Trusts whose ultimate beneficial owners have more than one nationality must now register each one with the authorities, in an update meant to bring Malta in line with European regulations.

The Malta Financial Services Authority (MFSA) issued a notice earlier this week informing trustees that enhancements have been carried out to the beneficial owner reporting system (known as TUBOR), as part of the ongoing work being undertaken by Malta to implement the Beneficial Ownership Registers Interconnection System (BORIS).

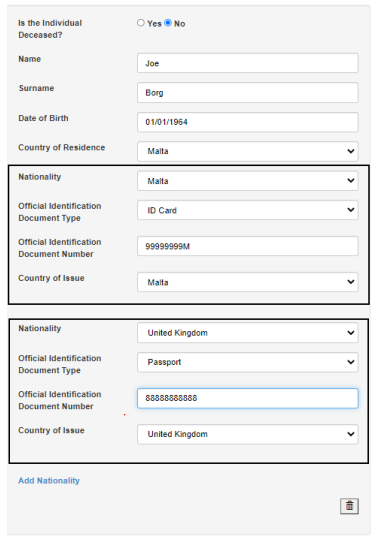

Significantly, the changes mean that the system now also allows for more than one nationality to be recorded.

The MFSA stressed that trustees must ensure that if any beneficial owners have more than one nationality, all such nationalities are to be reported on TUBOR, along with the applicable corresponding identification document details.

It said that it would accept that such identification details may not be available to the trustee only in the event that the beneficiary reported on TUBOR is a beneficiary designated by particular characteristics or class, and has never received a payout or exercised any vested rights in the trust.

This arises out of current AML legislation, which only requires trustees to identify and verify the identity of a beneficiary at the time of payout or at the time of the beneficiary exercising a vested right.

The MFSA also reminded trustees to indicate “whether the beneficiary has received a benefit or otherwise” in the field relating to the “nature and extent of the beneficial ownership”, in the case of individuals, warning them that failure to do so would mean that the submission will be taken to be incomplete and will not be accepted.

Trustees were also reminded to ensure that all information reported on TUBOR is accurate and up to date: “The Authority therefore expects Trustees to exercise the utmost prudence, diligence and attention when inputting data in relation to the declarations of beneficial ownership of trusts, and to refer closely to the guidance issued by the MFSA in the FAQs.”

The guidance comes amid fresh optimism that Malta’s efforts to get off the Financial Action Task Force’s (FATF) grey list are being well-received, with the body saying last month that “initial indications showed Malta had substantially completed its action plan”. FATF assessors also conducted a site visit earlier this month.

If the FATF is satisfied that Malta did make sufficient progress on the factors identified as problematic back in June 2021, the country stands a good change of getting off the grey list in June 2022, when the organisation hold its next plenary.

One of the key reasons given for putting Malta on the list of counties subject to enhanced monitoring, as the grey list is officially known, was in fact a beneficial ownership registration system that did not meet the standards expected by the FATF.

It had therefore called on Malta to demonstrate that beneficial ownership information is accurate and that, where appropriate, effective, proportionate, and dissuasive sanctions, commensurate with the ML/TF risks, are applied to legal persons if information provided is found to be inaccurate.

It also wanted Maltese authorities to ensure that effective, proportionate, and dissuasive sanctions are applied to gatekeepers when they do not comply with their obligations to obtain accurate and up-to-date beneficial ownership information.

Unpacking Malta’s new American-style bankruptcy framework

The EU is reforming its insolvency rules to adopt some of the most beneficial elements of the US framework

More than half of all workplace deaths in last two years involved construction

No women died on the job in 2022 and 2023

Government shells out close to €70 million to national bus operator Malta Public Transport in 2023

Buses became free for residents in late 2022, leading to a hefty increase in the public subsidy