Earlier this year, I published a series of articles in which I articulated my views on the state of the Maltese equity market and a number of initiatives that the authorities ought to consider to help improve investor sentiment following a number of years of very weak trading activity across the equity market.

Following these numerous articles, an important event was organised by the Malta Stock Exchange (MSE) on 19th June to discuss measures to increase trading participation and market liquidity.

During the MSE Capital Markets Roundtable held last June, the Minister of Finance indicated that some initiatives for the capital markets will feature in the forthcoming budget to stimulate further equity participation. It was particularly comforting to hear the Minister state a few months ago that the Government is counting on the financial community to help stimulate the market.

I was therefore eagerly awaiting the Finance Minister to deliver the Budget Speech on 28th October to understand what initiatives were being proposed for the capital market. However, as the Minster began his lengthy speech, I obtained access to the Budget Speech and rather than waiting for all the measures to be read out, I quickly searched the entire document to find any reference to the Government’s plans for the capital market.

Unfortunately, there was no mention across the entire Budget Speech of any such measures for the capital market. While not downplaying the importance of certain measures including the amendments to the tax bands as well as the increase in the children’s allowance, the lack of any initiatives for the capital market following the intervention by the Minister of Finance at the MSE Capital Markets Roundtable a few months ago is indeed very disappointing.

On the other hand, there were other measures announced that in my view are surely less important than any initiatives that could have been contemplated to assist the Maltese capital market. It was very painful to see that taxpayer funds were also used to widely advertise some of these less noteworthy measures in the media while ignoring a very important economic sector that urgently requires the attention of the highest authorities.

Since no new measures or initiatives were proposed by the Government for the capital market, which truthfully has been the case for several years now, the main area of interest for the local investing community from the Budget Speech was that related to an update on Government’s finances. The 2025 Budget Document provides detailed forecasts for the Government’s fiscal position up to 2027 as well as its funding requirements.

The Government’s financial performance in 2024 is expected to be better than originally projected in last year’s budget. A deficit of just over €900 million is still anticipated for 2024, but since the economy grew at a faster pace, the budget deficit will be equivalent to four per cent of GDP, rather than 4.5 per cent. The Government is then anticipating a deficit of just under €850 million in 2025 and it is envisaged that this will be reduced to €700 million in 2027.

The overall borrowing requirements for this year were reduced slightly from €1.73 billion to €1.68 billion. However, since the expected MGS issuance for 2024 was left unchanged at €1.7 billion, a further €440 million in MGS issuance is expected to be issued by the end of the year. The Treasury has not yet indicated whether retail investors will also be eligible to participate in the next MGS offerings planned by the end of the year.

In view of the ongoing annual budget deficit as well as the MGS’s being redeemed annually which need to be refinanced from fresh Government bond issues, the total amount of MGS’s in issue are expected to increase from the current levels of just over €9 billion to €11.8 billion by the end of 2027. By then, the overall amount of MGS in issue will account for 87 per cent of the Government’s forecasted debt of €13.5 billion.

Next year, new MGS issues are forecasted at €1.5 billion, of which around €0.6 billion is required to refinance existing debt being matured while €0.9 billion represents new borrowings to finance the projected deficit. Moreover, in 2026, MGS issuance is set to reach a new record of €1.8 billion as the Government already has €1 billion in debt maturing in 2026 that will need refinancing.

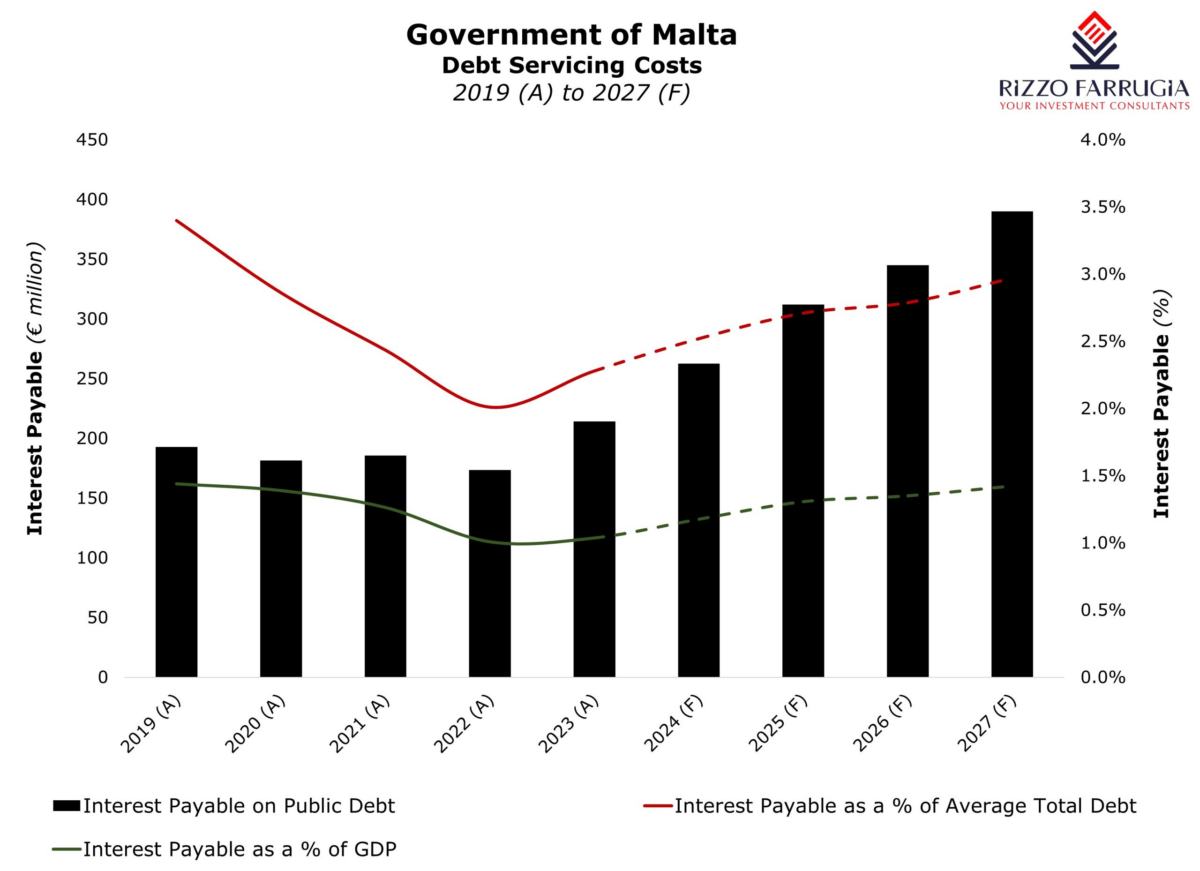

In 2024, interest payments on Malta’s government debt are estimated to increase to €263 million up from €214 million in 2023. In 2025, interest costs are set to rise further to €312 million, equivalent to 1.3 per cent of GDP. Interest costs are expected to continue rising, reaching €390 million by 2027. This would imply that the annual debt servicing requirements would have risen by just over 80 per cent between 2023 and 2027.

Turning back to the lack of initiatives to invigorate investor enthusiasm for Maltese equities, the Government needs to explain to all stakeholders its vision, if any, for the Maltese capital market.

The capital market cannot continue to experience such lacklustre activity (with the exception of activity in Bank of Valletta plc which has improved remarkably following the strong upturn in profits and dividend distributions). As I warned in my media interventions in the past, we need various reforms to create a revival of the equity risk culture in Malta that was prevalent over the 1990s and the years immediately prior to the pandemic.

Currently, we are now hearing about Vision 2050 for Malta. It is yet to be seen if the capital market will feature at all in such a long-term planning exercise that the country needs to embark upon. However, the reforms that are required for the capital market are truly immediate and cannot wait much longer if we wish investors to support both existing issuers as well as prospective issuers seeking an equity listing.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers).

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Mobilising savings into investments

Malta’s equity market needs to grow in size and depth if it is to embrace the EU’s Savings and Investments ...

Reduction in free float

Lowering Malta’s minimum free float requirement to 10% could unlock new opportunities for the local capital market

A golden age for GO plc

GO plc’s Annual General Meeting revealed a bold shift beyond traditional telecoms, stronger-than-ever financials, and possible share buy-backs