During the COVID-19 pandemic, household savings shot up as the opportunities to spend money decreased, with the curtailment of travel, eating out and events cutting people’s expenses and boosting their bank deposits.

Those extra savings have come in very useful, serving to keep families afloat during the post-pandemic reopening, which arrived with a major challenge in the shape of generationally high inflation rates.

Effectively, the money saved during the pandemic is currently being spent to keep up with the high prices seen for everything from food to household maintenance.

And in a new analysis by the Central Bank of Malta (CBM), it warns that “these excess savings are being depleted.”

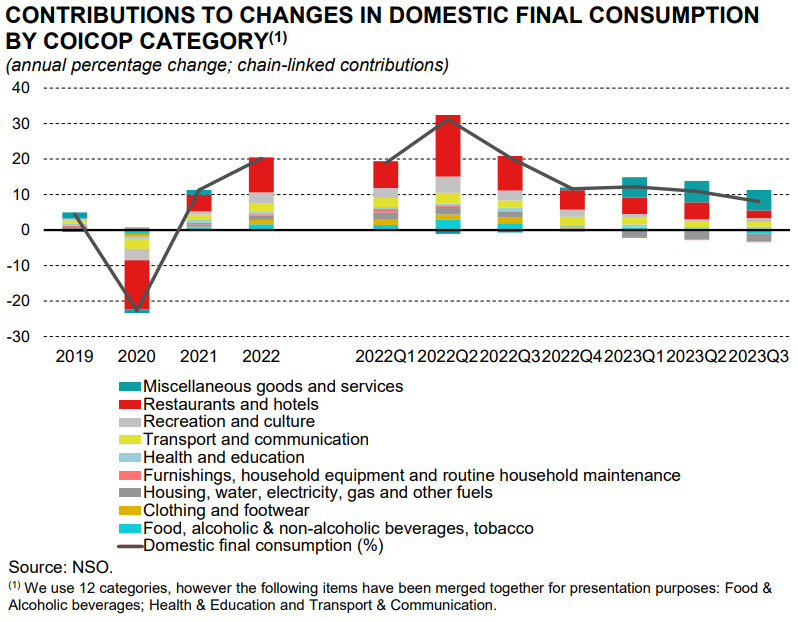

In its first outlook for the Maltese economy for 2024, the CBM notes the positive performance of private consumption after the pandemic. In fact, consumption exceeded pre-pandemic levels by 2022, and acted as one of the main drivers for economic growth.

During the first three quarters of 2023, growth in private consumption averaged eight per cent year-on-year, a figure the CBM admits “may be somewhat puzzling” in the current context of high inflation.

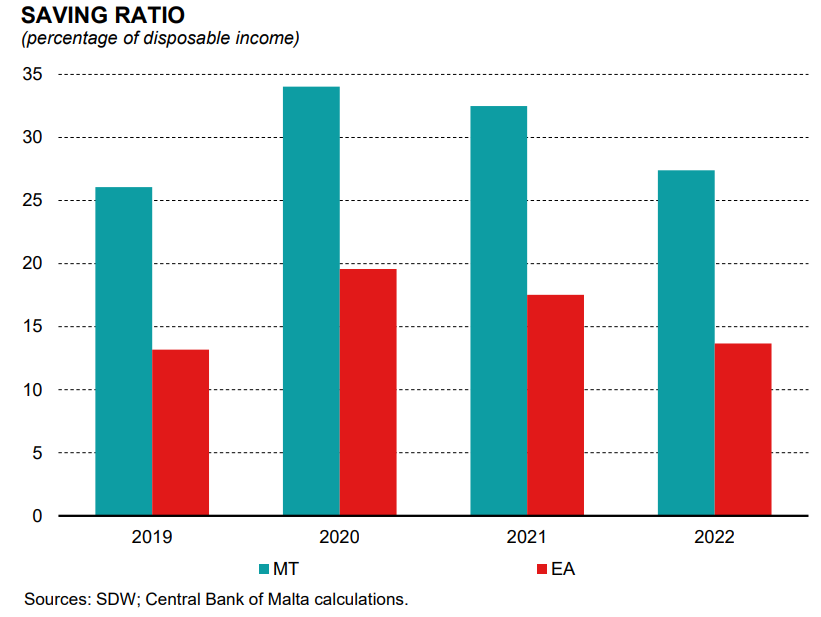

Malta has typically had a relatively high savings rate, which stood at 26.1 per cent in 2019 – 12.9 percentage points higher than the euro area average. This difference between the local savings rate and the euro area’s even increased to 13.7 per cent.

The high savings rate coupled with fixed energy prices shielded Maltese households, and facilitated consumption smoothing during the recent period of high inflation, according to the CBM.

Due to the pandemic, it was estimated that in 2020, 2021 and 2022 locals respectively saved eight per cent, 6.4 per cent and 1.3 per cent more, as a percentage of their disposable income, than they otherwise would have.

These “excess savings” were largely kept in liquid instruments like bank deposits, which could easily to tapped into and likely “provided a strong impulse to consumption.”

Delving into the data, the CBM’s researchers – Maria Christine Saliba, a senior economist, and Abigail Marie Rapa, a principal economist within the Economic Projections and Conjunctural Analysis Office – find that growth in total domestic consumption rose very sharply during 2021 and 2022, driven by all categories, but especially restaurants and hotels, mirroring the strong tourism recovery.

In 2023, the largest contributor was miscellaneous goods and services, which includes expenditure on personal care, insurance, and financial services, among others. This was followed by restaurants and hotels, and recreation and culture.

During 2023, however, some categories registered declines, presumed to be related to relatively high inflation. These included house maintenance, food and drink, furnishings and household equipment.

While consumption remained strong, savings started falling by 2023, and in fact decreased below the 2019 levels, suggesting that these excess savings are being depleted.

Indeed, by December 2023, present savings were significantly below 2019 levels, “supporting the view that households have been utilising both their savings accumulated during the pandemic as well as their regular savings to smoothen consumption.”

The findings regarding savings and consumption are borne out by consumer confidence surveys, which show a steady decline throughout the second half of 2023, mainly driver by consumers’ expectations on the economic environment. On the other hand, expectations on major purchases such as furniture and electronic equipment have remained strong.

“This suggests that private consumption will remain relatively strong over the forecast horizon, though less so than in 2023.

“Similarly, the savings expectations indicator, which gauges households’ perception on their ability to save in the next 12 months, has been recovering from the sharp declines witnessed in 2022. This suggests that the saving ratio should begin to stabilise.”

Ultimately the CBM expects the saving ratio to stabilise at around 22.1 throughout 2024, which is close to the average of the last ten years – indicating that a return to normality might finally be with us.

Malta’s R&D spend stays level at 0.6% of GDP

Total expenditure of research and development amounted to €121 million in 2023, an increase of €16.1 million

Most Maltese scam victims don’t know about dispute resolution service, study finds

In this day and age ignorance costs, as scammers are getting increasingly clever

Extreme heat set to leave 2.5% dent in Malta’s GDP by mid-century

The country is set to see GDP impacts from extreme heat