Following last week’s article detailing the performance of the S&P 500 index in 2025, it is worth devoting time to review the developments across the European equity markets in my last article for the year.

European stock markets outperformed most other global equity markets during early 2025 and registered one of their best starts of the year in decades. On the one hand, German lawmakers initially formally approved to reform the country’s debt brake rule to enable a rise in public borrowing and shortly afterwards, they announced an unprecedented fiscal package aimed at bolstering defence and infrastructure spending. Moreover, investor sentiment towards European equities was also positive as there was a clear path for monetary policy easing by the European Central Bank (ECB) which is an important tailwind for equity investors.

On the other hand, investor confidence towards the US equity market was negatively impacted at the start of the year by the potential consequences of the damaging economic impact of President Trump’s trade tariffs. Furthermore, in the first few weeks of the year, the Federal Reserve indicated that it was unlikely to cut interest rates in the first half of 2025.

However, the positive momentum across Europe did not last long as political uncertainty in France coupled with weak economic data from Germany and persistent earnings downgrades dragged the performance of the European equity markets.

During the second half of the year, the positive performance of European equity markets resumed as inflation data was weaker-than-expected supporting further rate cuts by the ECB. Additionally, the delayed German fiscal stimulus then commenced and there was also an improved outlook for the Chinese economy which is important for several European exporters.

Essentially, the positive momentum across the European equity market was not only as a result of the combination of fiscal support, the easing interest rate environment and improved earnings prospects, but mostly as a result of what is referred to as “multiple expansion”, namely the willingness by investors to pay a higher earnings multiple. European stocks entered 2025 trading at discounted levels relative to their peers in the US, which helped attract capital flows into the European equity markets.

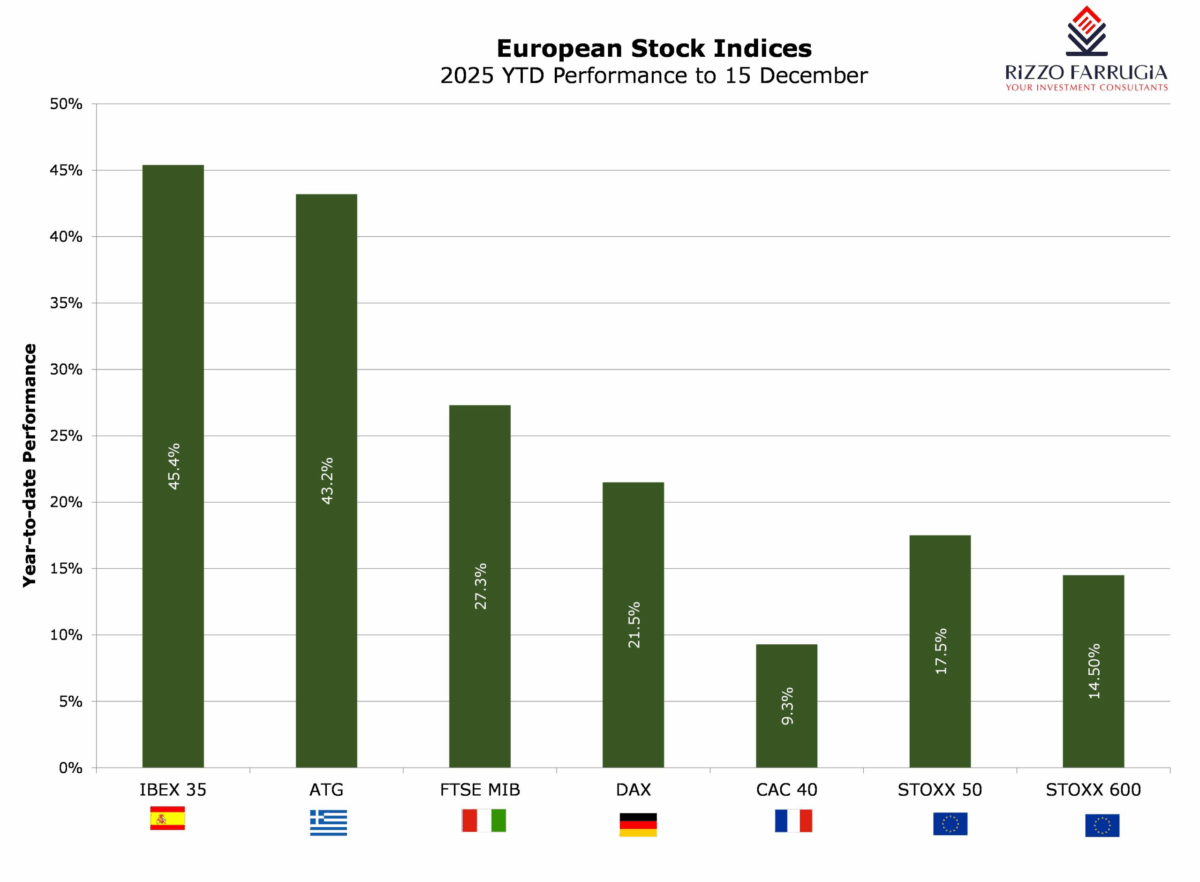

While in the US, the S&P500 is the most commonly-used index to track the performance of the equity market as opposed to the more concentrated indices namely the Dow Jones Industrial Average or the Nasdaq, the Euro STOXX 50 index or the STOXX Europe 600 are the popular benchmarks for Europe used by the financial media. While both these indices registered double-digit gains this year, a look at some of the individual markets would make one appreciate the extent of the upturn in equities across the region.

The equity markets across southern Europe strongly outperformed the larger core markets (Germany and France) this year.

Spain is clearly one of Europe’s standout performers this year with a surge of over 45 per cent (the largest annual increase in more than three decades). The Spanish equity market was supported by improved investor confidence arising from a number of credit rating upgrades.

The Greek stock market also experienced a very strong rally in 2025 (+43 per cent year-to-date), driven by improving investor confidence and continued evidence of the strong economic turnaround.

Italy’s main index, the FTSE MIB, also posted notable double-digit gains during 2025

One of the main themes that dominated the European markets was the surge in banking equities driven by robust earnings, cost-saving initiatives and improved credit conditions. In fact, this is one of the reasons for the strong performance of European equity indices given the high weighting of banks across most of the indices. An index of European bank stocks, the Stoxx 600 banks, climbed by almost 60 per cent this year following the 25 per cent gain in 2024.

Bank shares feature among the best performers across most of the indices. In Spain, the share price of Banco Santander rallied by over 120 per cent, while Alpha Bank in Greece saw a similar jump of over 110 per cent as Italy’s UniCredit was building up a stake in this bank as part of its ambitions for cross-border acquisitions. The share price of UniCredit likewise also rallied by over 75 per cent while another bank in Italy, Banca Popolare di Sondrio, saw a steepr rise at just under 90 per cent. 89.5 per cent.

Despite the political instability in France which dampened investor sentiment, the CAC40 still had a positive year and the share price of Societe Generale was the strong outperformer as it rallied by over 135 per cent significantly outperforming BNP Paribas at +33 per cent.

German equities also delivered solid gains during 2025 with bullish investor sentiment across specific sections namely defence, banking and industrials. Although the German defence company Rheinmetall was the strongest performer at +155 per cent, the very notable upturns were evident in Siemens Energy at +140 per cent as well as Commerzbank (+120 per cent) and Deutsche Bank (+91 per cent).

Despite the ongoing geopolitical risks as well as further possible trade disruption that could dampen investor sentiment, most analysts are expecting another positive year for European equity markets given the robustness of the banking sector, the large fiscal stimulus especially towards defence and infrastructure projects and a stable interest rate environment.

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Funding national projects

How can capital markets be used to diversify the funding sources of long-term national development projects

Malta’s earnings season

The importance of enhanced transparency, shareholder developments at HSBC Bank Malta, and broader capital market reforms

A chaotic start to 2026

Steady gains in January, but unprecedented swings in commodities, currencies and tech stocks