Malta’s Government debt-to-GDP ratio decreased over the last year on the back of the rapid rate of economic growth – the highest in the European Union.

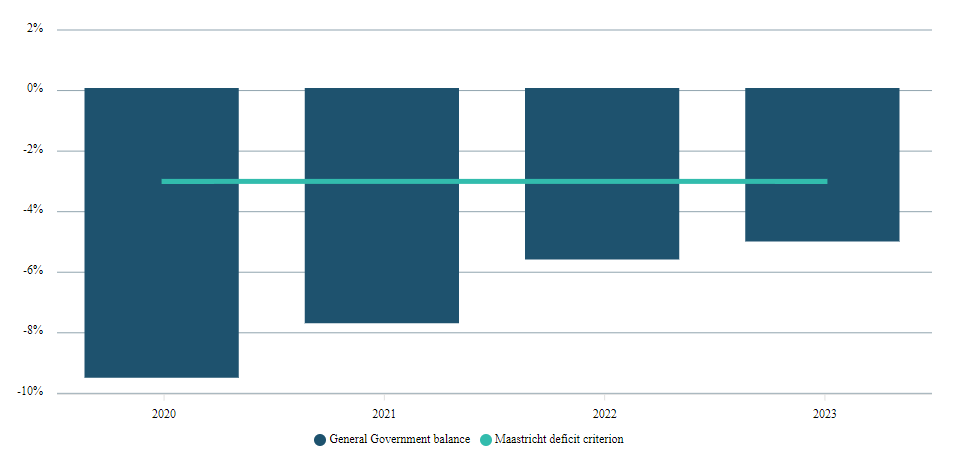

New data issued by the National Statistics Office shows that the Government registered a deficit of €950.4 million for 2023, equivalent to 4.9 per cent of GDP.

Although a reduction from the 5.5 per cent registered in 2022, the deficit is considerably higher than the three per cent limit set as part of the EU’s fiscal stability rules, and added €768 million to the national debt, which now stands at €9.77 billion.

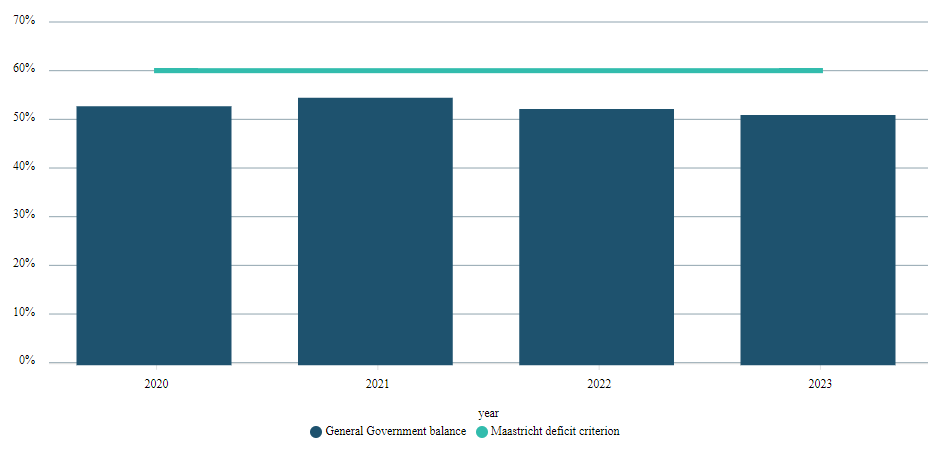

However, robust growth in GDP of around 3.8 per cent meant that despite the increase in total debt, it amounted to a smaller proportion of the Malta’s output for the year, bringing the debt-to-GDP ration down to 50.4 per cent.

This is well below the 60 per cent limit established by the EU’s Maastricht criteria.

In a statement, the Ministry for Finance said that the improvement in the deficit-to-GDP ratio will continue in the coming years, with a planned fiscal reduction of 0.5 per cent every year, as announced by Finance Minister Clyde Caruana in the Budget for the year 2024 and in line with the Economic Governance Framework after the agreement reached between the Finance Ministers of the European Union countries during an ECOFIN meeting last January.

The numbers in this latest release are different to those included in previous releases, as the latest data was compiled through an accruals-based exercise, in line with the established European methodology.

The latest data also included adjustments accounting for the inclusion of Extra Budgetary Units (EBUs) and the local government sector.

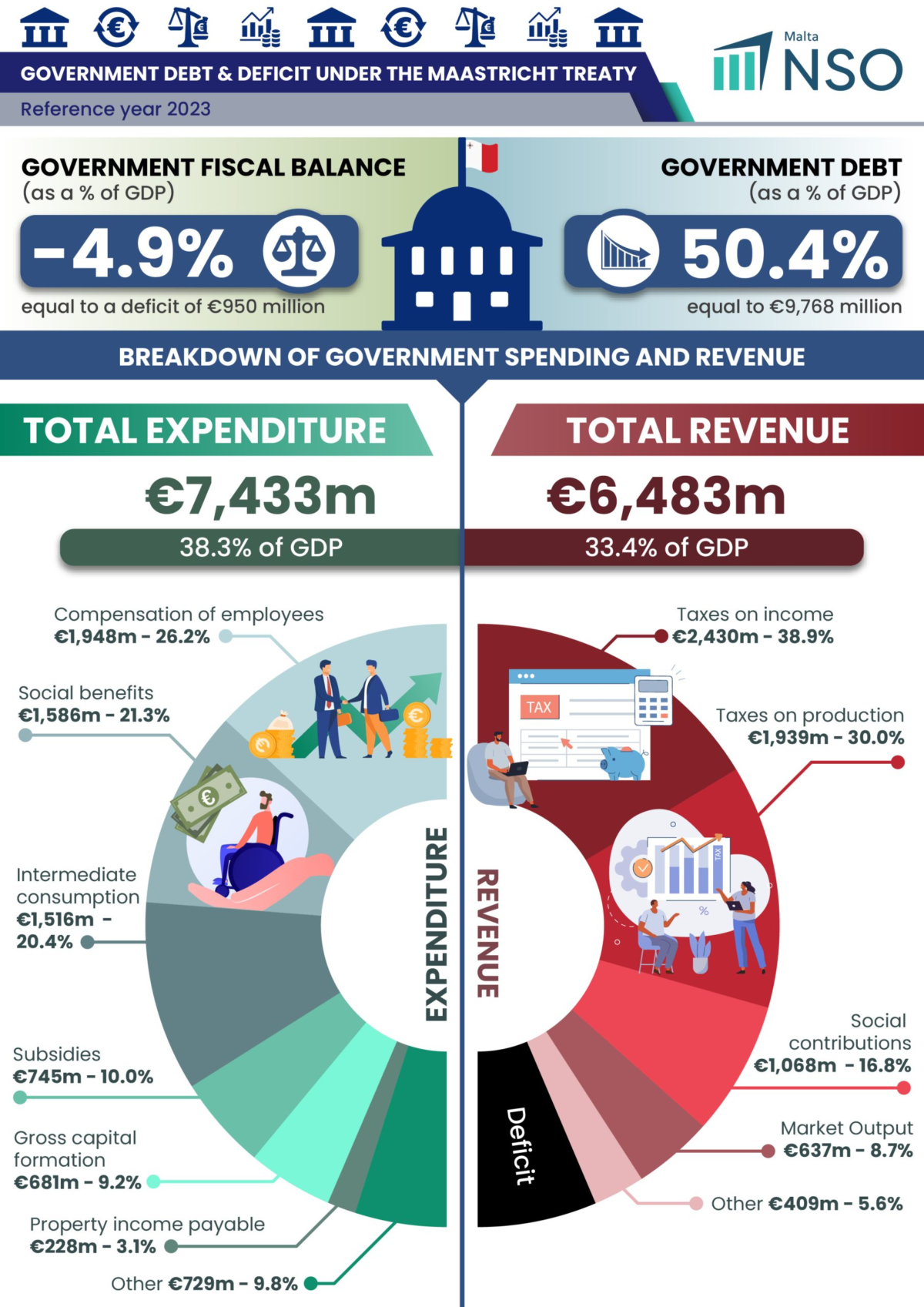

A breakdown of the Government’s income and expenditure released by the NSO shows that the biggest expense for the state is the compensation of employees, taking up over a quarter of its budget. Social benefits account for another 21.3 per cent, while intermediate consumption – including outsourcing – makes up another 20.4 per cent. Subsidies, such as those on electricity and grain, account for 10 per cent.

On the revenue ride, income tax is responsible for the lion’s share, at 38.9 per cent, while taxes on production make up another 30 per cent. The rest is made up with social security contributions (16.8 per cent), market output (8.7 per cent) and other income (5.6 per cent).

Għajn Tuffieħa Bay named ‘most beautiful beach in Europe’ for 2024 by European travel platform

The results are based on the votes of 103,224 worldwide travellers

MDA says April 2024 broke records with value of promise of sale agreements surging by 14.4%

A report from the MDA highlights that there were 1,385 promise of sale agreements last month

1,695 businesses found employing non-EU workers illegally in 2023

The figure amounts to a significant portion of all employers in Malta