Price transparency is essential for markets to function efficiently. In the housing sector, transparency is particularly important given the financial and social implications of securing a home.

As the regulator of the private residential rental market in Malta, the Housing Authority plays a central role in promoting price transparency through its rental dashboard, which provides detailed and regularly updated data on rental trends across localities. The dashboard has recently been updated to include information covering the first half of 2025, making it an important resource for stakeholders in this sector. This article explores the key developments in Malta’s rental market based on the latest update.

The number of rental contracts continued to increase. At the end of June 2025, there were 70,589 active rental contracts, marking an increase of 7.5 per cent compared to the same period in 2024. This indicates a robust demand for rental housing. The number of contract renewals also remains significant, with 17,632 renewals in the first half of 2025. Renewals play an important role in promoting rental stability, as more than 90 per cent are extended with the same rent. Although most new contracts are still signed for one-year durations, thanks to these renewals, nearly one-fifth of all active contracts now have a duration of three years or more.

Another development is the shift in the composition of contract types. The share of shared-space contracts has continued to rise and now accounts for 13 per cent of all active leases. This is likely influenced by the legislative amendments that came into force on 1st September 2024, which removed the distinction between long-term and shared-space leases. Among other measures, these reforms were intended to reduce bureaucracy, curb abuse and introduce limits on the number of residents per bedroom to address growing concerns about overcrowding.

The data also point to a gradual shift toward larger properties. While two-bedroom units remain the most common type of rental dwelling, their relative share has been trending downwards in recent years. Compared to three years ago, the proportion of one- and two-bedroom properties has declined slightly, while the share of three-bedroom and larger units has risen. Since the overall mix of available property types has not changed dramatically, this suggests that landlords may be modifying existing properties to accommodate sharing arrangements.

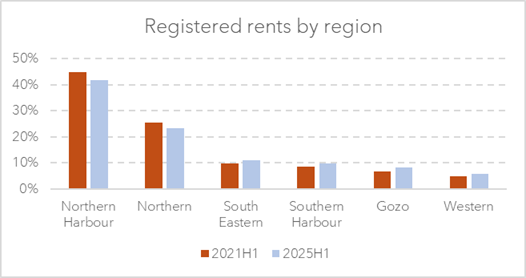

Rental activity is also becoming more geographically dispersed. There are now 19 localities in Malta with more than 1,000 active rental contracts, including one locality in Gozo. St Paul’s Bay remains the locality with the highest number of contracts, exceeding 10,000, followed by Sliema, Msida, Marsaskala, St Julian’s, Gzira and Birkirkara. Overall, while the Northern Harbour and Northern regions remain dominant, the share of contracts in all other regions has increased over the past three years, indicating a gradual expansion of rental demand beyond the traditional hotspots.

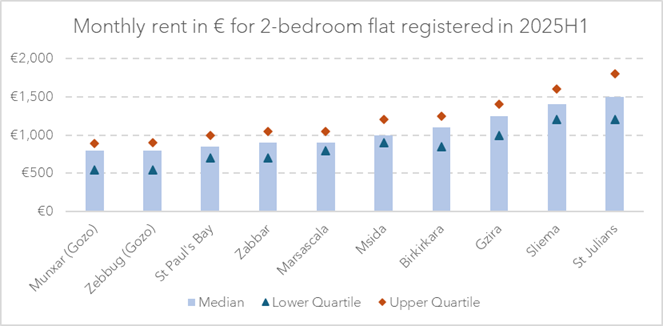

One of the dashboard’s most useful features is the Rent Calculator, which provides descriptive statistics for new contracts registered with the Housing Authority. Users can filter information by locality or region, property type and size. A recent enhancement includes the addition of the lower (25th) and upper (75th) quartiles, alongside mean and median rents, allowing for a more nuanced understanding of price differences within localities. Such variations reflect a range of factors, including the quality of finishes, amenities, or neighbourhood characteristics.

Recent data illustrate these differences clearly. For example, the median rent for a two-bedroom apartment in St Paul’s Bay stood at €850 in the first half of 2025, with the lower quartile at €700 and the upper quartile at €1,000. In St Julian’s, the median was significantly higher at €1,500, with a corresponding quartile range between €1,200 and €1,800. In Gozo, rents tend to be more affordable: the median for a two-bedroom property in localities such as Żebbuġ (which includes Marsalforn) and Munxar (which includes Xlendi) was €800.

However, headline rents do not tell the whole story, especially in a market where sharing is widespread. According to a recent survey conducted by the Housing Authority, around 90 per cent of tenants in Malta are foreign-born, with a high prevalence of sharing accommodation, especially among non-EU residents. Data on newly registered shared contracts show that around one-third fall within the €200 to €299 monthly bracket per tenant. This highlights the importance of considering not just property-level rents but also per-person costs when assessing affordability.

Overall, the dashboard reflects the Housing Authority’s continued commitment to improving price transparency in the private rental market by providing stakeholders with accessible and reliable data. More information is available from the Housing Authority’s dashboard.

Funding national projects

How can capital markets be used to diversify the funding sources of long-term national development projects

Malta’s earnings season

The importance of enhanced transparency, shareholder developments at HSBC Bank Malta, and broader capital market reforms

A chaotic start to 2026

Steady gains in January, but unprecedented swings in commodities, currencies and tech stocks