Last week Malta International Airport plc published its interim financial statements as at 30th June 2023. Following the significant impact to the airline and hospitality industry from the severe COVID disruptions during 2020, 2021 and also 2022, the performance of the airport operator together with companies in the hospitality and leisure industries should be compared to the 2019 levels to understand the extent of the recovery taking place this year.

Since MIA publishes its traffic results on a monthly basis, one ought to have expected a positive financial performance for the first half of the year. However, the extent of the growth in revenue and profitability over the 2019 levels is probably a surprise to many.

MIA had already reported its first half traffic results showing passenger movements rising by 5.6 per cent over the 2019 levels to a total of 3.43 million. Although passenger movements grew by just under 6 per cent, MIA generated a 20 per cent increase in revenues to a record of €53.6 million. Likewise, EBITDA surged by 24 per cent to €33.4 million and profit before tax jumped by 25 per cent to €27.1 million.

The improvement in margins is another important aspect with the EBITDA margin strengthening to 62.4 per cent from 60.5 per cent in 2019 and the net profit margin rising to 32.7 per cent from 31.3 per cent in H1 2019. Likewise, the company has managed to strengthen its return on equity to just above 22 per cent which is below the levels achieved pre-pandemic as a result of the high level of shareholder funds accumulated over the years. This will help fund the heavy investment plan over the next few years.

During a meeting with financial analysts last week, MIA’s CEO Mr Alan Borg provided a detailed overview of the traffic results indicating the very strong growth from the Italian market and a continued underperformance from the UK and Germany when compared to the 2019 figures. Ryanair remains the dominant airline with a 25 per cent growth in passengers over the 2019 levels and a 47 per cent market share.

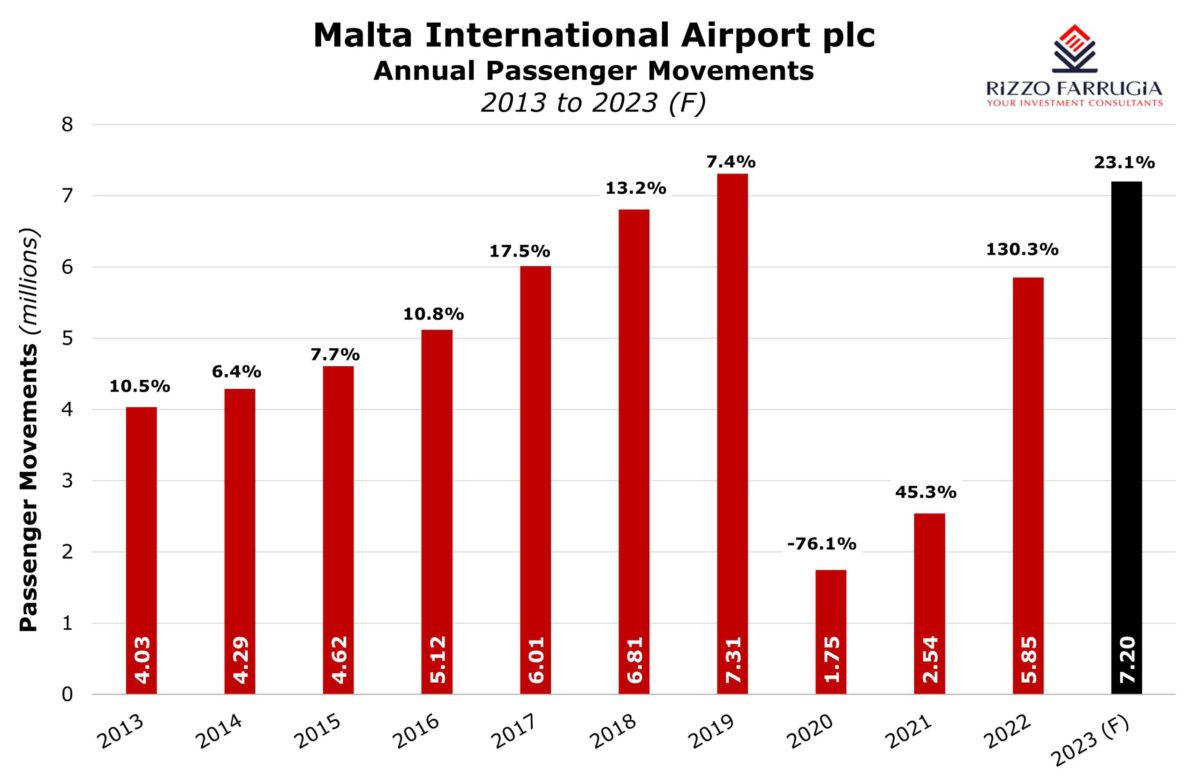

At the start of the year, MIA reinstated its guidance to the market by issuing traffic and financial projections for 2023. The company had announced that it expected to register total passenger movements of 6.3 million in 2023. This would have represented growth of 7.7 per cent over the 5.85 million passenger movements of 2022 and a recovery of 86 per cent of the record pre-pandemic traffic in 2019 which amounted to 7.31 million passengers.

Following the sharp growth in the first half of the year, last week MIA also upgraded its traffic and financial forecasts for 2023 in a significant manner. In fact, MIA increased its passenger numbers by 14 per cent from the original projection of 6.3 million at the start of the year to 7.2 million. Likewise, revenue is now expected to reach a new record of €113 million compared to the projected €97 million at the start of 2023 and the actual revenue of €100.2 million in 2019; EBITDA is expected to rise to €70 million compared to the original 2023 forecast of €59 million and the actual figure of €63.2 million in 2019 and net profit for 2023 is now forecasted at €37 million compared to the original projection of €29 million at the start of 2023 and the actual figure of €33.9 million in 2019.

While the upgrade to the traffic and financial forecasts is indeed material compared to the guidance issued at the start of the year, upon further analysis this seems to be a conservative estimate of what may materialise in the coming months. Even if during the second half of this year one would not assume continued growth in passenger volumes over 2019 implying that the H2 2019 passenger throughput of 4.05 million passengers will be replicated, this would imply that MIA is on course of achieving a new record of 7.49 million passengers.

The monthly traffic results being issued in the days and weeks ahead covering the Q3 period (generally the July – September quarter accounts for over 30 per cent of annual movements) will provide a very strong indication of the likely results for the full year.

Irrespective of whether the base case scenario as announced by MIA of 7.2 million passengers will be achieved or whether this is improved further to above 7.4 million, the reality is that the recovery from the pandemic across the travel sector is evidently much stronger than ever anticipated. Over recent years, there were countless articles mentioning the doomsday scenario of the likely prolonged hit to the travel industry from the pandemic with the recovery lasting as long as 2025. The recent developments are very reassuring despite the ongoing challenges both from a macroeconomic perspective and those specifically related to the aviation and travel sector.

Last week, MIA also restored its semi-annual dividend policy that had been a regular occurrence ever since their IPO in 2002 until the pandemic in 2020. While the absolute dividend of €0.03 per share may be viewed as a token amount in the context of the financial strength and ongoing profitability of the company, it represents an important decision for the investing public following the very challenging environment over recent years. Meanwhile, should MIA maintain its dividend payout ratio at 60 per cent, based on the projected net profit of €37 million, this would imply that the company will distribute a net dividend of €0.16 for the 2023 financial year which would represent a growth of 33 per cent over the €0.12 per share paid in May 2023 in respect of the 2022 financial year.

While the financial performance of the company has been very positive over recent months with an evident improvement over the 2019 figures and a stronger balance sheet with a sizeable accumulation of cash and cash equivalents totalling €67 million as at 30 June 2023, the share price has failed to respond accordingly as it continues to hover at below the level of €6.00.

As explained in the past, the hit to investor sentiment in Malta from the series of setbacks since late 2019 is still very evident indeed and is presumably one of the main factors that is contributing to the lack of reaction in the market to the very strong performance of MIA unlike the strong recovery in share prices being seen internationally across many sectors.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers)

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Mobilising savings into investments

Malta’s equity market needs to grow in size and depth if it is to embrace the EU’s Savings and Investments ...

Reduction in free float

Lowering Malta’s minimum free float requirement to 10% could unlock new opportunities for the local capital market

A golden age for GO plc

GO plc’s Annual General Meeting revealed a bold shift beyond traditional telecoms, stronger-than-ever financials, and possible share buy-backs