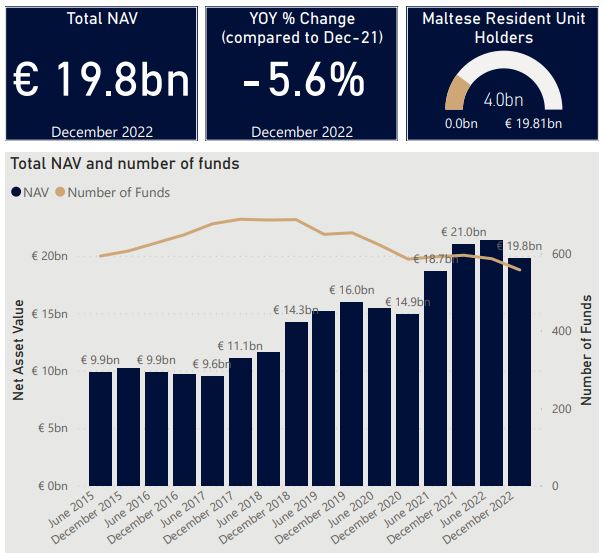

The net asset value (NAV) of Malta-domiciled funds decreased by 5.6 per cent over the course of 2022, a symptom of what went down as a historically bad year for stocks and other equities as inflation and global uncertainty brought the post-COVID recovery to a shuddering halt.

However, the decrease was actually less pronounced than that registered in the European and worldwide aggregate value of regulated funds, which saw drops of 12.8 per cent and 10 per cent respectively.

The statistics emerge from a publication by the Malta Financial Services Authority (MFSA) outlining key indicators on the Maltese and international fund industries.

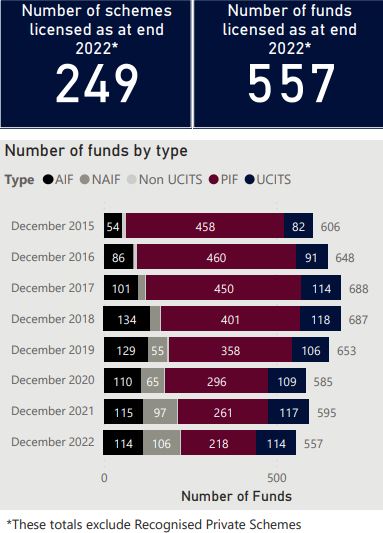

The release shows a marked shift in investor interest in domestic structures, with the number of Professional Investor Funds (PIFs) falling by 16.5 per cent as the number of Notified Alternative Investment Funds (NAIFs) increased by 9.3 per cent over the year. This, the MFSA notes, is largely a result of a large number of PIFs converting their licence to become NAIFs.

Despite the rapid rise in NAIFs’ popularity, PIFs remained the most common type of fund in Malta.

The MFSA acknowledges that 2022 “was a negative year for funds in terms of funding, which experienced total net outflows equal to €528 million compared to net inflows of €3.1 billion during 2021”.

The largest net outflows were registered by AIFs equal to €1.3 billion. Net revaluation adjustments decreased the NAV by a further €313 million.

In Europe, total net assets declined by 12.8 per cent in 2022, ending the year at €19.1 trillion.

“Close to 90 per cent of this decline was due to the losses in stock and bond markets, and the remaining 10 per cent due to outflows from investors. In terms of net sales, equity funds suffered the most in 2022, with total net outflows equal to €289 billion,” said the MFSA.

Meanwhile, “worldwide regulated open-end fund assets decreased by 10 per cent in euro terms to €60.6 trillion in December 2022 compared to December 2021. Net sales of worldwide regulated open-end funds registered net inflows of €51.1 billion in 2022 compared to €3.5 trillion in 2021, with bond funds experiencing a significant shift from net inflows of more than one trillion euro in 2021 to net outflows of €248 billion in 2022.

The statistics show that the vast majority (89.5 per cent) of funds are administered from within Malta accounting for 68.5 per cent of the NAV of funds registered in the country.

Additionally, just under half (49.7 per cent) of the total number of funds accounting for just over half the total NAV (50.8 per cent) are managed locally. About a third are self-managed, while the rest are managed from outside Malta.

Top 5% of taxpayers responsible for one-third of all income tax paid in Malta

On the other hand, the bottom third of income earners pay just 1.7% of all income tax generated

The Malta Institute of Accountants prepares for its 2024 Anti-Money Laundering Conference

Held at the Radisson Blu, St Julians, this latest AML Conference promises to bring exclusive insights on new procedures

Eurozone interest rates to remain unchanged

The European Central Bank noted that price pressures remain persistent