In early 2024, I published a number of articles dealing with the state of the Maltese equity market and also highlighting a number of initiatives that could revive sentiment towards shares. I also aired my views in a number of industry events dealing with the local capital market starting off with my keynote speech at the first MSE Capital Markets Roundtable in June 2024 in the presence of the Minister of Finance together with top executives of both the Malta Stock Exchange (MSE) and the Malta Financial Services Authority (MFSA).

Unfortunately, the general state of disgruntlement by various cohorts of investors has continued over the past two years with a lack of excitement across the equity market as a result of the very low level of trading volumes in most equities and the unresponsive nature to most company announcements.

Without going into further detail on the initiatives that I had proposed, I felt the need to highlight a number of general observations in today’s article.

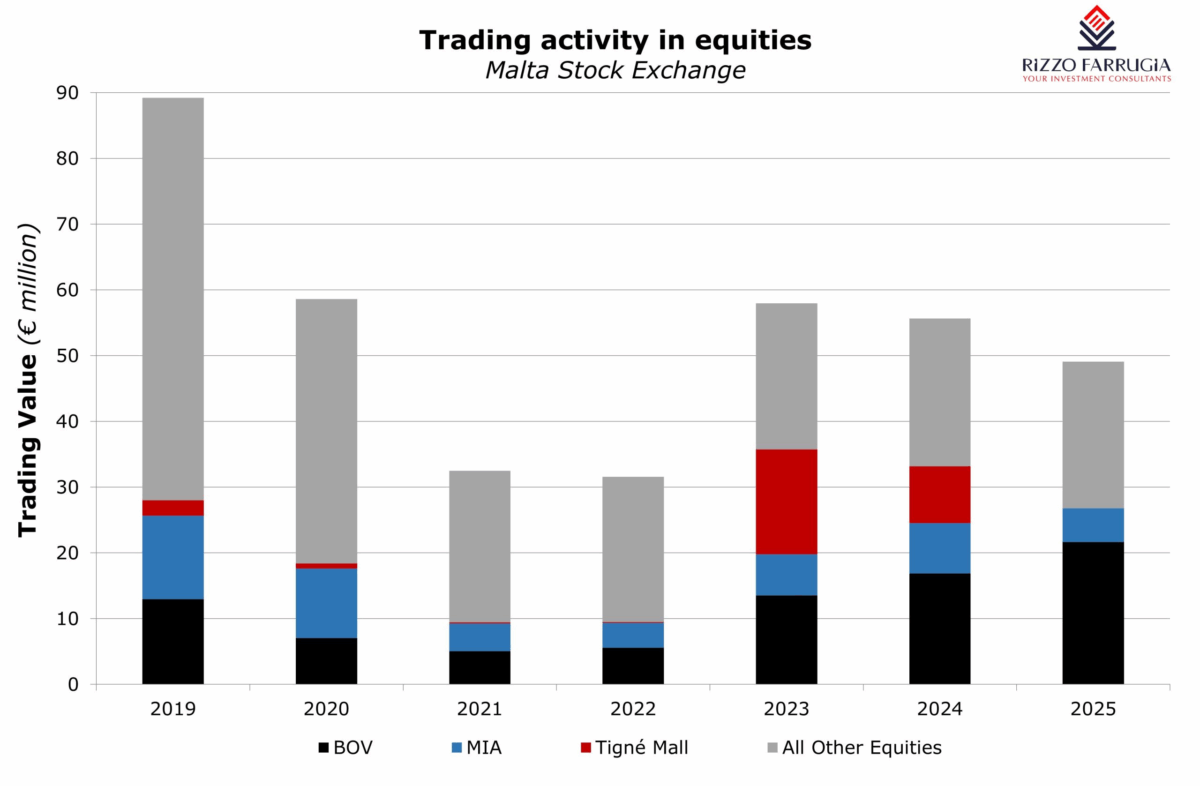

Bank of Valletta plc (BOV) remains the principal driver of the equity market performance and overall trading activity. Its market capitalisation reached a record of €1.21 billion during 2025 and with just over €21.6 million worth of shares changing hands, it accounted for 44 per cent of total equity market activity. BOV’s share price performed positively for the third successive year and the bank is now publishing detailed announcements on its financial performance on a quarterly basis. Moreover, in another important development, BOV has resumed its semi-annual dividend distribution to shareholders with a payout ratio established at a maximum of 50 per cent and has also began providing financial guidance to the market. Finally, BOV also commenced a share buyback programme in August 2025 following approval by shareholders during the last Annual General Meeting.

The enhanced level of transparency by BOV and a few other companies is an important development for the market and is one of the catalysts that can help to start to restore credibility following a number of very difficult years for the overall equity market compared to the bullish sentiment and buoyant activity until the onset of the COVID-pandemic almost 6 years ago.

This is amply evident in BOV as trading activity has surged over the past three years and is now very much in line with the level of activity in 2018 at over €20 million on an annual basis.

While BOV’s share price has also jumped materially over the past three years in line with the improved profitability and resumption of dividends, the equity is still trading below its book value or net asset value per share. On the other hand, most eurozone banks (except some of the French banks) are trading at either their book value or at a multiple above the book value given the improved fortunes of the sector following the increase in interest rates by the European Central Bank since 2023.

BOV’s dominant market position in Malta, its balance sheet repositioning away from excessive idle liquidity at the central bank and its improved return on equity should be important determinants on the fair multiple that this equity should be trading at.

Although the trading activity seen across BOV shares has improved, the situation is very different across all the other equities listed on the MSE. A comparison of the volumes traded in 2025 compared to the pre-COVID levels shows a marked deterioration as the overall equity market continues to be dominated by generally very weak sentiment. This is very evident from the activity in the shares of Malta International Airport plc for example. Despite publishing regular announcements to the market, commencing a share buyback programme (albeit with the huge limitations on the volumes allowed) and with the company’s financial performance being positively impacted by the surge in passenger traffic to just above 10 million passenger movements, the activity in MIA shares is 60 per cent below the volumes experienced in 2019.

Similar declines are also evident in most other equities including GO plc, PG plc, Simonds Farsons Cisk plc, BMIT Technologies plc and RS2 plc to name a few.

The statistics used for the determination of the trading activity excludes the block trades that took place ‘Off-Market’. Despite the very subdued sentiment, it is positive and at times contradictory to report on the large trades that took place in the shares of BOV, Malta Properties Company plc and Plaza Centres plc apart from those related to the takeover of Hili Properties plc. Moreover, the positive response to the recent €45 million rights issue by APS Bank plc is another very positive signal which contrasts with secondary market activity.

Within the property segment, the large transactions in both MPC and Plaza involving new shareholders came on the back of the important developments in prior years when a fully-owned subsidiary of Hili Ventures Ltd first acquired a minority stake in Tigne Mall plc and then effected a complete takeover. A comparison of the prices of these trades with the book value per share of each of the companies also provides evidence of how the general weak sentiment has resulted in a number of share prices being detached from their fair value.

At this time of the year, many investors would be taking decisions on any repositioning required on their investment portfolios. Despite the important block trades that took place in 2025 and the general positive financial performances being reported by a number of companies, it is difficult to expect overall sentiment to improve materially. Unfortunately, the hugely disappointing ongoing developments at MIDI plc and Malita Investments plc are undoubtedly continuing to destroy credibility of the equity market.

What is certain is that capital flight will continue as equity-oriented investors understandably focus on the international equity markets given the few options available locally.

Numerous companies in Malta are in need of an equity listing to shore up their capital to either pursue their growth ambitions (at times also on an international scale) or for succession planning purposes. While there is an abundance of liquidity across the banking system that is being mobilised towards the bond market, policymakers and market participants are yet to agree on a clear action plan to achieve the proper intermediation that is necessary for investors to channel their idle savings towards companies that are in urgent need of equity.

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

A chaotic start to 2026

Steady gains in January, but unprecedented swings in commodities, currencies and tech stocks

Strengthening leadership for BNF Bank’s next phase of growth

Two senior Executive Committee appointments signal BNF Bank’s commitment to building a strong leadership foundation for sustainable growth

Revisiting the idea of privatising the Malta Stock Exchange

The involvement of international institutional investors is likely to result in a more liquid secondary market, notes Edward Rizzo