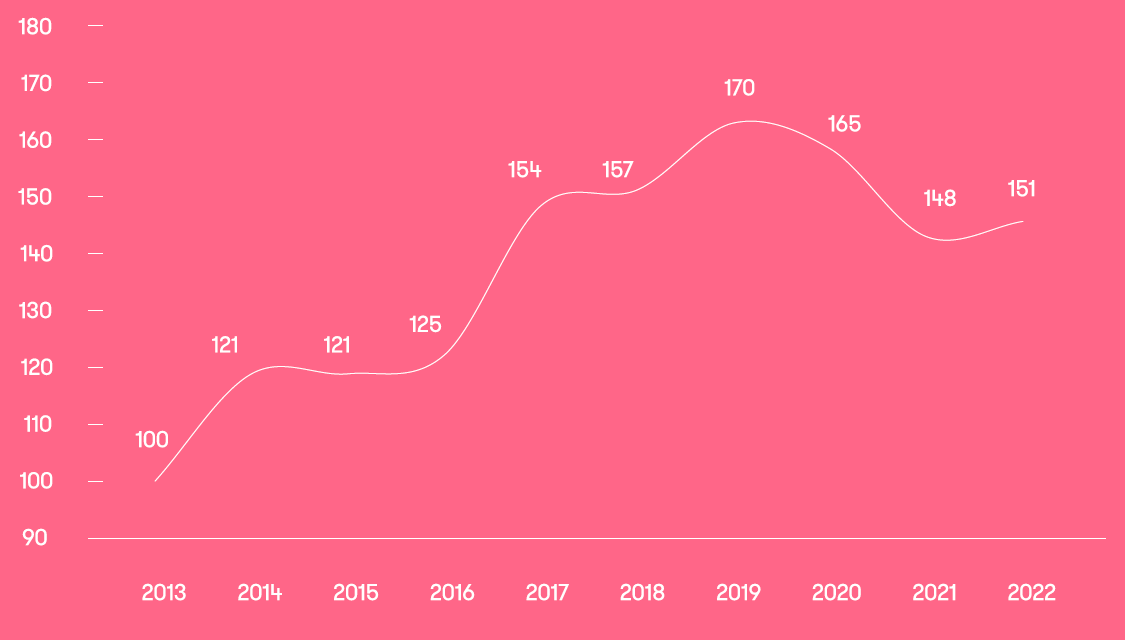

Office rental prices have decreased significantly over the last few years, although they are still much higher than they were 10 years ago, according to a recent report on Malta’s property market.

For the first time, the 2023 edition of The Malta Property Market – A True Picture also features an analysis on the Maltese commercial property market.

In particular, the report, drawn up by advisory firm Grant Thornton based on data from real estate agency Dhalia, examines recent developments in the office rental market and includes a rental price index covering the period from 2013 to 2022.

Additionally, the report includes an analysis of the supply and demand for office space, shedding light on key drivers of developments in the market for offices.

“Over the last ten years, demand for such property was driven by the strong growth within the tourism, financial services, online gaming and wholesale and retail activities sectors,” it reads.

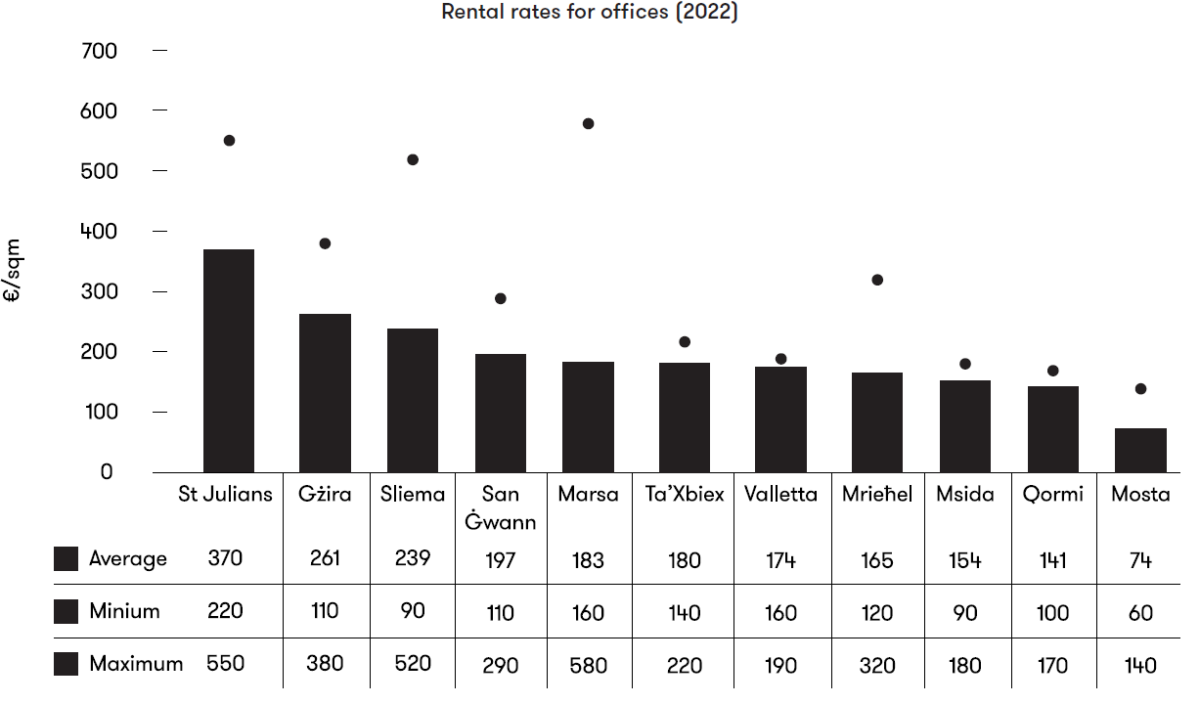

The localities that are home to some of Malta’s most thriving businesses, such as online gaming and financial services ranged between €180/sqm and €370/sqm per annum. These include St Julian’s, Sliema, Gżira, San Ġwann, Marsa and Ta’ Xbiex.

Other areas that are popular with the Maltese business community, such as Msida, Mrieħel and Valletta, have rented office space at prices ranging between €150/sqm and € 175/sqm per annum, while office space located in less sought after areas, such as Mosta, rents for around €74/sqm per annum.

These prices, the report notes, are necessarily indicative and, in practice, vary depending on the property-specific characteristics, including type of finish and availability of parking among other factors. Furthermore, these prices are not representative of office space found in high-end business centres.

The analysis shows that between 2017 and 2022, works had commenced on the development of office space that can accommodate more workers than the registered increase in office-based employment.

This suggests that there may be an oversupply of office space, especially when also taking into consideration that the demand estimates do not account for the growing trend of persons working from home.

Speaking during a panel discussion folowing the report’s presentation, Justin Mizzi, a valuation specialist working with architecture firm Archi+, agreed with the figure, saying that in some cases, prices are even down by higher margins, although the whole picture is a mixed bag.

“Yes, the 11 per cent reduction in average rental rates of offices makes sense to me, taking is as a rough average of all the offices in Malta. Obviously this is not the case for all offices; for some there has been some growth – although negligible – and on the other extreme I have seen far worse, with some reductions of up to 20 per cent.”

Mr Mizzi continued: “One would think that this kind of reduction to rents would lead to lower property prices, and in an efficient property market this would probably be the case. However, property values are not a function of the maths, but of the market. And the local property market is far from perfect, as investment decision-making is very often undertaken by imperfect players in imperfect markets using imperfect information.

“Valuations answer the question ‘what is the price?’, not ‘is it worth that price?’. They should therefore reflect the market as it is – however imperfect it might be – not as it should be. And I am not seeing any significant reductions in office capital values so far.”

Denise Xuereb, director of construction and development at AX Group, said that the office rental market has undergone a major evolution over the last 10 to 15 years.

“The market really started with the advent of the igaming industry in Malta,” she said. “That was when we saw a major shift in demand, both in terms of growth and in terms of expectations, like new office layouts and the need for collaborative spaces.”

Ms Xuereb continued: “Office space nowadays is about promoting the right kind of lifestyle. Tenants look for office space they can be proud of hosting their employees in, that make their workers’ lives better.”

Trident Estates CEO Charles Xuereb noted that the landmark project undertaken by his firm sought to do just that, and has seen very satisfactory take up as a result.

“By creating a product that stands out from the market, we are able to command a premium,” he said, and argued that other commercial real estate developers should follow the same template to protect themselves against market downturns.

Mr Xuereb also admitted that, ultimately, the office rental market is highly dependent on the country’s general economic development.

“Strong, healthy companies need to be attracted to Malta,” he said. “Marketing is key in that regard. We have a strong product and can welcome good companies of international repute – but we need to work together to make sure that message is heard outside of our shores.”

Oriana Abela, partner at Grant Thornton, touched on the impact the large number of foreign workers is having on the space.

“We have thousands of workers from abroad who come to Malta to work. For them, the office is not just the office – it’s at the heart of their life in this country. They are more likely to live close to their place of work, within walking distance if possible. These demographic changes mean that even residential real estate is affected by the placement of offices.”

On sustainability, Ms Xuereb highlighted the importance of its integration from the very earliest stages of project planning.

“It needs to be planned throughout. From initial design all the way down to the appliances used. There’s a lot that goes into making a building sustainable.”

Mr Xuereb agreed, noting that the environmental credentials of Trident Park, which involves an innovative heating and cooling system, allow tenants to save as much as 30 per cent of their electricity bills.

Closing the discussion, Mr Mizzi spoke with optimism for the office market’s continued development.

“It’s a young market that really only got going after Malta joined the EU. True, there has been a boom in recent years, but we must not forget that it takes time for markets to mature. The future is bright.”

European Parliament adopts regulation making it easier for companies to be paid on time

The maximum credit term under the new Late Payment Regulation is to up to 120 days, for some sectors

French ATC strike forces Ryanair to cancel over 300 flights, affecting 50,000 passengers

The low-cost carrier is demanding the EU carries out reforms to ensure travel continues undisrupted

Valletta ranks 8th most expensive European capital city to live in – study

While London is the most expensive, Bucharest is the most affordable