Following the 16th January announcement by Malta International Airport plc (MIA) with respect to the traffic results for 2024 and the guidance on traffic expectations and financial targets for 2025, the investing public should not have been too anxious ahead of the publication of the 2024 annual financial statements last week.

The airport operator revealed that as a result of the 15 per cent growth in passenger movements to 8.96 million, revenue surged by 19 per cent in 2024 to a new record of €142.9 million. The segmental analysis of revenue generation confirmed that both main operating segments registered higher income with the ‘Airport’ segment increasing by 20 per cent to €99.1 million (representing 69.4 per cent of total revenues) while revenue from the ’Retail & Property’ segment climbed 16 per cent higher to €43.5 million (representing just over 30 per cent of revenue).

The jump in revenue helped the company achieve an improved operational performance with earnings before interest, tax, depreciation and amortisation (EBITDA) rising by 16 per cent to €87.1 million although the EBITDA margin dropped to 60.9 per cent from 62.6 per cent in 2023.

MIA’s operating profit similarly increased by 15 per cent to €72.3 million with a pre-tax profit of €72.2 million (2023: €62.2 million) and a record net profit of €46.3 million, which is 15 per cent higher than the 2023 level of €40.3 million. The return on average equity also improved to 23.0 per cent in 2024 from 22.3 per cent in the previous year.

During the course of last year, MIA upgraded its traffic and financial projections on two occasions. The actual results achieved in 2024 are unsurprisingly exactly in line with the last projections published in November 2024 just a few weeks before the year-end.

In view of the regular communications by the company on the level of passenger movements throughout the year as well as the financial forecasts upgraded just before the end of the financial year, the main highlight of last week’s announcement related to the amount of dividends being recommended for approval at the upcoming Annual General Meeting especially in the light of the planned share buyback programme also announced on 16 January 2025 and effective as from 1 June 2025 subject to approval by shareholders also during the next AGM taking place on 14 May.

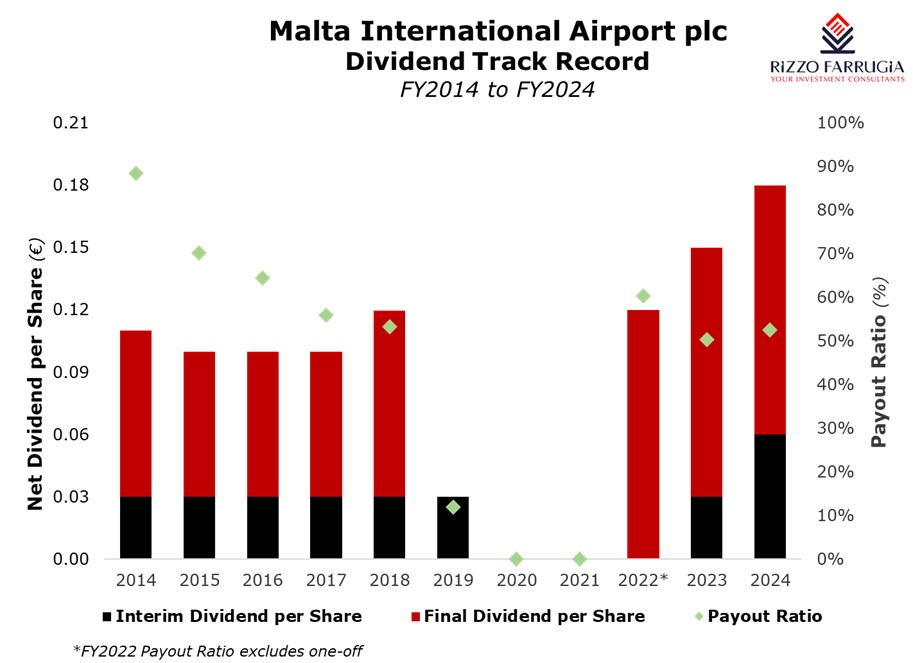

The Board of Directors is recommending an unchanged final net dividend of €0.12 per share. However, when taking into consideration the net interim dividend of €0.06 per share paid in September 2024 (which is double the net interim dividend paid in the previous financial year), the total net dividend attributable to the 2024 financial year amounts to a record of €0.18 per share (+20 per cent). Based on the profitability achieved in 2024, the dividend payout ratio works out at 52.6 per cent.

The other main highlight announced by MIA last week relates to the accelerated investment programme totalling €345 million during the next 5 years. During a meeting with financial analysts last week, MIA’s CEO Mr Alan Borg explained that this programme includes significant operational improvements to cater for the increased passenger traffic and includes the upcoming Eastward Terminal Expansion (an extension of 6,000 sqm). The company aims to commence works on this major initiative by the end of 2025.

The investment programme being embarked on by MIA also entails a number of sustainability-related improvements as well as commercial developments including Sky Parks Business Centre II.

While MIA has been free from any borrowings for quite a number of years at it utilised its cash flow and the growing level of accumulated cash reserves to fund its previous investments, the CEO acknowledged that the company aims to utilise some bank borrowings for its capital expenditure requirements going forward.

This should be viewed positively by the company’s shareholders since it will allow the continuation of dividend distributions despite the elevated level of capital expenditure required. Furthermore, the cost of debt should be relatively low for MIA which will lead to a more optimal capital structure with a better balance between debt and equity. At the start of the year, MIA published its traffic and financial forecasts in which it announced that it expects another record performance in 2025 with a further 3.7 per cent increase in passenger movements to 9.3 million passengers. If this is achieved, it is envisaged that revenues will amount to €147 million (+2.9 per cent), EBITDA will reach €91 million (+4.5 per cent) and net profit will be €48 million (+3.6 per cent).

Since the company issues monthly announcements showing the traffic results, the investing public will undoubtedly be monitoring these figures to gauge whether the traffic guidance is not only achievable but also whether this can be surpassed as in previous years which would lead to upgraded forecasts by the company. In fact, MIA’s CEO also acknowledged the “good momentum” during the first quarter of the year. Following the nine per cent growth achieved in January, the company will also be announcing the traffic results for February in the coming days. Naturally, the passenger movements during the peak summer months remain the most important for the company despite the strong upturn achieved in the shoulder months over recent years.

Apart from the monitoring of the monthly traffic movements, MIA’s shareholders should be eagerly awaiting the AGM on 14 May 2025 in view of the proposed share buyback programme. This is the first time that MIA will be embarking on such an important initiative and is a direct consequence of the comments made in last year’s AGM wherein the Chairman had highlighted the “disparity between the company’s strong financial performance and share price recovery in 2023”. This has indeed continued throughout the course of 2024.

It would be important for shareholders to understand the procedure to be undertaken for planned share buyback as from 1 June 2025 given the range disclosed in the January announcement of a minimum purchase price per share of €3.00 and a maximum of €7.38 given the current share price of €6.15. Moreover, it would also be interesting to monitoring the regular announcements that should take place to inform the market on the amounts being acquired given that the maximum amount that can be purchased until the 2026 AGM is of 1,353,000 shares which amounts to one per cent of the total issued share capital. Irrespective of the amount of shares that will be acquired during the next 12 months, hopefully this important initiative will be replicated also in future years to ensure a more active secondary market develops in the 2nd largest company listed on the MSE.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers).

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Featured Image:

Malta International Airport / Facebook

The bond market in 2026

In 2025, €717 million were issued on the Regulated Main Market of the Malta Stock Exchange

Institute of Directors training now available in Malta through ThinkTalent

By offering IoD’s globally respected curriculum, ThinkTalent is fulfilling its mission to be the definitive partner in strategic talent optimisation

Foreign bank participation in the MGS market

Strong institutional demand for Malta Government Stocks, shifting investor dynamics, and the growing role of international banks in MGS auctions