The United States national debt ceiling was reached in the first week of 2025 as the outstanding debt in the world’s largest economy reached a new record of USD36.1 trillion. The debt ceiling in the US is a limit set by the US Congress on the amount of money that the government is allowed to borrow. Those who typically follow the US economy are well accustomed to political issues surrounding the debt ceiling, with the previous limit suspended recently in 2023 when the US debt had reached its limit at the time of USD31.4 trillion and the issue was ultimately resolved after months of negotiations.

The debt ceiling limit is a cause of concern for the US Treasury Department which must conduct various extraordinary measures to ensure that the government can continue to function. Nonetheless, the Treasury Department is estimated to hold higher cash balances when compared to the debt limit debate of 2023, thus its operations are expected to last for several months, even with the debt limit restriction in place.

The increase in government debt is typically brought about by government deficits, which is the result of costs being higher than income streams. In the fiscal year ended 30 September 2024, the US government recorded a deficit of USD1.83 trillion, the third largest in its history and only lower than the record deficits incurred during 2020 and 2021 due to the pandemic. Expenditure in fiscal year 2024 amounted to USD6.75 trillion with the highest costs being allocated to social security (20%), Medicare (16%), and national defense (14%).

A widely used measure of a country’s indebtedness is by calculating total debt as a percent of its Gross Domestic Product (GDP). On this basis, the debt-to-GDP of the US currently stands at around 120% and was only higher during the pandemic in 2020. The US debt-to-GDP ratio has exceeded the 100% level since 2012. For comparative purposes, the debt-to-GDP in the euro area stands at around 88% with only Greece (164%) and Italy (137%) exceeding the 120% level. An important consideration, however, is that while 80% of the US government debt is held by the public (including foreign governments and institutions), the other 20% is intragovernmental, thus held by government departments making surplus revenue. As such, when excluding intragovernmental debt, the US debt-to GDP ratio is closer to 100%.

Governments cover their debt obligations with their income streams, typically taxes, and thus the sustainability of government revenue is also an important consideration for creditworthiness. As such, governments such as the US with effective tax systems are considered as less likely to default while countries with less effective systems and wider tax evasion would carry a higher credit risk even if they hold a lower debt-to-GDP ratio. The government revenue in the US which amounted to USD4.92 trillion in the latest fiscal year was generated through individual income taxes (49%), social security and Medicare taxes (35%) and corporate taxes (11%).

The political stability is also an important consideration in sovereign credit ratings, with the assumption that in a functioning political system a default is considered as a last resort. Following the latest US election given that the Republican Party now holds the majority in both Senate and the House of Representatives, the new administration should find it easier to reset the debt limit and avoid a default.

While all international credit rating agencies classify US sovereign debt as investment grade with very low probability of default, in August 2023 Fitch Ratings downgraded the US credit rating by one notch citing a “steady deterioration in standards of governance over the last 20 years, including on fiscal and debt matters.” Meanwhile, in August 2011, S&P Global Ratings had also lowered its rating by one notch as it noted that “the effectiveness, stability, and predictability of American policymaking and political institutions have weakened at a time of ongoing fiscal and economic challenges.” On the other hand, Moody’s still assigns the US sovereign debt with its highest ‘AAA’ rating but lowered its outlook to negative in November 2023 due to declining debt affordability.

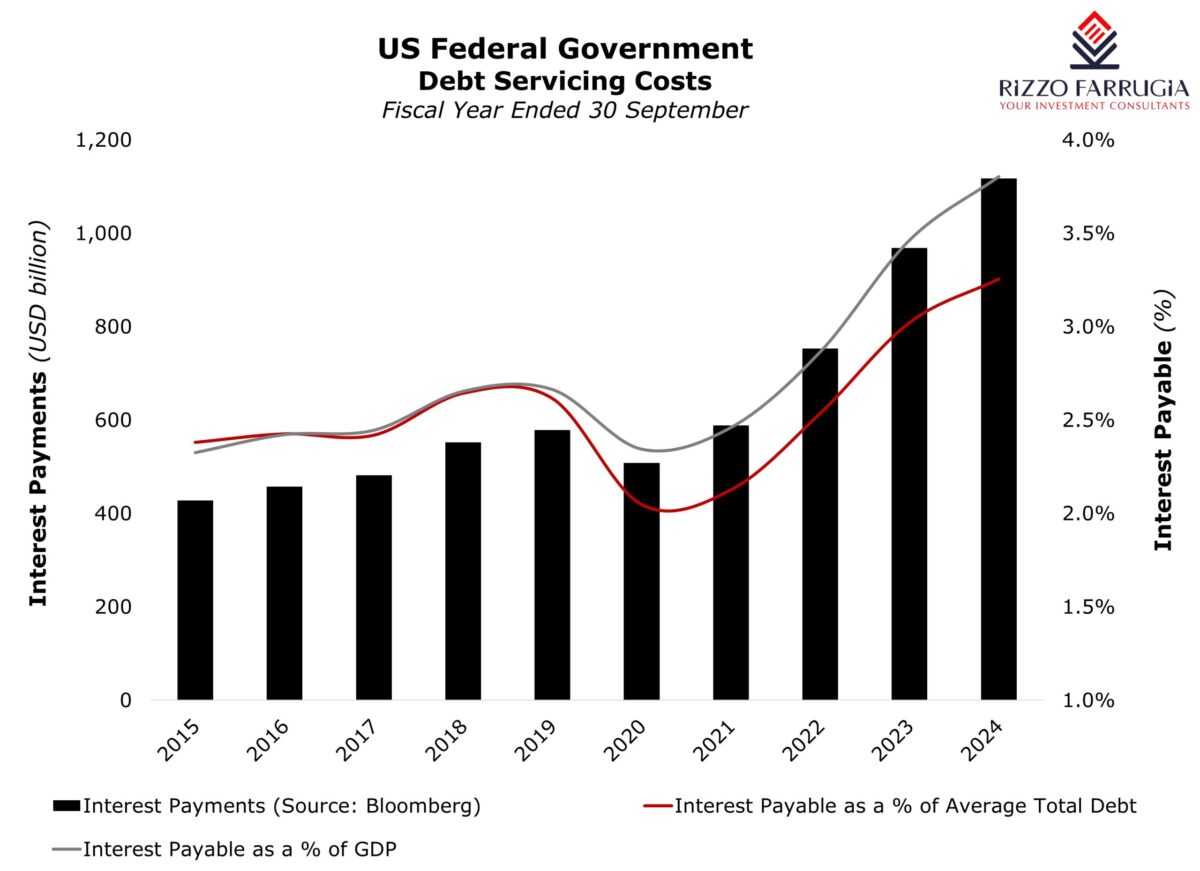

Indeed, the record debt levels coupled with the higher interest rates of the past years led to a sharper increase in the interest payment costs for the US Government that should remain closely monitored and are likely to feature in various financial discussions in the years ahead. Annual interest payments on US debt exceeded the USD1 trillion level for the first time in 2024 while the effective interest rate on US debt also exceeded the 3% level for the first time in more than a decade. Effectively, the annual interest payments for US debt doubled in just four years from USD508 billion in 2020 to USD1.12 trillion in 2024.

Looking ahead, the overall economic prospects in the US remain favourable with strong consumer demand and a relatively low unemployment rate. On the other hand, the elevated borrowing costs together with geopolitical issues and potential disruptions in global trade could pose risks to economic stability. With the expectations of tax cuts by the new Trump administration, it will be interesting to monitor how these will impact the revenue streams for the US government and whether the overall increase in economic activity translates into more manageable debt servicing obligations.

Read more of Mr Falzon’s insights at Rizzo Farrugia (Stockbrokers).

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Vision 2030 & 2050: A strategic lens on Malta’s tourism, hospitality, and leisure industries

Malta’s next challenge is not growth – but quality

From stability to strategy – The 2025 banking reset and the 2026 roadmap

Global markets closed 2025 on a strong note as AI-led equity gains

Strong year for European equities

European equity markets capped off 2025 with strong double-digit gains