Maltese banks have avoided the significant outflows of deposits that have put the eurozone’s banks under stress and contributed to the collapse of Switzerland’s Credit Suisse and California’s Silicon Valley Bank.

In fact, they have continued to increase, albeit at a more moderate rate.

APS Bank chief risk officer Giovanni Bartolotta shared his insight during a webinar organised by the Malta Association for Credit Management, held last week, addressing whether the world is on the verge of another banking crisis.

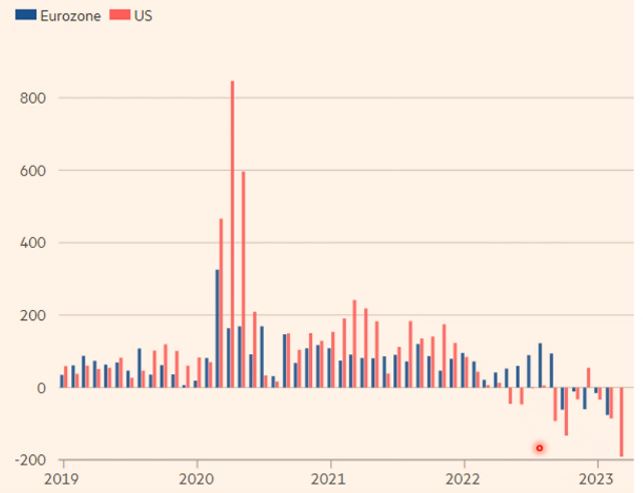

Mr Bartolotta explained that in the eurozone as well as in the United States, bank deposits increased during COVID, a phenomenon attributed to the lack of consumption options due to the travel restrictions and the closure of non-essential establishments, coupled with the generous pandemic relief in the form of income subsidies.

However, in the five months since October 2022, depositors have withdrawn €214 billion from eurozone banks, with outflows hitting a record level in February. This represents 1.4 per cent of the almost €14 trillion in deposits held by eurozone banks.

Across the pond, the figure is even higher, with $500 billion pulled out of US banks over the last months.

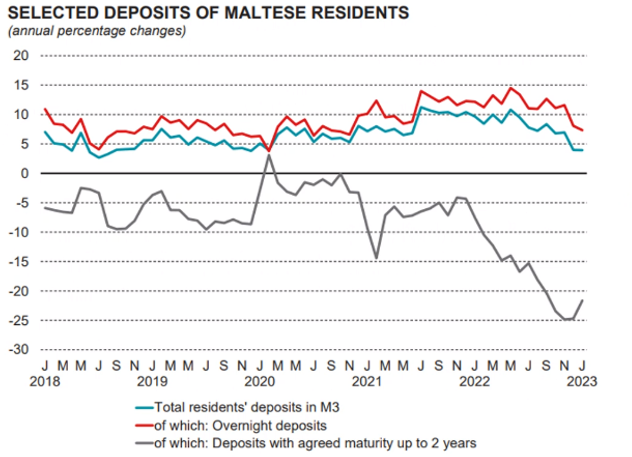

Malta has bucked this trend, with deposits remaining high despite the significant number of corporate bonds coming to market in recent months.

More importantly, the need to finance first the wage supplement scheme and now energy subsidies means that Government has significantly increased its balance sheet, largely through the issuance of large amount of Malta Government Stock.

The Government’s finance data records an increase in Malta Government Stock running to the hundreds of millions, largely held by locals, while another €1.6 billion are expected to be issued throughout 2023.

Despite the significant influx of cash into the Government’s coffers, deposits in Malta’s banks, estimated to be around €25 billion, have not come down at all.

Credit rating agency Fitch Ratings noted that liquidity levels in Malta’s banks are “exceptionally strong”, with Malta reporting the largest liquidity coverage ratio among EU countries as of thethird quarter of 2022.

Planning Authority launches €30 million restoration scheme

Owners of heritage properties or ones with traditional façades located in Urban Conservation Areas are eligible

Transport Malta launches €1 million assistance scheme for Storm Harry damage

The scheme will be financed through money collected from traffic fines

The Remarkable Collective announces strategic partnership with digital transformation leader Zenah Hemedan

The partnership strengthens TRC’s execution capability in project governance, ERP delivery and digital transformation