News that the American agency Fitch Ratings is considering downgrading Malta’s largest bank may have raised eyebrows in business and financial circles, but the Government’s involvement, through its shareholding, should put to rest any such fears.

In a recent statement , Fitch said that updates to the criteria it uses to generate banks’ credit ratings left BOV with lower scores than it currently has.

The ratings agency however sought to allay investor concerns, noting that in the case of all four banks in Europe and the Middle East affected by the changes, the potential downgrade was only by one notch.

Asked for a reaction to the news, a BOV representative told BusinessNow.mt: “Fitch is in the process of revising its rating criteria, but prior to this, there are some institutions, of which the bank is one, which will be undergoing a period of observation to see whether such a revision of rating is justifiable.”

The bank declined to comment on what impact a downgrade might have on its financial estimates for next year.

Meanwhile, a consultant with links to the banking sector, who asked not to be named, said that although a downgrade is never good news, it should not be seen in isolation.

“Looking at it from a depositor perspective,” she said, “a one-notch downgrade should not worry depositors if the bank’s capital and liquidity ratios are in order.”

She further explained that the Maltese Government’s 25 per cent shareholding in BOV significantly decreases the risks

“It’s simply too important for Malta. If it fails, the whole economy goes.”

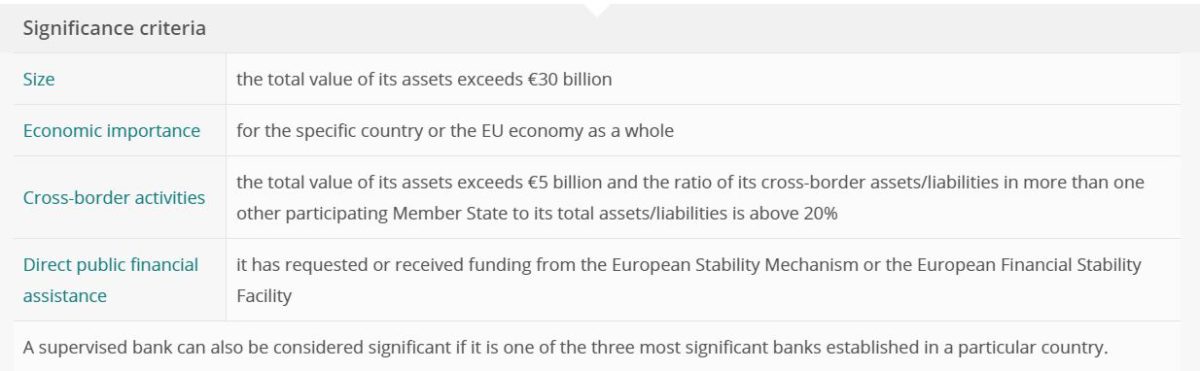

In fact, since it is deemed a “significant bank”, BOV, together with HSBC and MeDirect, is directly supervised by the ECB, and not by the Malta Financial Services Authority (MFSA), unlike other financial institutions.

The bank’s systemic importance and large Government shareholding means it lies at the heart of the Maltese economy.

“From a financial stability viewpoint, therefore,” continued the consultant, “BOV is critical. That is why proper governance is important – a point mentioned by both the ECB and Fitch.”

BNF Bank and Mastercard partner to bring added value to Maltese customers

Collaboration enhances everyday banking through exclusive experiences, rewards, and innovative payment solutions

ĠEMMA launches new podcast series to make financial literacy accessible for all

New episodes will be released every two weeks and will be available across multiple platforms

Malta introduces new 15% tax regime for highly skilled professionals

Qualifying individuals are taxed at a flat 15% rate for an initial five-year period