The Financial Estimates published by the Ministry of Finance last week together with the Budget Speech provide key data on the state of the Government’s finances as well as on the economic projections over the next three years to 2025.

Following the budget deficits of €1.27 billion in 2020 and €1.14 billion in 2021 (equivalent to 7.8 per cent of GDP), the Government is expecting a deficit of €948 million in 2022 (equivalent to 5.8 per cent of GDP and revised higher from the original estimate of €851 million). The fiscal situation is anticipated to improve as from 2024 onwards. In fact, largely as a result of the sizeable energy subsidies, the budget deficit in 2023 is expected to rise to €972 million but in view of the projected growth in GDP, this would equate to 5.5 per cent of GDP compared to 5.8 per cent of GDP in 2022. The budget deficit is then projected to decline to €793 million in 2024 and €564 million in 2025 which would equate to 2.8 per cent of GDP. Interestingly, compared to the Financial Estimates published exactly a year ago, the budget deficit is expected to widen by circa €100 million annually in both 2024 and 2025 since the projections last year were for a deficit of €707 million in 2023 and €496 million in 2024.

As a result of the sizeable deficits over recent years, the overall public debt is expected to amount to €9.3 billion by the end of 2022, which is equivalent to 57 per cent of GDP. This is a very important metric used by international credit rating agencies when assessing the risk profile of any country.

As I had commented in an article last year on the state of the Government’s finances, Malta entered the pandemic from a position of strength as the debt to GDP ratio had dropped to 43 per cent in 2019. As such, despite the very significant assistance provided to selected economic sectors during the pandemic coupled with the sharp drop in GDP, the increase in the debt to GDP ratio was sustainable especially in the context of a comparison to the debt metrics of many other countries across the eurozone. The average debt to GDP ratio of eurozone states as at the end June 2022 stood at just above 94 per cent. It is possibly within this context that the Government of Malta immediately confirmed earlier this year that it will be providing significant energy subsidies (amounting to over €600 million in 2023) in order to control the level of inflation.

In fact, in the coming years, although the overall level of public debt will continue to increase reaching an estimated €11.9 billion by 2025, as a percentage of GDP, this is equivalent to 60 per cent of GDP.

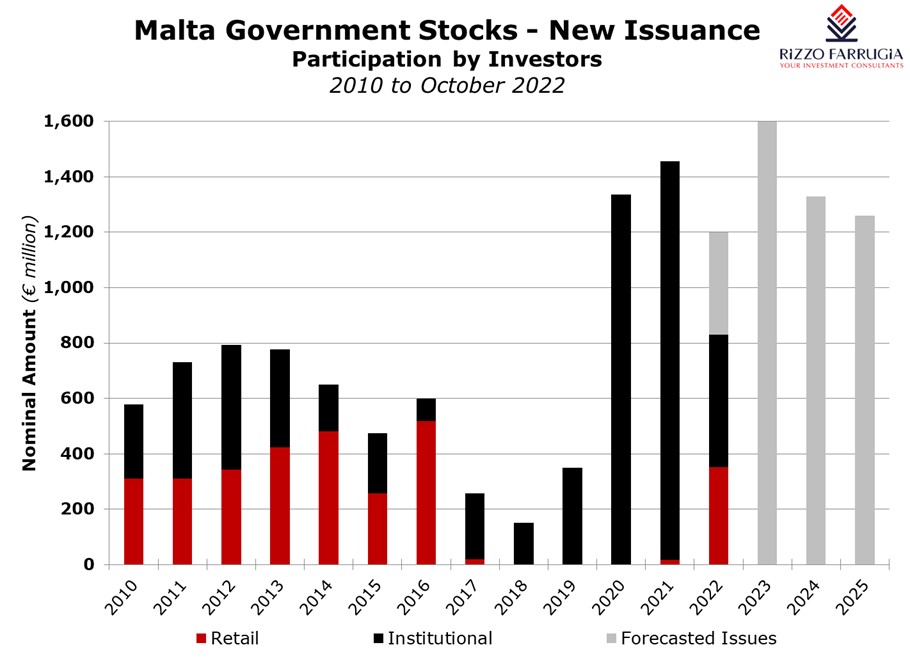

The investing public may be interested to note that the substantial rise in total Government debt will undoubtedly entail issuance of significant amounts of new Malta Government Stocks in order to finance the budget deficits as well as the maturing bonds over the coming years. In this respect, the Financial Estimates indicate that apart from an imminent issue of €370 million by the end of 2022, a total of €1.6 billion in new MGS issues is required in 2023 followed by a further €1.3 billion in 2024 and €1.25 billion in 2025.

The Financial Estimates also indicated that the overall amount of outstanding MGS in issue will rise substantially from €7.1 billion in 2022 to €10.1 billion in 2025. The sharp increase in yields this year will essentially translate into a significant increase in the debt servicing requirements (with interest costs rising from €173.5 million in 2022 to an estimated €300 million in 2025). On a positive note, however, the higher yields are igniting enthusiasm once again among the retail community as was amply evident last month with just over €293 million in new MGS’s taken up by over 10,000 applicants.

This elevated appetite by retail investors will hopefully be sustained in the near term as well as in the coming years in order to ensure that there is sufficient demand for the sizeable amounts of new MGS’s needed to finance both the annual deficit as well as the upcoming MGS redemptions which are sizeable every year until 2032. An important consideration is that the overall amount of MGS’s held by ‘resident households’ declined drastically during the 5-year period from 2017 to 2021 according to data available from the Central Bank of Malta. The amount of MGS’s held by ‘resident households’ dropped from 31.7 per cent of total outstanding MGS’s in December 2014 to 10.8 per cent in December 2021 which equates to a decline of circa €840 million to a total of €717 million.

The sharp decline could be due to a number of factors. Primarily, this may be as a result of the sizeable increase in MGS prices mainly between 2014 and earlier this year which encouraged numerous retail investors to capitalise on the strong gains and reduce their exposure to Maltese sovereign bonds. Secondly, there were no MGS offers available to retail investors between February 2017 and July 2021 with new issuance during this period aimed at institutional investors apart from the 62+ Government Savings Bonds totalling €100 million annually. Moreover, the decline in MGS’s held by retail investors is also undoubtedly as a result of the sizeable amount of MGS’s maturing annually that were held by retail investors and not reinvested in a subsequent issue.

In essence, the sharp increase in yields which has started to attract investors to shift part of their idle bank deposits back into the capital market coupled with the reduction in MGS holdings over the years will hopefully generate sufficient appetite from retail investors to increase their sovereign bond exposure to partially satisfy the significant new issuance which will take place annually until 2025 and beyond. It is evident that with maturities of MGS’s of between €356 million and €670 million annually over the next 10 years, we are undoubtedly entering a period of heightened issuance in the coming decade which is far higher than that seen in the period prior to the pandemic.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers)

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Reinventing the single market: Strategic vision and bold reforms for Malta and Europe

Proposed reforms present significant opportunities and formidable challenges for our small island nation

The equity market in pre-COVID times

Investor sentiment has evidently failed to recover from the series of shocks since the start of 2020

Interest rate divergence ahead?

Inflation is falling faster than forecast in Europe, while exceeding expectations in the US