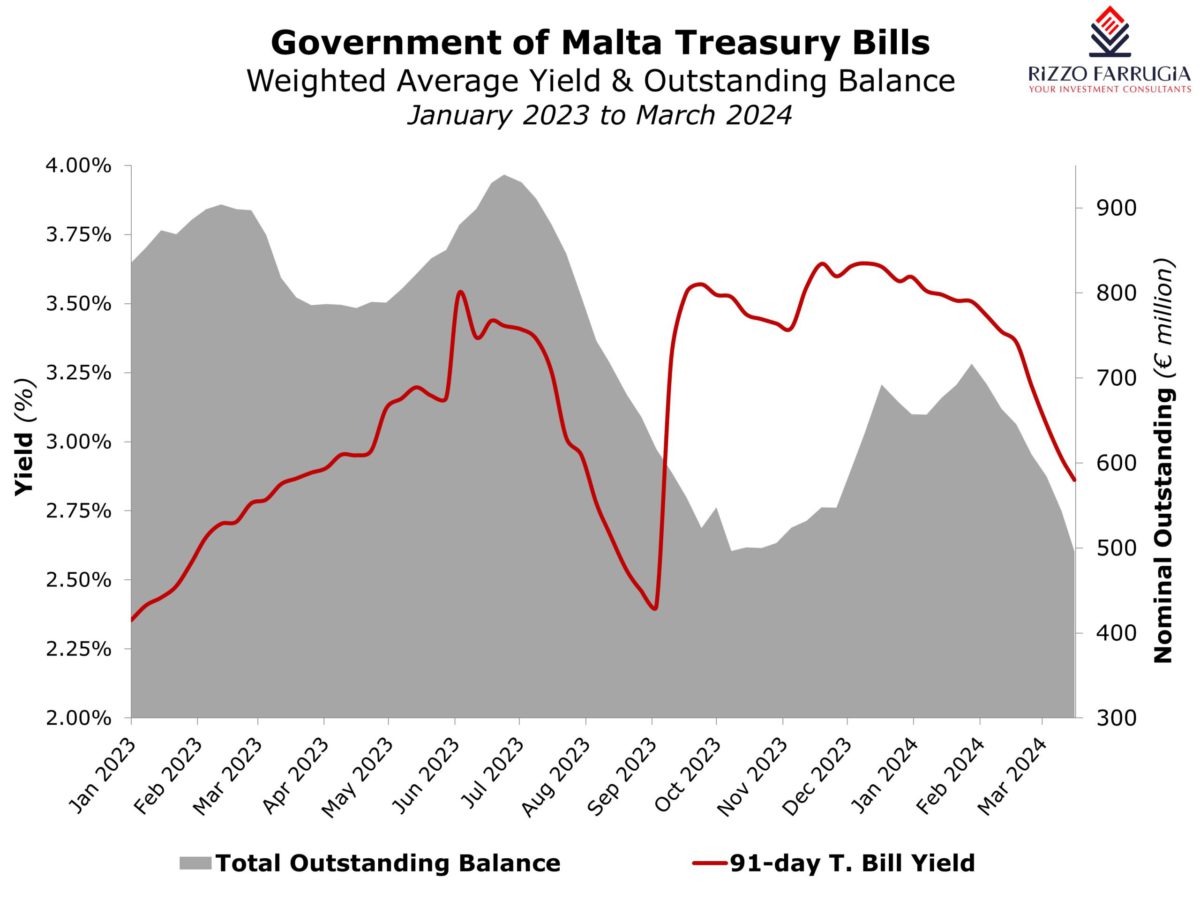

In fact, the total outstanding Treasury Bill issuance approached the €1 billion level in September 2022 and remained above the €800 million level for most of the first half of 2023. Treasury Bill issuance declined rapidly in September and October 2023 to below €500 million and subsequently increased once again to €700 million in early 2024. However, last week the total outstanding amount of Treasury Bills dropped once again to below the €500 million level. As a consequence of the lower acceptance by the Treasury, the yield on Malta Govt Treasury Bills also declined with the weighted average yield of the three-month Treasury Bill dropping below the 2.90 per cent level compared to a high of 3.646 per cent in December 2023.

Investors may be surprised at the decline in Treasury Bill issuance when the budget deficit is still expected to remain high on an absolute level (totalling €920 million in 2024) and in view of this, the Government is expected to require funding of up to €1.7 billion during the year. However, following the recent MGS issuance of €399 million and the issue of Malta Government Savings Bonds of €72 million available only to pensioners, last week it was revealed that during the first two months of the year, the Government’s consolidated fund reported a surplus of €151.4 million. As such, the low level of Treasury Bill issuance is clearly directly as a result of the current low funding requirements of the Government.

While yields on Malta Government Treasury Bills have declined during the past several weeks, it is worth highlighting that this is not reflective of the situation across the eurozone. The lower yield is only due to the lower amounts being accepted by the Treasury and the consistent level of demand by investors. Several investors may be indifferent on the maximisation of yields and may simply wish to generate a positive return compared to zero (or close to zero) rates of interest on savings or term deposits among the larger credit institutions in Malta.

On the other hand, yields on other short-term bonds across the international bond markets (with exactly the same characteristics of Malta Government Treasury Bills) are still generating yields of well-above the three per cent level.

In fact, the main international finance websites depict yields on short-term sovereign bonds on an ongoing basis with the 3-month German bund yield currently at 3.75 per cent, France at 3.9 per cent and Italy at 3.8 per cent just to name a few. Moreover, there are several investment-grade corporate bonds (some with similar credit ratings of the Malta Government and others also with a higher rating) of well-known multinationals also providing attractive yields for short-term bonds.

Investors need to align their investment portfolios with their overall investment objectives in view of the ‘reinvestment risk’ in the months ahead. While Treasury Bills have consistently given an annualised yield of above three per cent over the past 18 months, it should not be assumed that this will continue indefinitely especially as the European Central Bank is expected to start reducing its deposit facility as from June 2024 which should lead to lower yields.

As such, Treasury Bills and other money market instruments should be utilised solely for that portion of liquidity that truly may be required in the short term. Investors need to rethink the optimum level of cash and short-term liquid instruments that needs to be kept in the bank or in money market instruments, and subsequently select financial instruments that match their ulterior investment objectives.

The opportunity cost of holding excess liquidity has been evident over the past 18 months as investors could have easily obtained annualised yields in excess of three per cent in very short-term financial instruments both locally as well as internationally as opposed to keeping them idle on call at credit institutions. Likewise, with yields possibly declining in the months ahead, investors need to be cognisant of the reinvestment risk of keeping too large a balance of idle cash and short-term liquid instruments as opposed to a portfolio that is suitability structured to match longer-term objectives.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers).

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Reinventing the single market: Strategic vision and bold reforms for Malta and Europe

Proposed reforms present significant opportunities and formidable challenges for our small island nation

The equity market in pre-COVID times

Investor sentiment has evidently failed to recover from the series of shocks since the start of 2020

Interest rate divergence ahead?

Inflation is falling faster than forecast in Europe, while exceeding expectations in the US