The latest Central Bank of Malta (CBM) quarterly review, covering Q3 of 2022, demonstrates an ever-tightening labour market in an environment of strong and stable economic growth.

During the quarter in question, real GDP grew by a respectable 5.2 per cent.

This was a drop from the Q2 2022 high of 9.4 per cent, but it was expected that such a feat would be difficult to achieve for two consecutive quarters. A factor at play which contributed to a slower economic growth during Q3 compared to Q2 was weaker domestic demand, in light of rising inflation.

Taking a deeper dive into the economy, the CBM calculated Malta’s output gap, an economic measure of the difference between the actual output of an economy and its potential output.

The output gap for Q3 of 2022 stood at 1.2 per cent, indicating an over-utilisation of the national economy’s productive capacity. “This reflects a strong pace of activity in the context of labour shortages and other supply bottlenecks,” noted the CBM.

Developments within the labour market remained positive, which is a double-edged sword since it means a starker labour shortage.

Employment levels overall rose to new highs, and unemployment stood at 2.9 per cent, with fewer than 1000 individuals on the unemployment register. New employment was registered in large part by a growing number of women participating in the economy.

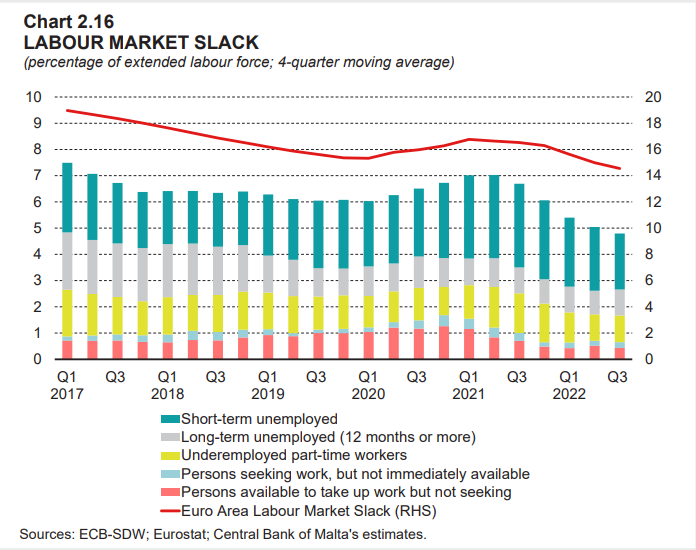

The CBM analysis provides insights into Malta’s labour market slack (i.e., unemployed and underemployed individuals). By the end of Q3 of 2022, it registered at 4.8 per cent, well below the eurozone average of 14.6 per cent.

Short-term unemployed individuals were the biggest contributors to labour market slack, followed by underemployed part-time workers who were able to work a few more hours.

Price pressures continued to build during Q3 of 2022. Annual inflation as measured by the Harmonised Index of Consumer Prices (HCIP) stood at 7.4 per cent by the end of Q3 2022 and had not declined in any significant way by the end of the 2023.

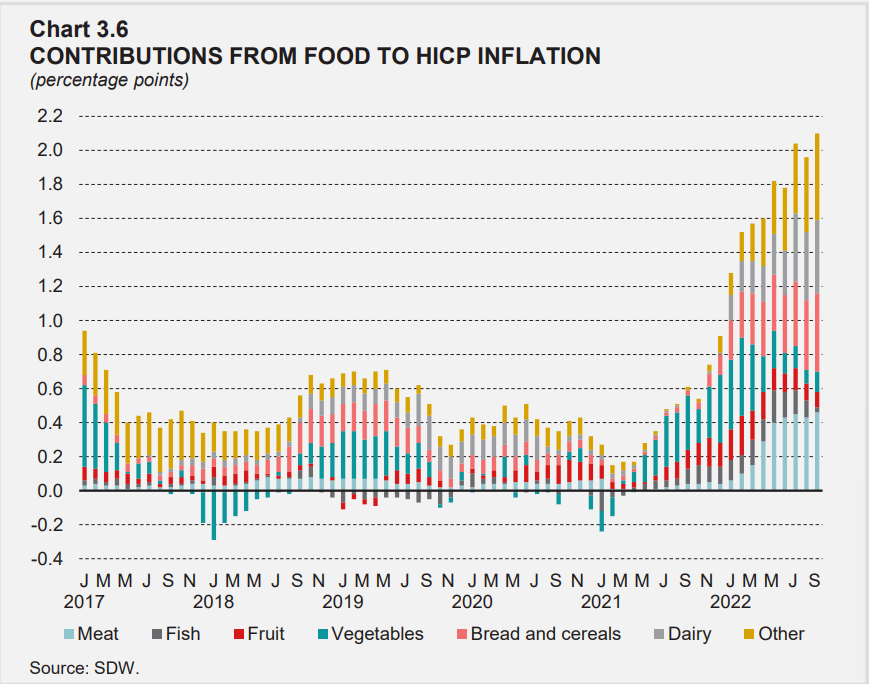

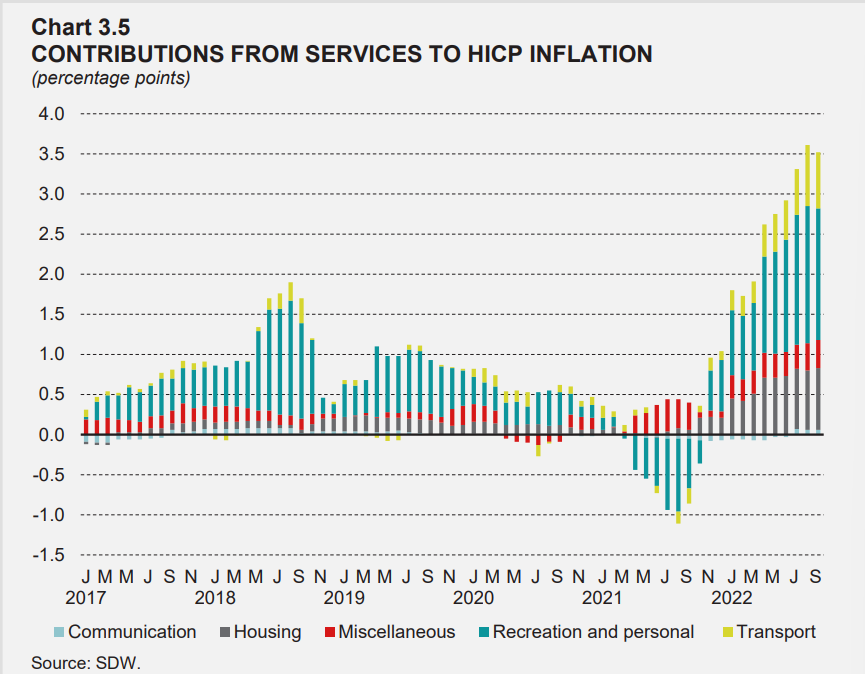

Between Q2 and Q3 of 2022, the cost of services was seen as the main driver behind inflation, followed by food and non-energy industrial goods.

The primary factors contributing to the increasing cost of services were identified in the rising cost of recreational and transportation services. On the other hand, the rising cost of food was largely attributed to more expensive meat, dairy, and bread.

While not insignificant, Malta’s rate of inflation during Q3 of 2022 was well below the EU average, which was recorded above the 10 per cent for the quarter. This is in large part due to Malta’s Government implementing broad price-freezing subsidies on the energy market.

While such a measure has protected households from fluctuating energy prices, the International Monetary Fund drew the country’s attention to the need for an exit plan from the costly measure.

The generous subsidy programme is budgeted to cost the state around 10 per cent of its national expenditure in 2023.

For a fuller picture of the Central Bank’s review of Q3 2022, click here.

Malta’s inflation edges up to 2.7% in October as food and services lead price pressures

The October RPI reading indicates some re-acceleration in consumer-facing sectors after a period of summer stabilisation

db Group reports turnover of almost €100 million and record profit as it opens bond issue to public investors

This coincides with the launch of a €60 million bond programme to support the Group’s continued expansion

Celebrating success: stories from the team behind Finco Trust

The stories of Lee-Anne Abela, Kris Vella, and Maria Mamo reflect the values that continue to guide the firm forward