“The trend is your friend” is a commonly-used phrase across financial markets. It is generally used to describe specific trading patterns either in a specific asset class such as in foreign exchange markets or across specific securities. It is also used to explain the importance of identifying and investing in major market trends or secular themes (such as the rise of ecommerce since the turn of the millennium or the recent focus on generative AI and obesity drugs) to try to achieve exposure to new industry trends in investor portfolios.

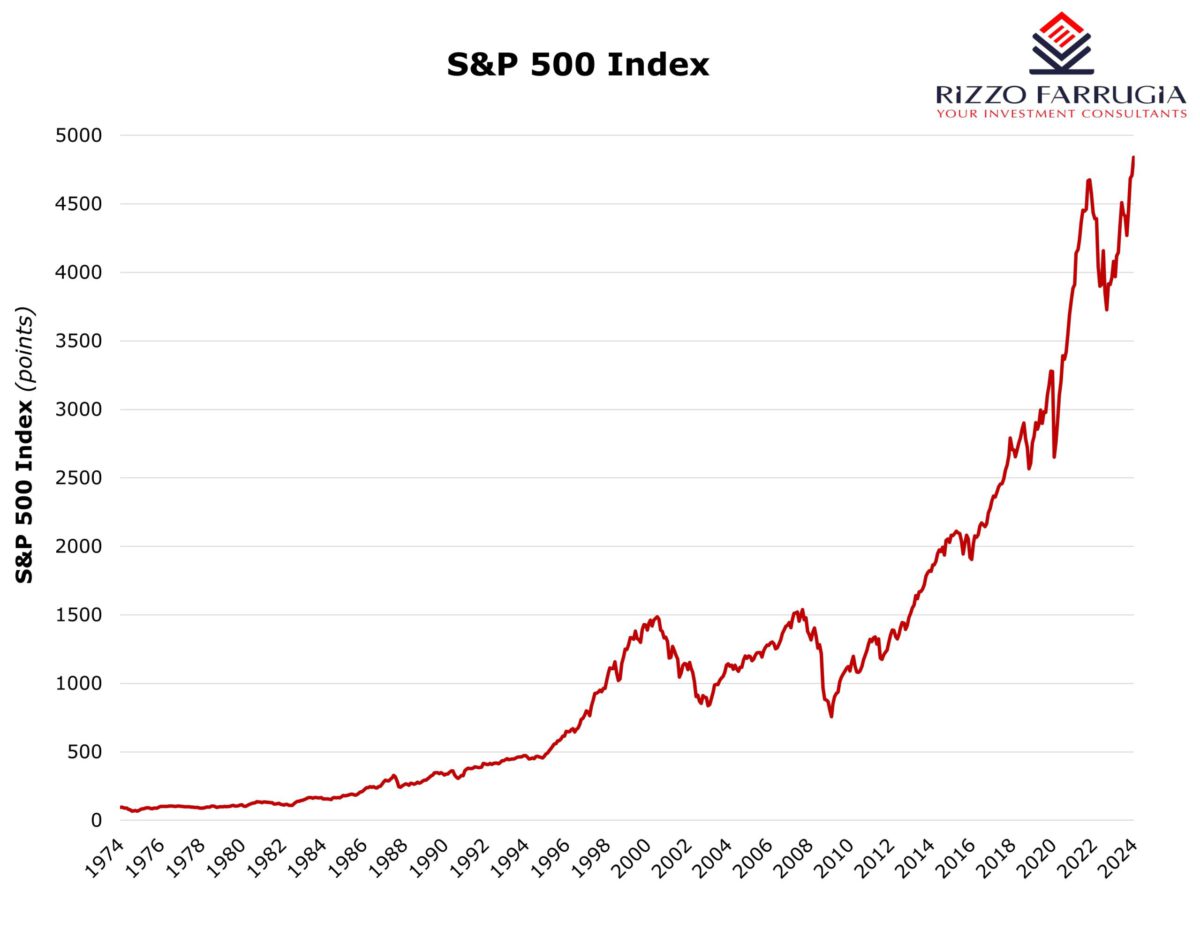

However, this phrase can also be very helpful in portraying the long-term trajectory of equity markets and the importance for all types of investors to gain exposure to equities as part of a well-diversified portfolio built around the specific investor objectives and requirements.

Incidentally, the S&P 500 index in the US closed at a fresh record high of 4,839.81 points last Friday (and pushed higher again on Monday), thereby surpassing the previous record level of 3rd January 2022. In recent weeks, I detailed that the background behind the sharp rally in equity markets in Q4 2023 was the optimism that the major central banks were on track to bring inflation back to target levels. This would enable them to start cutting interest rates as early as March 2024.

Once again, the upturn in the S&P 500 index during the start of 2024 is being driven by some of the Big Tech names with Nvidia, Meta Platforms and Microsoft all closing at new highs in recent days.

Nvidia, which was the top performer across the S&P 500 index last year with a gain of 236 per cent, has risen by over 20 per cent during the start of 2024 enabling the company to approach a market cap of USD1.5 trillion. The company could soon surpass Amazon as the 5th largest public company in the world.

Generally, a bull market is reached when an index or a security registers a gain of more than 20 per cent. Other market commentators believe that an index or a security needs to reach a new high before labelling it an official bull market. As such, the US equity market, as measured by the S&P 500 index, is now undoubtedly in a bull market. Since the low of 3,577.03 points in October 2022, the index has rallied by more than 34 per cent. Moreover since the most recent 52-week low in March 2023 at the time of the banking crisis, the S&P 500 index has risen by almost 26 per cent.

The extent of such gains may seem surprising given the economic backdrop and geopolitical developments. Over the past two years, financial markets have had to deal with the largest war in Europe since World War II, the fastest pace of inflation since the 1980’s and the highest borrowing costs since the turn of the millennium. Although equity markets dropped into bear market territory in mid-2022 (after reaching a record high in January 2022) and reached a bottom in October 2022, they have performed surprisingly well since then.

With a bull market now evidently intact, it is interesting to review some statistics on past patterns to obtain an understanding on the possible longevity of this renewed upturn across the US equity market. The S&P 500 index is effectively the world’s most-followed index since it represents more than half the entire value of global equity markets and therefore it is the correct benchmark to use in such an analysis.

Data since the mid-1940’s indicates that the S&P 500 index has on average surged 156 per cent over the course of the typical bull market with the median gain at 101 per cent. Bull markets on average last more than 1,700 days (or longer than four and a half years) with the median length of a bull run of just over 1,500 days (just over 4 years). The longest bull run lasted between 2009 and 2020 (nearly 4,000 calendar days) with an overall gain of more than 400 per cent.

By comparison, so far, the current bull market is in its 15th month and if history is any indication, the US equity market could continue to register positive performances in the months and years ahead.

Markets never go up in a straight line and although the US equity market is now officially in bull territory inevitably there will be periods of weakness ahead especially as a result of ongoing geopolitical tensions, any adverse economic data, the timing of interest rate cuts and also political developments with the US Presidential election later on this year. Timing the highs and the lows in the market is among the hardest strategies and even the most successful investors advocate that ‘time in the market’ is the most important factor for generating adequate returns across the equity market.

Since 1928 the S&P 500 index generated a compounded annual return of just under 10 per cent despite the Great Depression, World War Two, the severe bear markets in 1987 and 1999/2000 and more recently the financial crisis in 2008/09 as well as the COVID-19 pandemic. Equity markets have trended higher over an extended period of time despite multiple economic shocks and they have also outperformed fixed-income securities in the process. In fact, while the S&P 500 index generated a compounded annual return of just under 10 per cent over the past century, the annualised return on 10-year US Treasury bonds was 4.6 per cent This is a very important factor for investors to appreciate irrespective of their ultimate objective and risk profile.

I recently came across a newsletter which highlighted the important difference between fixed-income securities (bonds) and shares in a very clear manner. I feel that this is very important to share for the benefit of several Maltese investors who invariably demand having a sizeable exposure to bonds. The author claims that the significant outperformance of shares over bonds is “unsurprising” since “equities benefit from a feature which no other asset class, including bonds, can provide: a portion of the profit or cash flow which belongs to the shareholders is reinvested each year by the company. This is the retained profit which is not paid out as dividends, and its investment is the source of compounding which underpins the returns of long-term investment”.

Investors may not truly appreciate the compounding effect of retained profits. This is what helps companies grow their profits as well as dividend distributions over time as opposed to fixed-income securities or bonds which are eroded by inflation over the passage of time.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers).

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Reinventing the single market: Strategic vision and bold reforms for Malta and Europe

Proposed reforms present significant opportunities and formidable challenges for our small island nation

The equity market in pre-COVID times

Investor sentiment has evidently failed to recover from the series of shocks since the start of 2020

Interest rate divergence ahead?

Inflation is falling faster than forecast in Europe, while exceeding expectations in the US