The extension of COVID-19 support schemes and measures to mitigate the pandemic’s impact on workplaces, enhanced efforts to achieve carbon neutrality, and a response to the adverse banking environment exacerbated by Malta’s greylisting were among the key areas identified by the Chamber of SMEs as central to the continued growth of Malta’s economy

The Chamber of SMEs on Monday released its proposals for the Government’s 2022 Budget, where it identified a number of policy priorities it believes are necessary to improve the business environment for small and medium enterprises.

Noting that 2021 was worse than hoped but better than feared, the SME Chamber acknowledged the continued impact of COVID-19 measures on the Maltese economy, and said it hopes Malta’s economy would be further along the path to normality in 2022.

It said its 26 proposals for the 2022 Budget, split across 11 thematic areas, are aimed at accelerating the economic recovery, future proofing businesses, addressing the lengthened impact of the COVID-19 pandemic, and moving back to normality.

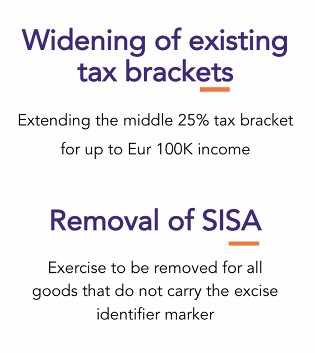

Tax

The Chamber of SMEs started by calling for a reduction in income tax for those earning up to €100,000, through an increase in the threshold for the 35 per cent income tax bracket from €60,000 to €100,000.

It also called for the removal of the excise duty (SISA) on goods that do not carry the excise identifier market, calling it an “unfair tax on both businesses and consumers”. It noted that it affects many consumer goods, including those related to hygiene and personal care, and said it is unethical to continue charging it when the use of such items is being recommended due to the pandemic.

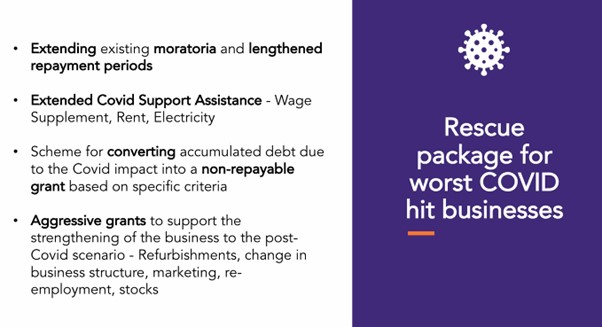

Rescue package for worst COVID-hit businesses

The SME Chamber called for an extension to existing moratoria on bank loan repayments, and a lengthening of the repayment period.

It also called for an extension to the measures introduced to support businesses during the pandemic, including the wage supplement and the rent and electricity support schemes.

Businesses preparing for the post COVID scenario were proposed to be supported through what the organisation termed “aggressive grants”.

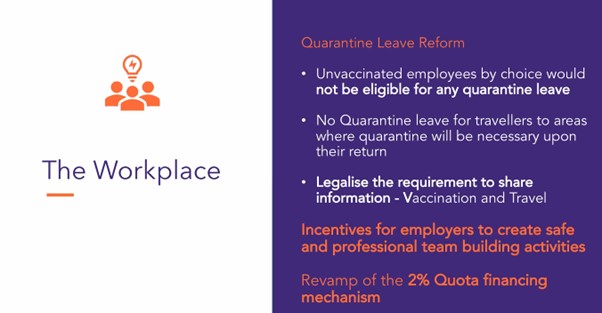

The workplace

Turning to measures affecting the workplace, the SME Chamber called for a reform to the system of quarantine leave, including ineligibility of such leave for unvaccinated employees and those travelling to areas they know will necessitate quarantine upon their return to Maltese shores.

It also said employers need to have the means to ensure safety within their workplaces, and therefore asked the Government to mandate the requirement of employees to share their vaccination and travel information with their employers.

Regarding the loss of company feeling experienced in many workplaces due to the shift to remote work, the SME Chamber suggested the introduction of incentives for employers to create safe and professional team building activities.

Referring to the quota on employers with more than 20 employees that requires them to have at least two per cent of their workforce with a registered disability, the organisation said income obtained from this scheme should not be added to general Government income but should instead be ring-fenced to be spent on accessibility-related initiatives. These could include both infrastructural interventions and training.

Accredited training

The SME Chamber also proposed a fully financed training scheme for work-related training, for employers to reduce the burden of costs related to employee training.

It also called for an upgrade to the Get Qualified Scheme. For courses at MQF Level 5 (e.g. Higher Diploma), it suggested an increase in the rebate from the current 70 per cent to 100 per cent, and an increase in the cap from €3500 to €5500. For courses at MQF Level 6 (e.g. Bachelor’s Degree), it suggested an increase in the rebate from 70 per cent to 85 per cent, and in the cap from €12,500 to €13,500.

Additionally, it proposed the option of requesting a grant instead of a tax credit, to make it advantageous to those not currently in employment.

The Chamber of SMEs also identified the education sector as one that could bring a lot of value to Malta, and called for the creation of a new economic pillar through accredited institutions.

Digitalisation strategy

The Chamber of SMEs also called for a grant scheme for businesses going online, and the inclusion of Software as a Service (SaaS) subscriptions into existing incentives. It noted that all major suppliers are moving to this model, and Government schemes need to keep up with developments in the market.

It also noted the significant increase in cyber security threats, and proposed a tax credit to incentivise businesses to invest in their mitigation.

MicroInvest

Turning to the flagship investment incentive run by Malta Enterprise, MicroInvest, the SME Chamber said the measure allowing businesses to convert half (or up to €5,000) of the eligible tax credit into a grant, introduced during the pandemic, should continue beyond it and be turned into a permanent feature.

Meanwhile, the maximum time in which the tax credit could be used up should be increase from three to five years, while the maximum eligible credit should be increased from the current €50,000 to €70,000. Acknowledging that this amount is already obtainable by certain businesses, such as those based in Gozo, those run by women, and those identified as family businesses, it said the maximum for these should in turn rise to €90,000.

Import and export

The SME Chamber said that Malta took an outsized hit from Brexit, with the UK-EU agreement not taking into account the needs of Malta, a small market with a heavy reliance on the UK. Some UK firms, it noted, are now considering that the Maltese market is not worth the level of bureaucracy and additional costs, and have stopped exporting to Malta. Therefore, it called on the Government to negotiate exemptions from the agreement for Malta.

Similarly, it said the Maltese Government needs to present its case on why Malta qualifies for special treatment to the EU to allow state interventions in the shipping sector.

It also proposed sustainable import substitution, where possible, to reduce dependence on imported goods.

The SME Chamber said it had identified Africa as a place of opportunity, but one that carries certain risk. The Government, it said, should therefore support businesses exploring opportunities in African through a Guarantee scheme or assistance with insurance.

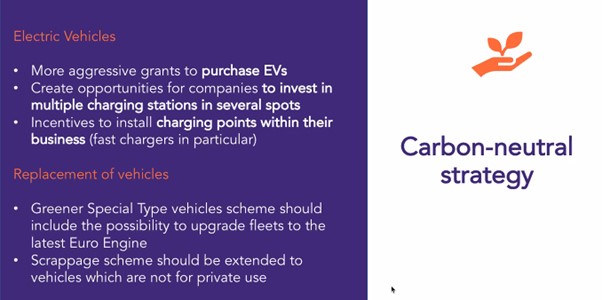

Carbon neutrality

The organisation said the achievement of the Government’s ambitious target to get 65,000 electric vehicles (EVs) on Maltese roads by 2030 requires more aggressive grants to incentivise consumers to make the leap.

It also said more charging stations are required, and that private enterprise should be encouraged, through fiscal initiatives, to install such stations on their premises.

It said the scrappage scheme, which it described as “very good”, should be extended to businesses wishing to overhaul their fleet, noting that they would need a large investment to both change their fleet and get charging stations to power them all.

It also noted that EVs do not fix the issue of congestion, and suggested that the solution lies in a mixed-modal approach whereby e-scooters, e-bikes, mopeds and ferries could be used, and insisted that infrastructure needs to be built to accommodate users of such transport methods, to ensure they can travel safely.

Addressing the adverse banking environment

The SME Chamber said the adverse banking environment, which it attacked during the press conference for creating an “impossible situation” for small businesses, needs to be addressed, as it lamented the increase bureaucracy, paperwork and fees involved.

Noting the “dominant” position banks have in the Maltese economy, it proposed interventions to recreate a balance which it says has been lost due to the greylisting and prior scrutiny by the European Union.

The SME Chamber therefore proposed the establishment of a task force to supervise banking services, and the creation of a charter for banking Services.

On the other hand, it also called for greater competition in the sector, by both public entities like the Malta Development Bank and Malta Enterprise, and private ones.

Mitigating the greylisting

The SME Chamber also suggested the setting up of a centralised repository of Know Your Customer (KYC) documentation to avoid the repeated filling out of such forms for different entities, describing this as a burden that is especially felt by small businesses.

It also said the Malta Business Registry (MBR) should be more user-centred, and avoid issuing harsh fines for first offences, noting that the many changes introduced recently have been difficult to keep up with.

Relatedly, it said a grant could help Company Services Providers (CSPs) to invest and upgrade their due diligence systems.

Gozo

Finally, regarding Gozo, the SME Chamber said that Gozo should remain at a certain level and standard to preserve its beauty and character, and called for a complete moratorium on all building on ODZ, and the introduction of a scheme to renovate old buildings and save them from disrepair.

It also suggested incentives for digital companies to open in Gozo, a reduction in ferry cost for those going to Gozo with EVs, and the construction of a multi-storey car park in the capital to address the longstanding parking problem.

The Chamber of SMEs’ document containing their proposals for the 2022 Budget can be found here.

EU member states approve long-awaited South American trade deal

The deal follows over two decades of negotiations between the European Commission and a group of Latin American countries

Malta property prices rise 5.7% annually in Q3 2025

Malta’s residential property prices continued to rise

BOV and IFSP join forces to drive skills development across Malta’s financial services industry

A new agreement will focus on professional development, knowledge sharing and joint initiatives to support Malta’s evolving financial services industry