Sales of used vehicles, typically imported from Japan or the UK, have continued to plummet in the first months of 2022, barely reaching half the number of sales seen prior to the pandemic.

The problem, industry insiders say, is that the UK market has essentially been eliminated as a source of imports, with both Brexit and supply chain issues leading to a steep increase in the price of such vehicles.

“Brexit hit us hard,” says one car dealer, who asked not to be named. “The additional VAT and duty raised prices significantly.”

Authorities’ nonexistent effort to obtain a derogation from new Brexit customs rules prior to their coming into force remains unexplained, while attempts to negotiate an exception for Malta’s unique case, as a country which drives on the left side of the road, came far too late.

In fact, derogations could only be discussed before Brexit. “It is like going to a notary, signing a contract, then turning up a few months later to ask for some changes. It just doesn’t work that way.”

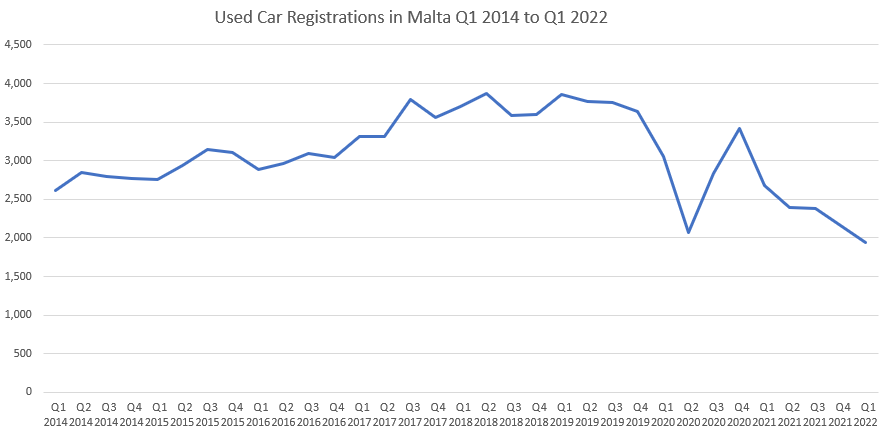

Data from the National Statistics shows that a quarterly average of 3,754 registrations of used vehicles in 2019 had dropped by over a third, to 2,404, by 2021, when each quarter saw fewer registrations than the one preceding it.

The first quarter of 2022 saw used car registrations reach a low unseen in years, with only 1,948 registered during this period.

This continuing decline can also be chalked up to increasing prices in the UK itself, which has seen the prices of such vehicles shoot up by some 35 per cent.

All this means that the UK used car import sector is effectively “decimated”, the insider says. “The only cars still coming from the UK are for those who want a particular car but don’t have the budget to buy it new.”

Affected businesses also find it difficult to shift their imports to the Japanese market, the other major source for used automobiles in Malta, thanks to the indirect monopoly of the Used Vehicles Importers Association (UVIA).

Transport Malta, BusinessNow.mt is reliably informed, does not allow the registration of used cars from Japan unless the importer is a member of the UVIA, which reportedly requests a joining fee of €39,000.

The issue is a longstanding one – a 2010 news report hints at agreements between the UVIA, TM, and the British VCA, which provides internationally recognised testing and certification for vehicles.

BusinessNow.mt reached out to TM to confirm, and is awaiting reply.

This is in stark contrast to the situation with UK imports, which can be registered by any individual without any prior form of authorisation. In fact, prior to Brexit, it was not uncommon for prospective buyers to journey personally to England in order to choose a vehicle and drive it down themselves.

While the distance to Japan makes it unlikely that this would be a popular option, the as of yet closed nature of the market prevents new players from entering, while those who previously focused on UK imports have been left out in the cold.

More than half of all workplace deaths in last two years involved construction

No women died on the job in 2022 and 2023

Government shells out close to €70 million to national bus operator Malta Public Transport in 2023

Buses became free for residents in late 2022, leading to a hefty increase in the public subsidy

Opera Cloud PMS: The cost-effective property management system for any hotel size

Smart Technologies Ltd provides leading hotel PMS system, starting from just €6 per room per month