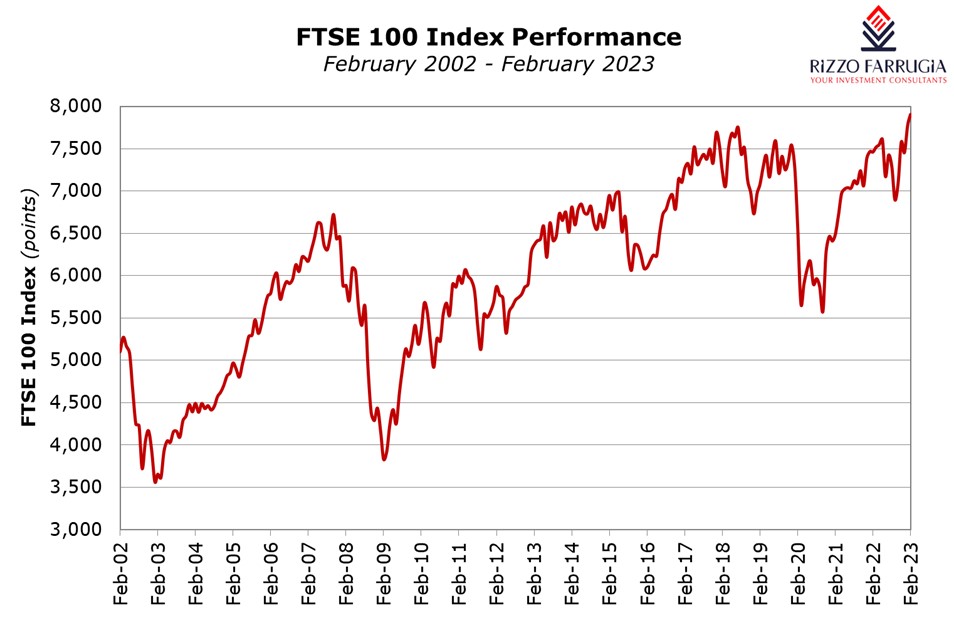

Last Friday, the UK’s FTSE 100 hit an all-time high of 7,906.58 points thereby surpassing its previous peak of 7,903.50 points reached on 22nd May 2018.

In isolation, this development may be surprising to many investors as the UK economy seems to be heading for a recession and the value of the British pound continues to remain weak. However, the FTSE 100 index is dominated by multinational companies that are not dependent on the British economy. Moreover, sterling’s devaluation over recent years against both the euro and the US dollar helps companies that account for the bulk of their revenues overseas once they are translated back into sterling.

The UK’s main benchmark index is indeed dominated by companies in the oil and gas sector as well as mining companies, banks, insurers, utilities and consumer staples companies that benefit from weakness in the British pound.

During the market turmoil in 2022, the FTSE 100 outperformed the main equity market indices as it registered a marginal gain of just below one per cent while all other indices shed double-digit percentages. However, this must also be seen in the context of the significant underperformance in prior years largely due to the low exposure to the technology sector that largely contributed to the strong double-digit gains in the US equity market especially in 2019, 2020 and 2021.

In fact, over a long-term period, the FTSE 100 is up by a mere 14 per cent per cent since its dotcom era high in 1999 compared to a much stronger performance for the US stock market with the S&P 500 having climbed by more than two-and-a-half times over this same time period.

Global equity markets have started the new year on a very strong footing with a largely unexpected rally over recent weeks. Investor sentiment improved as a result of the easing of inflation in most parts of the world and on hopes that various central banks will start to slow the pace of interest rate rises. Last week both the Federal Reserve and the Bank of England indicated that they may be close to ending the cycle of rate rises. On the other hand, the European Central Bank strongly hinted that eurozone borrowing costs would need to rise further beyond an almost certain hike of a further 50 basis points in March to the three per cent level.

Another important development that buoyed the performance of the international equity markets in the first five weeks of 2023 was the impact of China’s reopening which has raised expectations that the Chinese economy will experience a strong recovery in the first half of 2023 thereby benefiting both China and its trading partners across the globe.

The FTSE 100 has so far risen 6.1 per cent in 2023 but most other European and US markets have performed better. In fact, the S&P 500 index registered an uplift of 7.7 per cent, the Nasdaq composite index rallied 14.7 per cent and the Euro Stoxx 50 increased by nine per cent. On the other hand, the Dow Jones Industrial Average only registered a gain of 2.4 per cent.

Over the last year, the UK large-cap index has also sharply outperformed the mid-cap FTSE 250 index which is much more closely correlated to the UK’s economic and political uncertainty. The FTSE 100 benefitted from rising energy prices and interest rates since the start of 2022 which are positive catalysts for some of the index heavyweights within the index.

Currently, the Anglo-Dutch oil major Shell plc is the largest component of the FTSE 100. The share price of Shell jumped by 43 per cent last year following the sharp upturn in the oil price.

The pharmaceutical company AstraZeneca plc is the second largest constituent and benefits from robust, non-cyclical demand for medicines. The share price of AstraZeneca advanced by almost 28 per cent over the past year.

HSBC Holdings plc, the third-largest component of the FTSE 100, also saw its share price gain 15 per cent since the start of 2023 as higher interest rates represents an important tailwind for the banking sector following a number of challenging years with low to negative interest rates.

Currently, the top five companies (namely Shell plc, AstraZeneca plc, HSBC Holdings plc, Unilever plc, and BP plc) account for just over 31 per cent of the overall market capitalisation of the FTSE 100.

In the near term, while there are several factors that may impinge upon the overall direction of international equity markets (geopolitical risk, inflation readings and monetary policy developments), the reopening of China following the severe and lengthy COVID-19 restrictions is very likely to lead to significant demand for commodities. This is undoubtedly positive news for the overall UK equity benchmark given the exposure to the oil and gas companies such as Shell plc, BP plc and Centrica plc as well as the mining companies Rio Tinto plc, Glencore and Antofagasta.

Meanwhile, according to a reputable international finance publication, the FTSE 100 is vying with Hong Kong’s Hang Seng index for the title of “most undervalued developed benchmark” based on two common multiples, namely the price/earnings ratio and dividend yield. While it is hard to gauge whether the FTSE 100 will outperform again this year as it did in 2022, the columnist who recently reported about the FTSE 100 claimed that on the basis of the low multiples quoted above, the overall defensive nature of the companies within the index as well as the exposure to commodities, would indicate that an investment in the FTSE 100 is warranted within a diversified portfolio.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers)

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Mobilising savings into investments

Malta’s equity market needs to grow in size and depth if it is to embrace the EU’s Savings and Investments ...

Reduction in free float

Lowering Malta’s minimum free float requirement to 10% could unlock new opportunities for the local capital market

A golden age for GO plc

GO plc’s Annual General Meeting revealed a bold shift beyond traditional telecoms, stronger-than-ever financials, and possible share buy-backs