The third quarter of the year has come to an end and during the summer months, one of the notable movements across the financial markets was the resumed strength of the US Dollar against the euro.

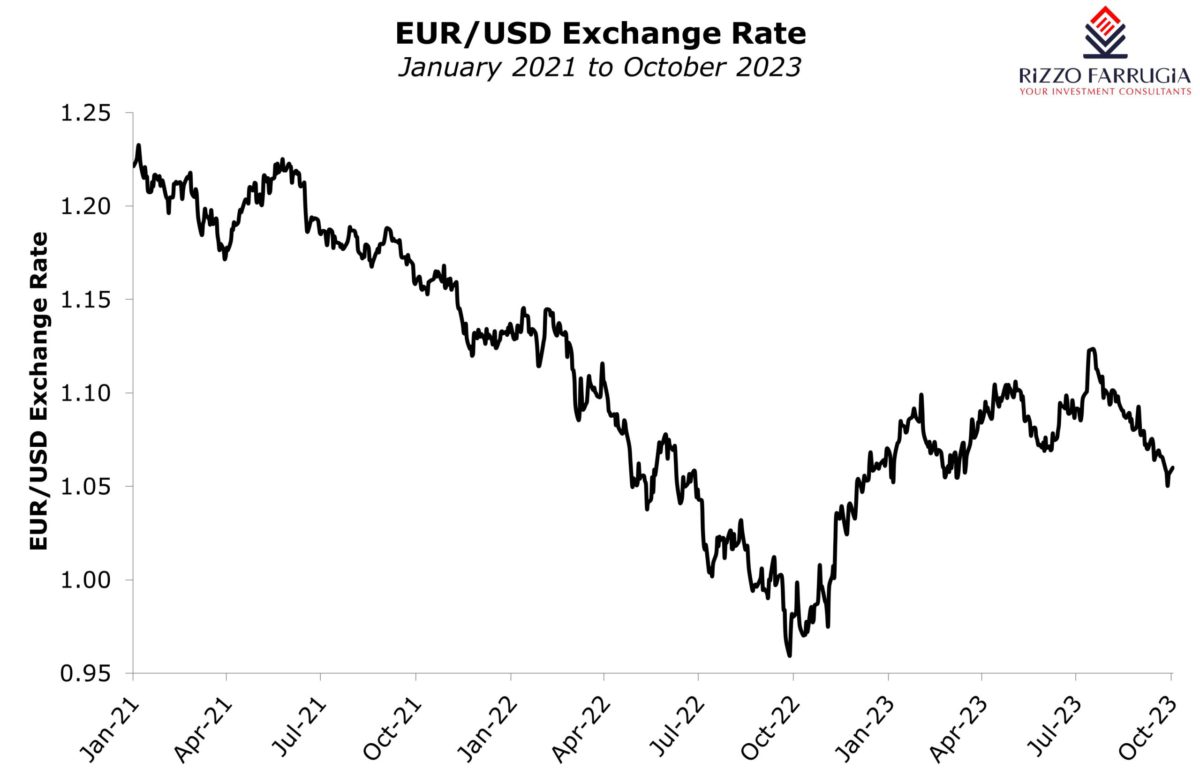

Looking back at the currency movements over the past few years, the consistent strengthening of the US Dollar from early 2021 was noticeable. This culminated in the US Dollar finally breaking parity against the euro as it appreciated to a level below USD0.96 in September 2022. From then on, the US Dollar lost some of its gains and ended the year at the USD1.07 level representing a gain of 5.5 per cent during the course of 2022.

In an article I published at the start of this year I had explained the background to the trend in 2022 whereby the US Dollar gained remarkably on the back of the aggressive moves by the Federal Reserve as it raised interest rates from 0.125 per cent at the start of 2022 to 4.375 per cent by the end of the year in a bid to combat inflation. On the other hand, the European Central Bank delayed its rate hikes to the second half of the year as it proceeded with its first increase in July 2022 (50 basis points) bringing rates out of negative territory for the first time since 2014. The ECB then followed with 75 basis points hikes in both September and October and a further 50 basis point rate rise in December resulting in a year-end deposit facility of 2 per cent.

The partial recovery of the euro against the US Dollar seen towards the end of 2022 gathered momentum for most of the first half of 2023 despite the occasional bouts of volatility especially in March at the time of the banking crisis. The US Dollar had weakened to a value of just below the USD1.13 level at the start of summer (representing a loss of 5.3 per cent against the euro since the start of 2023) but then made a remarkable comeback over the past ten weeks as it appreciated by over seven per cent to a level below the USD1.05 level. These intense movements across the currency markets within a few months are truly noteworthy. Essentially, the US dollar recovered all of its losses during the first seven months of the year.

One of the main reasons that the US Dollar weakened significantly during the first half of 2023 was the evident signs that the very high level of inflation was cooling. This indicated that the Federal Reserve would not only slow the pace of rate hikes but also eventually start reducing interest rates by the end of the year. The data showing that annual US inflation eased to three per cent in June was not the only catalyst that led to US Dollar weakness (euro strength) during the first half of the year. The other driver for these movements were improving economic growth forecasts in Europe. In fact, a prominent US investment bank had announced in the first half of the year that it no longer expected a recession across the euro zone in 2023 with an improved GDP forecast for the single-currency region to +0.6 per cent from the previous forecast of -0.1 per cent.

Despite the US credit rating downgrade on 1st August by the credit rating agency Fitch, the US Dollar began to recover strongly as clear signals emerged that the US economy was proving more resilient than other major economies.

In fact, during the latest monetary policy meeting of the Federal Reserve during the month of September, interest rates were kept unchanged at their highest level in 22 years. Moreover, the Federal Reserve indicated that they plan to cut interest rates at a slower pace during the course of 2024 and 2025.

The eurozone is facing a deteriorating growth outlook with the chief economist of the European Central Bank recently explaining that risks to the region’s growth were “tilted to the downside” as manufacturing activity is “set to remain weak” coupled with “clear signs of a slowdown” in the services sector.

The intense volatility in the EUR/USD exchange rate has wide implications for investors not only as this impacts the overall performance of an investment portfolio but also since currency movements of this magnitude affects the financial performance of several multinationals.

A strong dollar negatively impacts US companies that operate internationally such as the large tech companies. On the other hand, a strong dollar is beneficial to those companies that export products to the US. A number of companies in the healthcare sector are reportedly among the main beneficiaries from the rise of the US Dollar against the euro.

Although it is hard to predict movements across various asset classes, most especially currencies as was very evident over recent years, a number of the large investment banks currently believe that the US Dollar will weaken once again towards the USD1.12 level by mid-2024. Naturally, this will be very dependent on economic data and corresponding decisions by both the Federal Reserve and the European Central Bank. The timing of eventual rate cuts by the major central banks will affect most asset classes in one way or another.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers)

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Pioneering the 5th freedom: Enhancing research, innovation, and education in the single market and Malta’s role

Malta stands to gain significantly from the establishment of the 5th Freedom

Beyond numbers: Understanding the significance of pricing multiples for informed investing

Market participants may calculate financial metrics to take investment decisions following the end of the reporting season

Reinventing the single market: Strategic vision and bold reforms for Malta and Europe

Proposed reforms present significant opportunities and formidable challenges for our small island nation