Revolut Pro has been unveiled in Malta, giving the country’s sole traders easy access to a dedicated business account within seconds.

Revolut Pro is a separate product from Revolut Business. The latter is still suspended for new applications from Malta.

Nevertheless, Revolut Pro gives access to many of the same functionalities as Revolut Business, without users having to download a separate app, making life easier for the bank’s power users.

Getting a Revolut Pro account

Revolut customers may get access to Revolut Pro from the app’s Hub. The app informs customers that they will be able to create a separate account within the standard Revolut app to manage all their self-employed finances, and receive a one per cent cashback on their transactions.

Prospective customers are required to describe what type of activity their work involves and link to a website, or alternatively, a social media account, that represents their business activities.

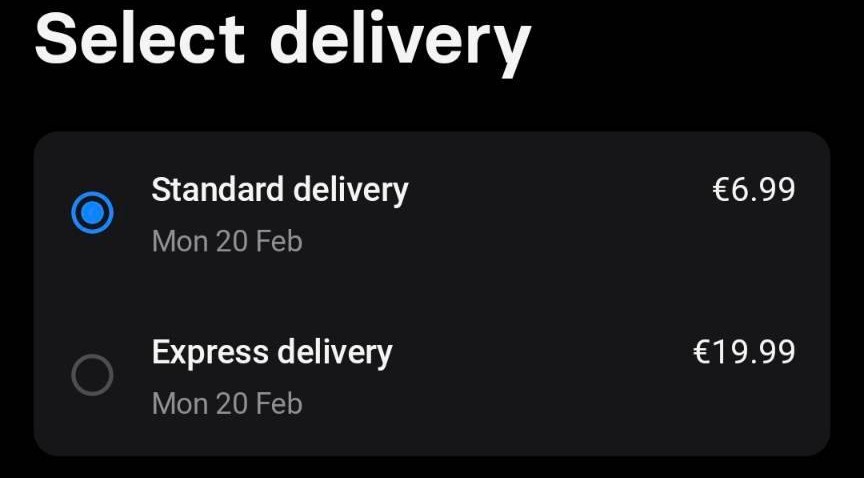

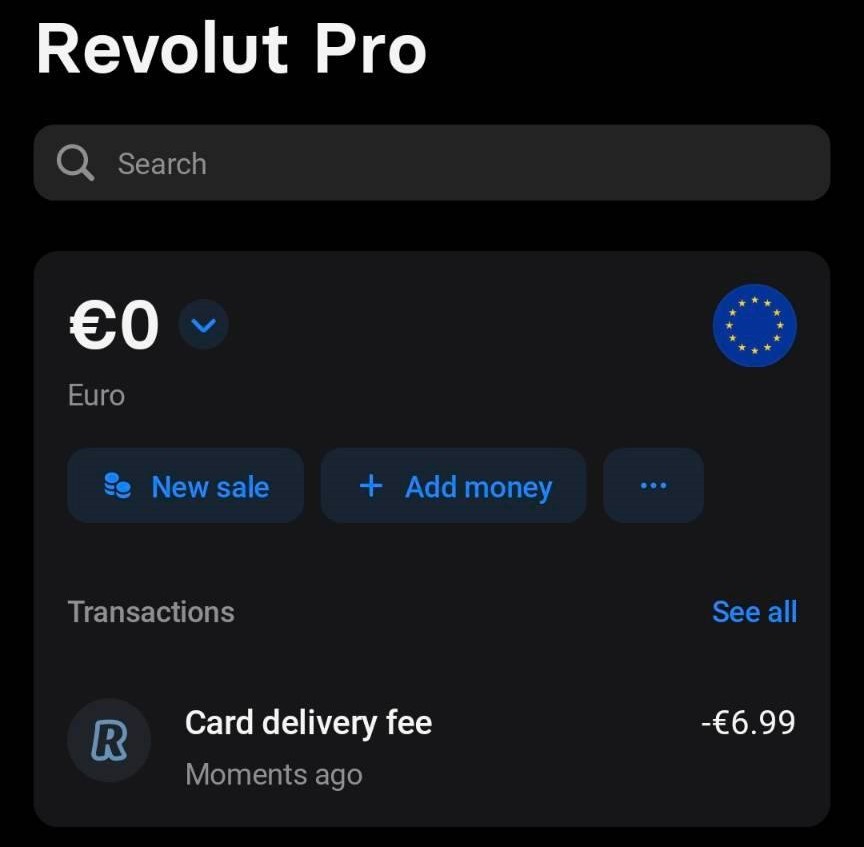

Once that is done, all that is left is for customers to order a free physical card (with a delivery charge) and/or request a virtual card.

At time of writing ordering a physical card by standard or express delivery to Malta is expected to take up to seven days.

Customers will be required to strictly use these bank cards for their business activities to use the account properly, and to benefit from any of the cashback perks.

Once the card is ordered, the onboarding process is complete.

Revolut Pro users receive a fully dedicated account for their sole trader activities, with dedicated bank cards, IBAN number, financial balance and their funds protected by the Deposit Guarantee Scheme (separately from their personal accounts).

What is not allowed with Revolut Pro

Revolut makes it explicitly clear that not every industry is allowed with the app. Thus far they do not accept businesses related to the following activities:

- dating and escort services:

- pornography;

- weapons;

- trading in precious metals, stones or art;

- running an auction house;

- cashback services;

- chemicals and related products;

- video-game arcades;

- trading in cryptocurrency;

- selling second-hand cars;

- binary options or gambling;

- debt collection;

- trading in prime-bank guarantees, debentures, letters of credit or medium-term notes.

This is not necessarily a limited list, and Revolut may update it in the future.

Since the company stopped accepting new applications for Maltese business accounts in June 2022, it created an opportunity for conventional banks and also Wamo to carve out a share of the market for themselves.

Yet, Revolut’s grip on the domestic market is still strong with over 190,000 customers. Enabling self-employed individuals to create a separate account without having to download a new app may prove a challenge to the company’s competitors.

Top 5% of taxpayers responsible for one-third of all income tax paid in Malta

On the other hand, the bottom third of income earners pay just 1.7% of all income tax generated

The Malta Institute of Accountants prepares for its 2024 Anti-Money Laundering Conference

Held at the Radisson Blu, St Julians, this latest AML Conference promises to bring exclusive insights on new procedures

Eurozone interest rates to remain unchanged

The European Central Bank noted that price pressures remain persistent