2022 can best be described as the year when the negative interest rate environment ended. All the major central banks tightened monetary policy aggressively during the year following the spike in inflation. In essence, the era of ultra-loose monetary policy measures came to an end and yields jumped up accordingly, reflecting the new inflationary environment being witnessed.

In the US, the Federal Reserve conducted its sharpest increase in interest rates ever as inflation jumped to the highest levels in 40 years. The Federal Reserve announced seven consecutive rate hikes in 2022 thereby raising the target federal funds rate range from 0 per cent – 0.25 per cent at the start of the year to 4.25 per cent – 4.50 per cent (the highest level since December 2007).

The European Central Bank (ECB) hiked interest rates four times during 2022 bringing the deposit facility to 2 per cent. The increase in July 2022 marked the first interest rate hike by the ECB since 2011. Previously, the ECB’s deposit facility rate had been stuck at minus 0.5 per cent since 2019 and below zero since 2013.

As a result of the sharp upward moves in interest rates, bond yields rallied to their highest levels in many years.

In the US, the 10-year Treasury yield surpassed a level of 4.2 per cent last month before easing to a current level of 3.75 per cent marking a significant increase compared to a level of 1.5 per cent in December 2021.

Across the eurozone, the yield on the 10-year German bund jumped to above 2.5 per cent this year from a level of minus 0.179 per cent in December 2021. In Italy, the 10-year bond yield spiked to 4.9 per cent compared to a level of below 1.40 per cent this time last year.

In the past few months, there was an increased level of volatility in yields as the markets reacted to publication of economic and inflation data as well as comments by top officials of the ECB. In fact, the yield on the 10-year German bund dropped from 1.75 per cent in June 2022 to 0.76 per cent in August before rallying to 2.4 per cent in October. Yields then eased once again to 1.78 per cent in early December before touching 2.50 per cent earlier this week.

This intense volatility in sovereign bond yields is rather exceptional and resulted in wild swings in bond prices in a relatively short period of time. As explained in several of my articles in the past, there is a clear and natural correlation between movements in yields across the eurozone and those on Malta Government Stocks. The sharp upward movement in yields throughout 2022 and the high degree of volatility experienced over the past few months was also reflected in Malta as the yield on the 10-year MGS shot up to 3.8 per cent compared to a level of 0.80 per cent at the start of the year.

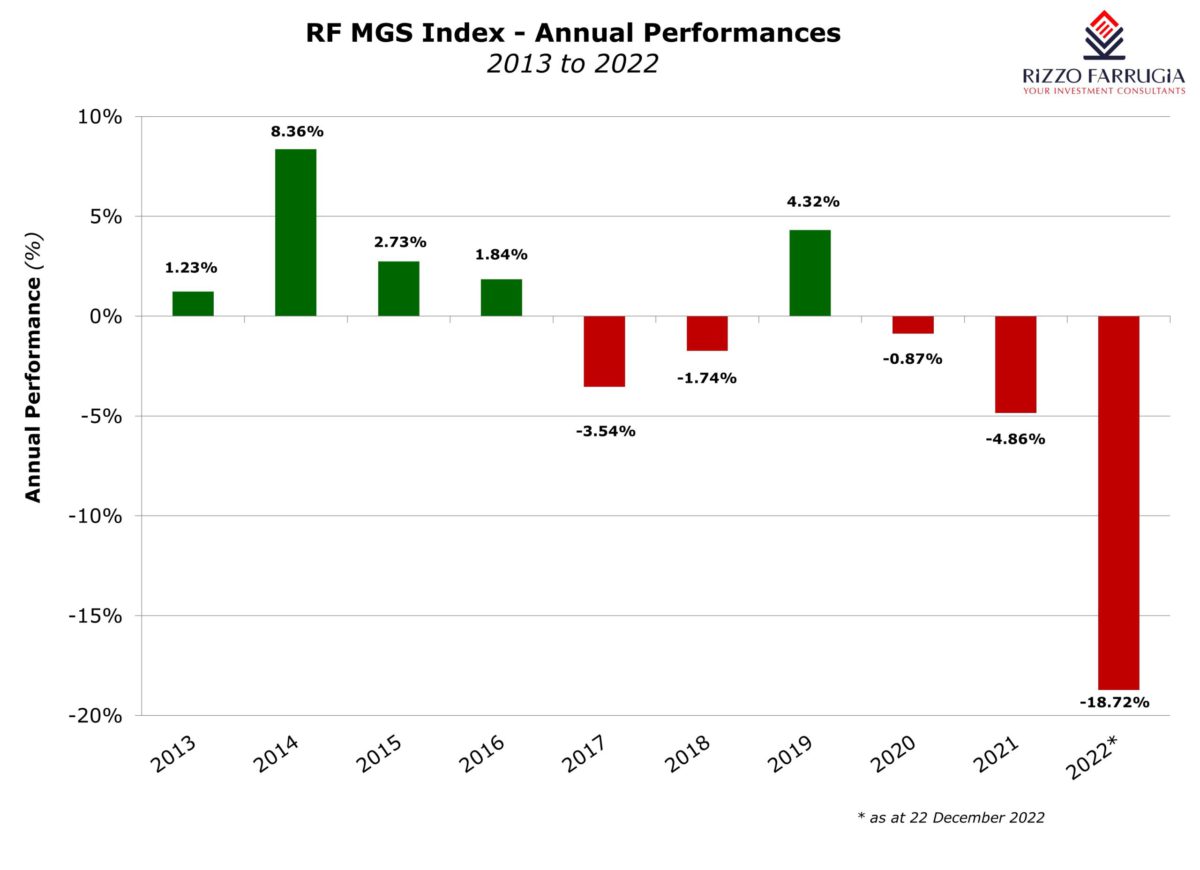

The RF MGS Index which is based on the MGS prices published by the Central Bank of Malta on a daily basis declined by an extraordinary 18.7 per cent in 2022 – the worst annual performance on record as yields spiked.

This is also the third annual consecutive decline in the MGS index as yields moved higher following an unprecedented period of very low yields caused by the quantitative easing programme by the ECB.

The extent of the decline in the bid prices in 2022 quoted by the Central Bank of Malta for several of the longer-term MGS’s is rather astonishing as most securities dropped well-below their par value. For example, the price of the three per cent MGS 2040 dropped by just over 38 percentage points from 126.61 per cent in December 2021 to just over 88 per cent a few days ago. Likewise, the 1.80 per cent MGS 2051 (which is the 30-year bond launched in 2021) saw its price plummet from 98.81 per cent to 62.05 per cent.

Similar to the exceptional sharp jump in MGS prices seen in 2014 and 2015 at the start of the quantitative easing programme by the ECB, the negative movement in prices over recent months is also severe by historic standards and not a normal feature associated with fixed-income instruments.

While 2022 was a brutal and painful year for investors holding MGS within their investment portfolios, the silver lining for the investing public holding excess idle liquidity is the higher yields available from the bond markets locally as well as internationally. This was very much in evidence when in October 2022, the Treasury issued a 10-year MGS at a yield of four per cent with the result that retail investors responded very enthusiastically and applied for just under €300 million.

While the higher yields will prove costly for borrowers including the Government of Malta who needs to raise a record amount of €1.6 billion in new MGS’s in 2023, the ample levels of liquidity in the financial system augur well for the Government and other corporate bond issuers aiming to tap the market in 2023.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers)

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Reinventing the single market: Strategic vision and bold reforms for Malta and Europe

Proposed reforms present significant opportunities and formidable challenges for our small island nation

The equity market in pre-COVID times

Investor sentiment has evidently failed to recover from the series of shocks since the start of 2020

Interest rate divergence ahead?

Inflation is falling faster than forecast in Europe, while exceeding expectations in the US