Following the end of the interim reporting season, a number of important developments took place across the local capital market. Among the equity issuers, BMIT Technologies plc held an Extraordinary General Meeting during which shareholders overwhelmingly approved the acquisition of 283 cellular towers from GO plc. BMIT will also be providing passive infrastructure services to GO for a period of at least 30 years for which GO will be paying BMIT a predetermined service fee per annum.

Another highly anticipated event was the publication on 22nd September of a Prospectus in connection with a two-for-three rights issue by Lombard Bank Malta plc. Through this corporate action, Lombard is aiming to raise circa €45 million which will be used to support its growth objectives and strengthen its capital base. Also in September, Trident Estates plc and Simonds Farsons Cisk plc published their respective interim financial statements reflecting very encouraging trends across two of the most important economic sectors in Malta.

On the local corporate bond market, SD Finance plc published an updated Financial Analysis Summary clearly showing the strength of the underlying dynamics of tourism and leisure. In fact, SD Holdings Limited (the Guarantor of SD Finance and the parent entity of db Group) is targeting record revenues of €80.19 million for FY2024 and an EBITDA of €25.35 million. Moreover, SD Holdings provided further insights into its strong pipeline of new investments for the coming years.

Equally interesting is the upcoming major international expansion of International Hotel Investments plc comprising the inauguration of seven Corinthia hotels in the coming three years spread across Europe, the US, the Middle East, and South Asia. In addition, IHI has applied to the Planning Authority for the proposed multi-million redevelopment of a large tract of land measuring over 83,000 sqm in Ħal-Ferħ to be converted into the landmark ‘Corinthia Oasis’ complex. On 28th September, IHI published a Prospectus in relation to the issuance of €60 million six per cent unsecured bonds redeemable in 2033. Most of the proceeds are earmarked towards the redemption of the existing 5.8 per cent and six per cent unsecured bonds maturing in mid-November 2023 and mid-May 2024 respectively.

Similarly, on 29th September, AX Group published a Prospectus in relation to the issuance of a ten-year €40 million bond at a coupon rate of 5.85 per cent which proceeds are earmarked for the rollover of the existing six per cent AX Investments plc unsecured bonds maturing on 6th March 2024. The financial information included in the Prospectus sheds light on the evident robust demand for leisure, entertainment, and accommodation, and also highlights the importance of the newly refurbished and enlarged AX Odycy Hotel (formerly Seashells Resort at Suncrest) which now features 147 additional rooms to a total of 599 keys apart from several new facilities including pools, restaurants, bars, and outdoor areas.

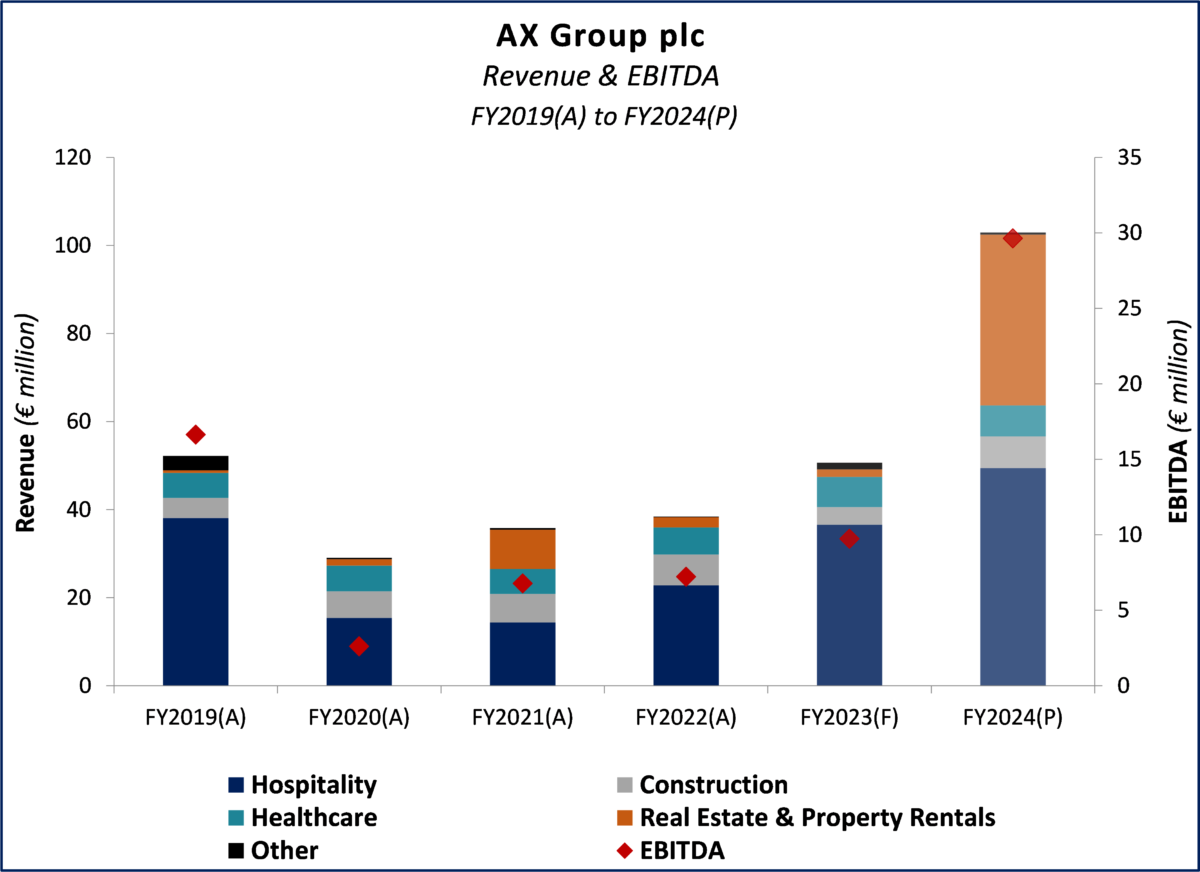

The soft opening of AX Odycy Hotel took place in late May 2023 after the Group invested circa €72 million for this ambitious project. In FY2024, AX Group is estimating total revenues from its various hotel properties to surge to a new record of €49.42 million which would be materially higher than the previous all-time high of €38.12 million registered in FY2019 prior to the global outbreak of the COVID-19 pandemic. The target revenue figure of €49.42 million from the Group’s hospitality division represents 48 per cent of the FY2024 projected aggregate income of €102.93 million, with a large chunk of the remaining revenues amounting to €37.05 million expected to be generated by the Group’s real estate segment. In this respect, the income reflects the sale of the first residential units at the Verdala Terraces forming part of the €70 million Verdala Project which is currently in an advanced stage of completion. The luxurious project will include a 40-room five-star all-suite Verdala Hotel, 23 high-end serviced/self-catering units, a state-of-the-art spa, as well as 87 exclusive apartments spread over two blocks (Block A ‘Royal Mansions’ and Block B ‘Grand Mansions’). Furthermore, the 19 existing Virtù Heights residential units are being remodelled and thereafter will be annexed to the Verdala Hotel once this property opens for business in Q4 2024 (i.e., at the start of the Group’s 2025 financial year).

On the back of the upsurge in business, AX Group is anticipating an EBITDA of €29.64 million in FY2024 (FY2023 forecast: €9.74 million) which would translate into a margin of 28.80 per cent. Likewise, the interest cover is projected to rise to 3.39 times (FY2023 forecast: 1.86 times) despite the notable increase in net finance costs to €8.74 million as the Group took on additional borrowings supporting its investments in AX Odycy Hotel and the Verdala Project. Nonetheless, the remarkable expansion of the Group’s asset base and operations will not jeopardise its financial standing particularly in view of the robust debt-to-asset ratio and net gearing position which are only expected to peak at 0.36 times and 40.74 per cent respectively by the end of the current financial year ending 31 October 2023. Furthermore, given the material projected increase in EBITDA in FY2024, the Group’s net debt-to-EBITDA multiple is anticipated to contract sharply to 5.43 times in FY2024 from a level of 17.17 times in FY2023.

In this context, AX Group can look ahead with confidence as it prepares itself for future projects. These include the extension of the Hilltop Gardens Retirement Village residences and, more significantly, the redevelopment of the Luzzu Complex and Sunny Coast & Spa lido which will be linked to the AX Odycy Hotel lido to form a series of laguna pools, restaurants, and commercial outlets. Moreover, AX Group plans to demolish and rebuild the Sunny Coast Resort & Spa into a new 200-unit aparthotel.

AX Group has certainly been one of the most visionary entities in Malta when it comes to identifying growth opportunities whilst maintaining a high level of quality and standard. Despite the considerable challenges experienced throughout the COVID-19 pandemic, the Group went ahead with resoluteness in transforming its single largest asset (AX Odycy Hotel) and pursuing the landmark Verdala Project. The excellent track-record built along the years coupled with the Group’s financial strength and sound management ethos are key ingredients for AX Group to continue its success story for many more years to come.

Disclaimer:

This article was written by Josef Cutajar, Financial Analyst at M.Z. Investment Services Limited (“MZI”). The author has obtained the information contained in this article from sources believed to be reliable and has not verified independently the information contained herein. The contents of the article are the author’s views and may not reflect the other opinions in the organisation. The article is being published solely for information purposes and should not be construed as investment, legal, or tax advice, or as a recommendation to buy, sell, or hold any security, investment strategy or market sector. The financial instrument referred to in this article may not be suitable or appropriate for every investor. Prospective investors are urged to consult their Investment Advisor prior to making an investment. Past performance is no guarantee of future results, and the value of investments may go down as well as up. MZI accepts no responsibility or liability whatsoever for any expense, loss or damages arising out of, or in any way connected with, the use of all or any part of this article. No part of this article may be shared, reproduced, or distributed at any time without the prior consent of MZI. MZI is acting as Sponsor to AX Group plc and an authorised financial intermediary to the AX Group plc bond issue.

MZI is a member of the Malta Stock Exchange and is licensed by the Malta Financial Services Authority to conduct investment services business under the Investment Services Act (Cap. 370) (License N° IS23936). M.Z. Investment Services Limited, 63 ‘MZ House’, St Rita Street, Rabat RBT 1523. Telephone: +356 21453739; Email: [email protected]; Website: www.mzinvestments.com.

Malta-flagged container ship targeted by missiles close to Yemen’s Mokha, British security firm says

Attacks by Iran-aligned Houthi group have had major impacts on global shipping

Employment growth set to halve to 3.2% in 2024 due to slowdown in economic activity – Central Bank

The Central Bank of Malta states that Malta’s labour force grew by 5.1% in the first nine months of 2023

In pictures: These Maltese houses just won architectural awards

The BIG SEE Architecture Awards are given to projects from South-East Europe