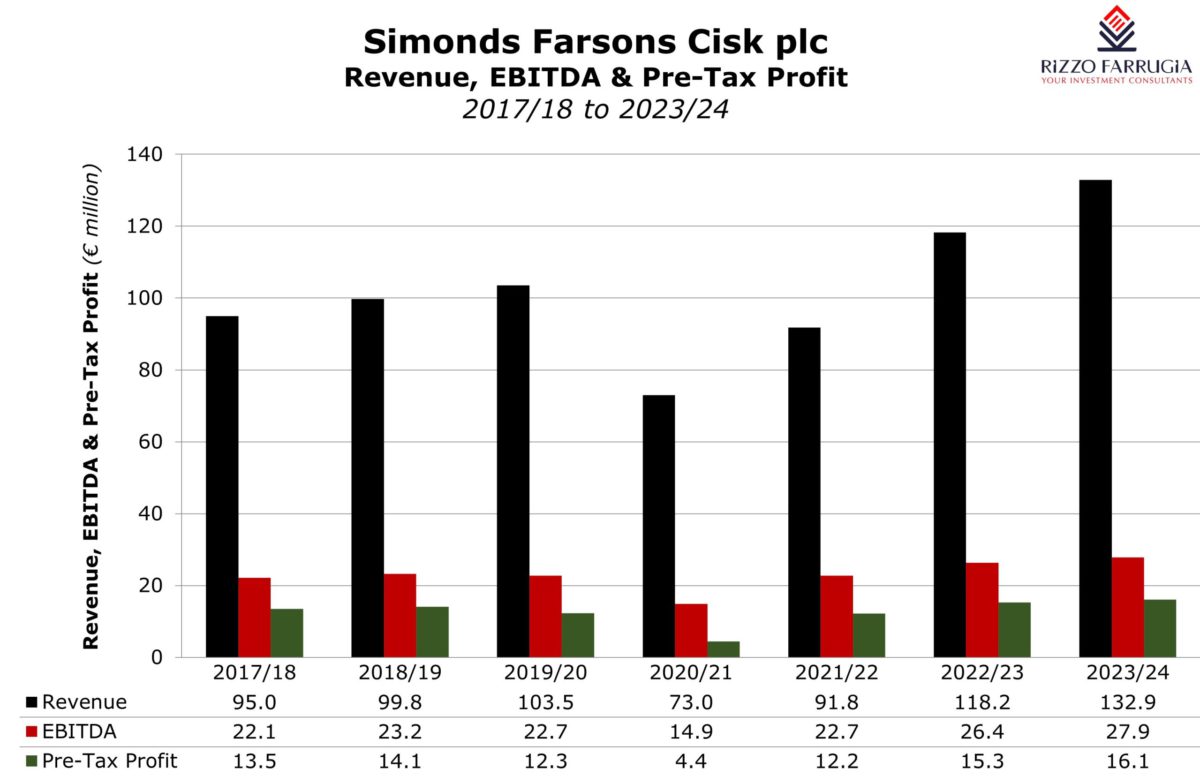

The Annual Report & Financial Statements recently published by Simonds Farsons Cisk plc covering the financial year between 1st February 2023 and 31st January 2024 shows record group revenue generation of €132.9 million, an increase of 12.4 per cent from last year’s previous record of €118.2 million. To place this into context, the group’s revenue had reached €103.5 million in FY19/20 just before the COVID pandemic.

Earnings before interest, tax, depreciation and amortisation (EBITDA) increased by 5.7 per cent in FY 2023/24 to a record of €27.9 million with pre-tax profits of €16.1 million representing growth of 4.9 per cent.

During a presentation to financial analysts last week, both the Chairman Mr Louis Farrugia and CEO Mr Norman Aquilina confirmed that due to market circumstances, there was margin compression as not all inflationary cost increases were passed on to consumers.

Meanwhile, the slight reduction in after-tax profits to €15.3 million is due to the higher tax charge of the subsidiary companies due to improved performances of a number of these companies compared to tax benefits available to the parent company.

Since Farsons is also a bond issuer on the Regulated Main Market of the Malta Stock Exchange, it is obliged to publish its financial forecasts annually. In July 2023, Farsons had announced that during the 2023/24 financial year, it had expected to generate revenue of €129.1 million, EBITDA of €27.7 million and pre-tax profits of €15.6 million.

The actual financial results for the financial year ended 31st January 2024 must therefore also be compared to the forecasts published last year. While actual revenue was higher than expected (at €132.9 million vs €129.1 million), the level of EBITDA was in line with forecasts of €27.7 million. Meanwhile, the actual pre-tax profit of €16.1 million was slightly ahead of expectations of €15.6 million.

In the latest Annual Report, there was a change in the reporting segments of the business units from previous years. The Group is now distinguishing clearly between the beverage segment and the food segment. The largest contributor continues to remain the Beverage segment (spearheaded by the sizeable market share as undisputed leader in Malta with CISK products). Revenue from the beverage segment grew by nine per cent to €95.8 million but due to reduced margins, the contribution dropped by 3.3 per cent to €14.5 million.

Meanwhile, the food segment, now incorporating Quintano Foods and Food Chain, experienced revenue growth of 23 per cent to €37.1 million. In the Annual Report, the Directors attribute this growth primarily from “the full year operation of a number of franchised outlets opened midway through the previous year and rising demand in general, due to changes in population and tourist demographics”. On the other hand, the importation and wholesale of food products saw “modest growth”.

At next week’s Annual General Meeting, shareholders will be asked to consider the payment of a final net dividend out of tax-exempt profits of €0.11 per share (unchanged over last year). When including the net interim dividend of €0.05 per share paid in October 2023, the total net dividend attributable to FY2023/24 amounts to €0.16 per share, which is 3.2 per cent higher than the total net dividend in respect of the previous financial year. The dividend payout ratio of 38 per cent remains conservative as the group maintains a balance of profit distribution and further reinvestments.

Farsons has started the construction of a new logistics centre for the food business as reported last year and will be investing in an automated returnable logistics facility within the operational land in Mrieħel.

The Farsons Group has a very strong balance sheet with total debt of only €28.4 million mainly comprising the €20 million bonds at 3.5 per cent due to mature in September 2027 and lease liabilities of €5.3 million. It is remarkable to note that over the years the total borrowings of the group never exceeded the €50 million level despite the investments undertaken totalling €112 million over a 10-year period.

While it will be interesting to monitor the upcoming performance of the Group in the coming months as it undoubtedly continues to benefit greatly from elevated tourism levels expected to reach new record levels again this year, the main focal point for the investing community should be on the food segment.

Farsons is carrying out a major investment in the construction of the new logistics centre in Ħandaq due for completion during 2026 which will reportedly “more than triple current storage facilities”. In his address to shareholders, the CEO acknowledged that this segment “merits strategic focus to be able to grow it to its full potential”.

While the performance of the beverage segment has been very encouraging over the years as CISK remained the undisputed leader in the Maltese beer segment, the food business continued to underperform. The intentions of the group are undoubtedly bold in this respect and shareholders should rightly monitor upcoming developments to ensure that the upcoming investments are truly justified.

The improved performance of Food Chain over recent years and the potential to represent brands such as Burger King and KFC on an international scale could be a long-term ambitious target for the food company.

It is also exciting and positive to note that the group is finalising a study on the most optimal structure for the food business which could very well translate into another important corporate action whereby, in the same manner of the spin-off of Trident Estates, shareholders of Farsons would receive shares in the food company which will then also be listed on the MSE. A decision in this respect is reportedly being taken this year and “the matter will be brought before the shareholders in due course”.

Companies listed on the MSE have increased advantages and alternatives when performing M&A activities due to tax benefits and options to compensate shareholders of target companies. This should be one of the major points for discussion for the food business given the importance of consolidation opportunities to achieve the desired targets in this respect.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers).

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Mobilising savings into investments

Malta’s equity market needs to grow in size and depth if it is to embrace the EU’s Savings and Investments ...

Reduction in free float

Lowering Malta’s minimum free float requirement to 10% could unlock new opportunities for the local capital market

A golden age for GO plc

GO plc’s Annual General Meeting revealed a bold shift beyond traditional telecoms, stronger-than-ever financials, and possible share buy-backs