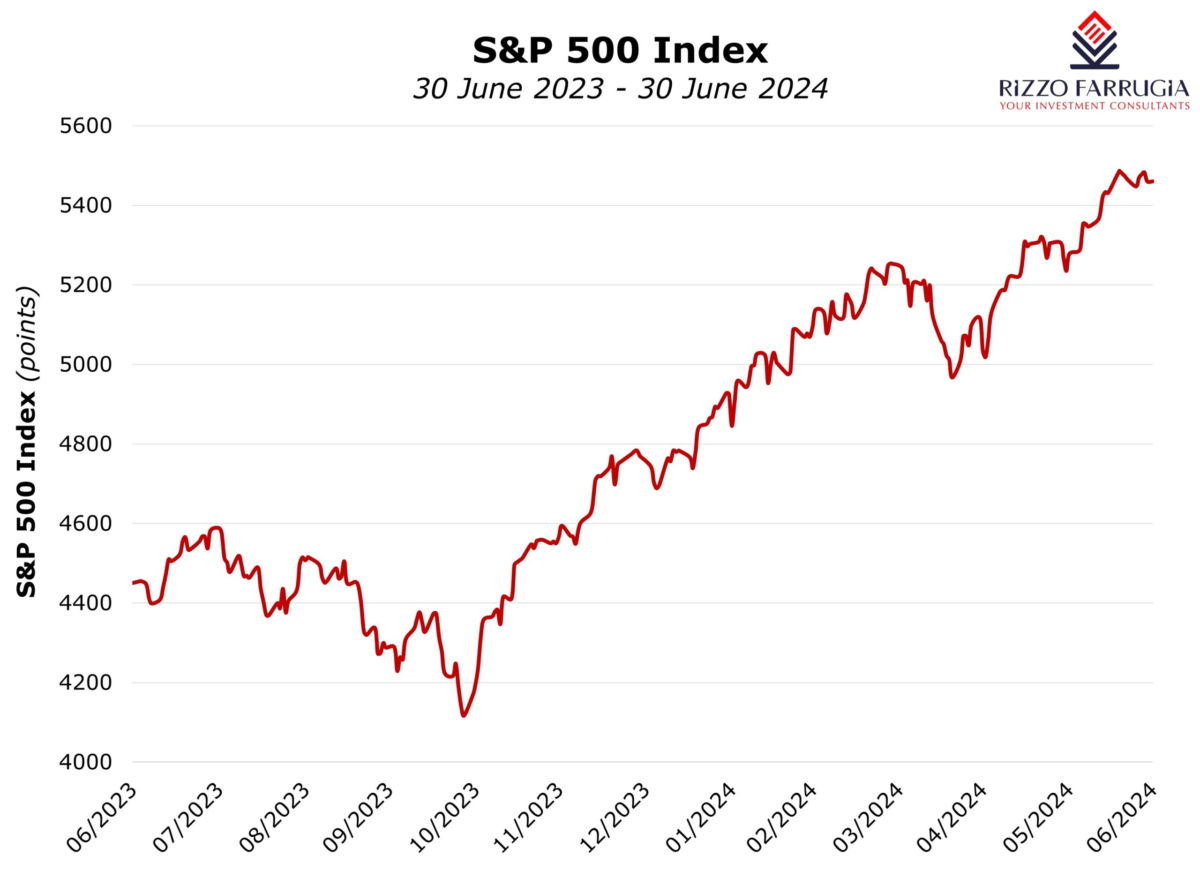

The S&P 500 index, which is the main benchmark index of the US stock market, climbed by almost 15 per cent during the first half of 2024. This ranks among the strongest performances for the opening six months of a year despite interest rates remaining elevated as a series of inflation readings during the first part of the year dampened expectations that the Federal Reserve will quickly embark on monetary policy easing measures.

During the first six months of 2024, the S&P 500 index registered new highs for a total of 31 times with 179 stocks hitting new all-time highs. All sectors within the index ended the first half with positive performances with the exception of real estate. The best performing sector was Technology with a 28 per cent gain in the first half of the year followed by Communication Services with a 26 per cent surge. Since the most recent low in October 2023 following a brief move into correction territory during last summer, the S&P 500 is up 33 per cent.

The Dow Jones Industrial Average index lagged behind the indices that have higher exposures to technology companies. The Dow Jones registered an overall gain of only four per cent during the past six months while the Nasdaq Composite climbed 19 per cent.

The stellar returns over recent months in the S&P 500 and NASDAQ indices have largely come from just five of the “megacap” companies, namely Nvidia, Microsoft, Amazon, Meta and Apple. The main driving force was the frenzy over the potential of generative artificial intelligence as Nvidia’s financial performance and updated near-term projections continued to easily surpass expectations. Moreover, the continued resilience of the US economy resulted in ongoing strength in corporate earnings across various economic sectors.

Among these five megacaps, Nvidia’s share price jumped a further 150 per cent during the first six months of 2024 (adding an additional $1.8 trillion in market value) following the extraordinary rally of almost 240 per cent in 2023. This resulted in Nvidia briefly becoming the largest company in the S&P 500 index as its market capitalisation surpassed $3 trillion level.

Nvidia has undoubtedly been the ‘talk of the town’ across business and also social circles. While many commentators are opining that this is reminiscent of the dotcom bubble in the late 1990s, others believe that the company’s upcoming computer chips (Microsoft, Meta Platforms and Amazon feature among Nvidia’s customers) will propel it to further success as it continues to dominate this rapidly emerging technology space. A particular analyst highlighted that Nvidia’s market cap could surpass $5 trillion during the course of 2025. Following such a meteoric rise (the share price soared nearly 700 per cent in just two years), Nvidia’s share price is undoubtedly prone to significant volatility. Between 20th June and 24th June, Nvidia’s market cap declined by $600 billion, representing a drop of 13 per cent over 3 days just shortly after surpassing a market cap of $3 trillion. The share price subsequently recovered a good part of the recent sell-off pushing the company’s market capitalisation back above $3 trillion.

In the technology sector, although Nvidia registered such strong gains once again, it was not the top performing stock. Super Micro Computer in fact ranks as the best performing company within the technology sector as its share price jumped by over 180 per cent. Other notable performers were Micron Technology (+55 per cent) and CrowdStrike (+51 per cent).

The share price of Microsoft surged 19 per cent in the first half of 2024 as its financial performance surpassed expectations with artificial intelligence boosting demand for its software and cloud services. In recent months, Microsoft also launched its Copilots – digital assistants fuelled by generative AI that help boost productivity.

Amazon became the fifth US company to ever reach a $2 trillion valuation as its share price climbed by 27 per cent after the company increased its focus on AI innovations and the company continue to register robust growth in its Amazon Web Services (AWS) division, which continued to dominate the cloud computing market.

On its part, Meta Platforms rallied by 42.5 per cent driven by robust advertising revenue, stemming from its dominant social media platforms namely – Facebook, Instagram, and WhatsApp, buoyed by advancements in AI-powered target advertising and e-commerce integration. The company’s cost-cutting measures and improved efficiency also positively impacted profitability and investor sentiment.

Apple was a late beneficiary to the AI rally with the share price only moving higher in recent weeks (+9 per cent since the start of the year) after the company announced a partnership with OpenAI on 10th June, which will support a new feature (“Apple Intelligence”) on iPhones and other devices. AI is likely to drive a new cycle of smartphone and device upgrades which resulted in many analysts projecting a jump in Apple’s financial performances in the years ahead.

Following the surprisingly strong rally over recent months, several investment banks have hiked their 2024 year-end targets for the S&P 500 index. In fact, the strong momentum in the first half augurs well for the next six months. During the years when the S&P 500 climbed more than 10 per cent in the first six months, the index subsequently jumped 7.9 per cent in the second half of the year.

One major investment bank recently upgraded its S&P 500 target to 5,600 points for the end of the year (representing upside of 2.6 per cent from current levels) but also articulated an alternative scenario with the benchmark index jumping up to 6,300 points by December 2024. The rationale for this possible 15 per cent rally from current levels would arise from “further mega-cap exceptionalism” as these technology companies continue to surpass expectations. There are many other stock market analysts that have such bullish scenarios for the US equity market on the back of the AI revolution still being in the very early stages.

On the other hand, another renowned US investment bank recently released its mid-year outlook, indicating a challenging environment with their target for the S&P 500 remaining at 4,200 points (which signals a 23 per cent downside from current levels). This bank is concerned about the ability of the mega cap stocks to sustain their earnings growth rates into the second half of the year.

An important event that could impinge on the performance of the S&P 500 index, and result in wide bouts of volatility, is the US election in November with President Biden up against former President Donald Trump.

With respect to the near-term outlook, investors will initially focus on the second-quarter earnings season which is about to commence as this will provide important evidence on company profitability levels. Moreover, signs of easing inflation have bolstered hopes that the Federal Reserve will cut rates as from September. The most recent reading published late last week continued to indicate that price pressures are easing. With the Federal Reserve expected to start cutting interest rates later in the year, bond yields are likely to move lower, which could continue to provide added momentum for the equity market over and above the ongoing AI revolution.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers).

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Mobilising savings into investments

Malta’s equity market needs to grow in size and depth if it is to embrace the EU’s Savings and Investments ...

Reduction in free float

Lowering Malta’s minimum free float requirement to 10% could unlock new opportunities for the local capital market

A golden age for GO plc

GO plc’s Annual General Meeting revealed a bold shift beyond traditional telecoms, stronger-than-ever financials, and possible share buy-backs