Business conditions during the second quarter of 2023 were found to have declined compared to the first quarter according to information gathered by the Central Bank of Malta (CBM), however this has not stopped most firms from planning on investing further and expanding their workforce.

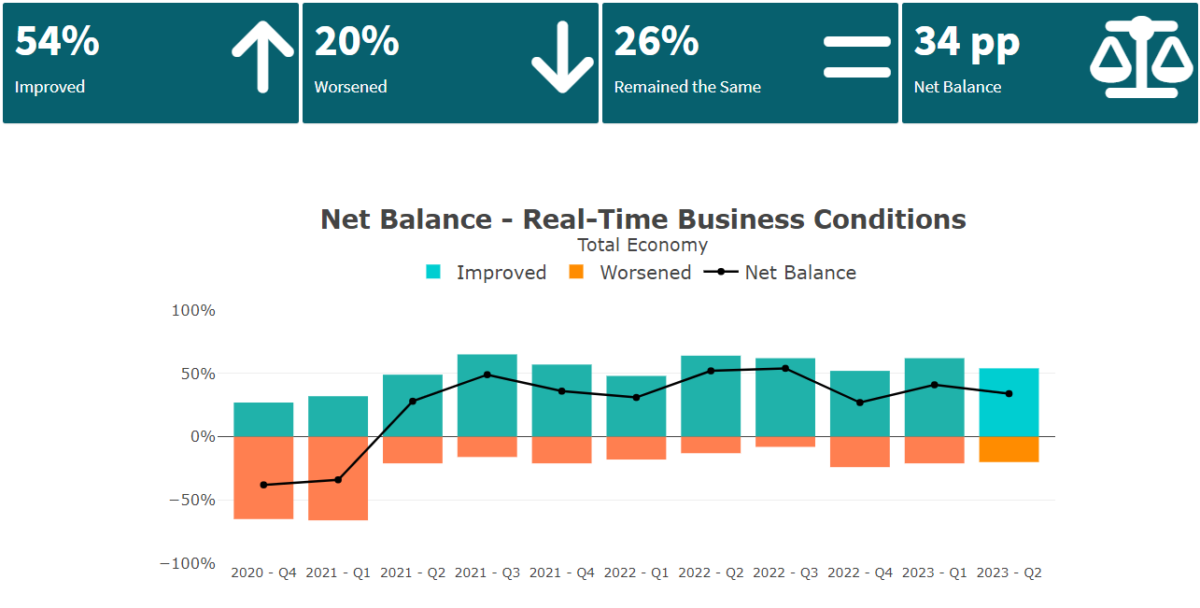

Overall, 54 per cent of businesses reported having had improved business conditions, while 20 per cent reported having worse business conditions. Overall, this meant that 34 per cent of businesses reported an increase in activity over the past three months, down from 41 per cent in the previous quarter.

On balance, conditions were positive across all sectors, except in construction and real estate.

Looking ahead, a net positive of 46 per cent of firms expected an improvement in short-term business activity, a small drop from 48 per cent in the previous quarter.

“Our business dialogue for the second quarter of this year tells us that the private sector is still bullish towards further investment and employment in spite of deteriorating business conditions and rising input costs,” commented Edward Scicluna, governor of the CBM.

Aided by improved supply chain conditions, the net share of firms reporting cost pressure eased. However, the indicator remained elevated from a historical perspective. During the last quarter, a net share of 62 per cent reported higher input prices, marginally lower than 64 per cent in the previous period.

When firms were asked about their unit cost expectations over the next 12 months, most firms expected these to remain stable or increase further. However, the high level of global uncertainty prevented several firms from giving a definitive answer.

More than half of surveyed firms (53 per cent) reported higher prices during the second quarter of 2023, up from 42 per cent in the previous quarter. Increases in input and selling costs were more prevalent in the wholesale and retail sectors.

On a positive note, the share of firms planning to invest more increased from 48 per cent to 68 per cent. The predisposition to invest increased in all sectors except in the real estate and construction sector.

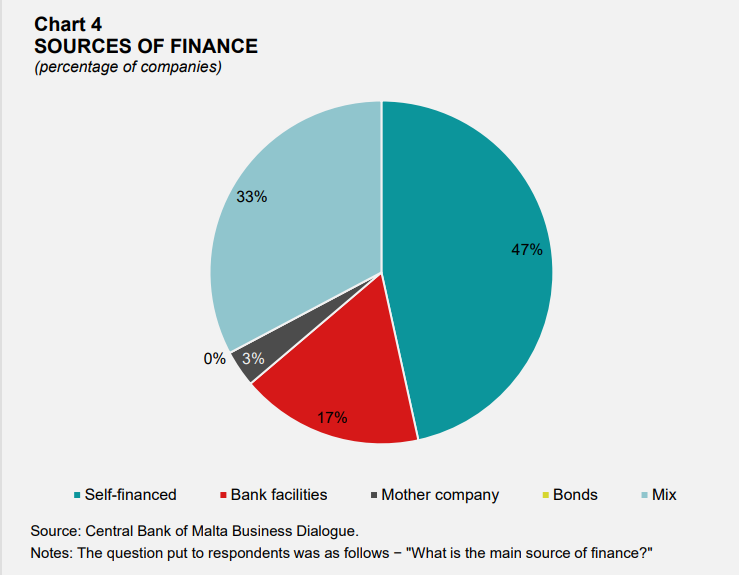

More than half of firms expressed the intention to self-finance, while 17 per cent said they planned on financing investments through bank facilities.

Furthermore, the net share of firms planning on increasing their headcount increased by 15 percentage points to 61 per cent, with the highest share being firms involved in trade and services.

However, firms continued to express concerns regarding both labour and skills shortages, and pressure to wage increases.

To address the workforce shortage some firms stated that they started making use of recruitment agency services to facilitate hiring, while other firms resorted to sub-contracting workers.

In some cases, firms expressed that they were trying to automate certain processes in order to limit their dependency on workers.

Hotels report strong 2024 so far, optimistic about a very busy summer

Trends are shifting in the preference for last-minute bookings, hotels say

Labour Party European Parliament manifesto: What’s in it for businesses?

Looking ahead, Prime Minister Robert Abela pledges new opportunities on the commercial and social sphere

WATCH: MEPs in dialogue – Enhancing Europe

The fourth in a series of debates designed to engage citizens in the lead-up to the MEP elections