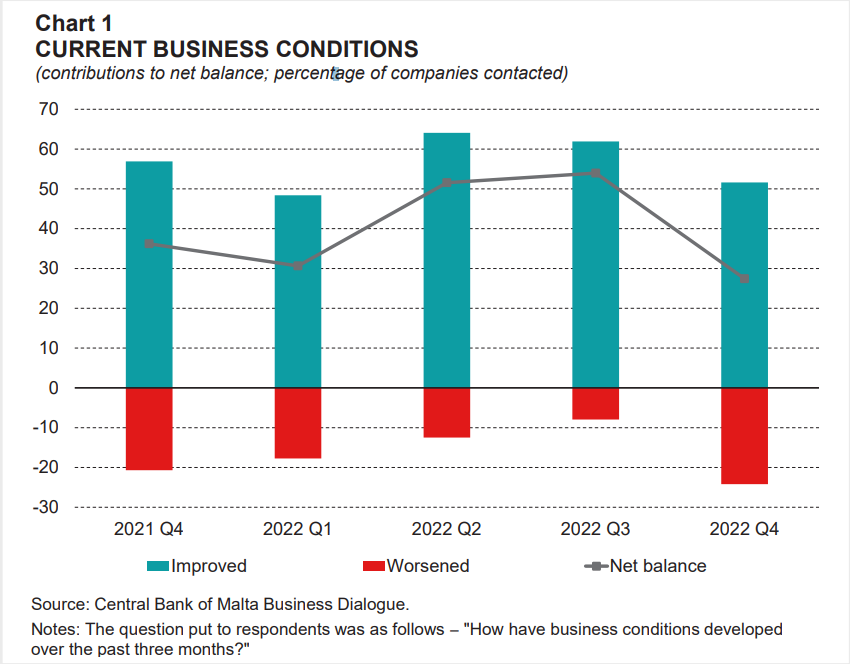

During the last quarter of 2022, business conditions remained positive, however, weaker activity was reported in manufacturing, construction and real estate, according to the Central Bank of Malta’s (CBM) Business Dialogue Publication.

Only a small net share of 27 per cent of firms reported positive business conditions between October and December 2022. This is a significant decline from 54 per cent in the previous quarter and the lowest balance since the second quarter of 2021.

Except for construction and real estate, all sectors reported positive conditions on balance. In fact, the number of construction and real estate firms to have reported higher activity during the fourth quarter of 2022 fell to 13 per cent from 40 per cent, bringing the net balance down to -25 per cent of businesses reporting positive business conditions.

This does not come as much of a surprise, considering that the number of the promise of sale agreements throughout 2022 declined by a fifth.

It was however evident that the construction industry witnessed the biggest drop in confidence in its outlook on business conditions, when compared to real estate, due to waning interest in developers to build new residential properties. The two main reasons behind this are the rising cost of construction goods and the strong increase in vacant units available on the market.

To compensate for the decline in activity, construction companies are increasingly active in government projects, resulting in more competitive tenders.

Manufacturing, on the other hand, remained positive, but experienced the sharpest decline in confidence.

The net balance of manufacturing companies reporting improved business conditions fell from 53 per cent in the third quarter of 2022, to 18 per cent in the fourth quarter. This is largely due to a significant number of firms reporting worse conditions (32 per cent) and a small but still relevant decline in companies reporting positive conditions (from 59 per cent to 50 per cent).

The next quarter

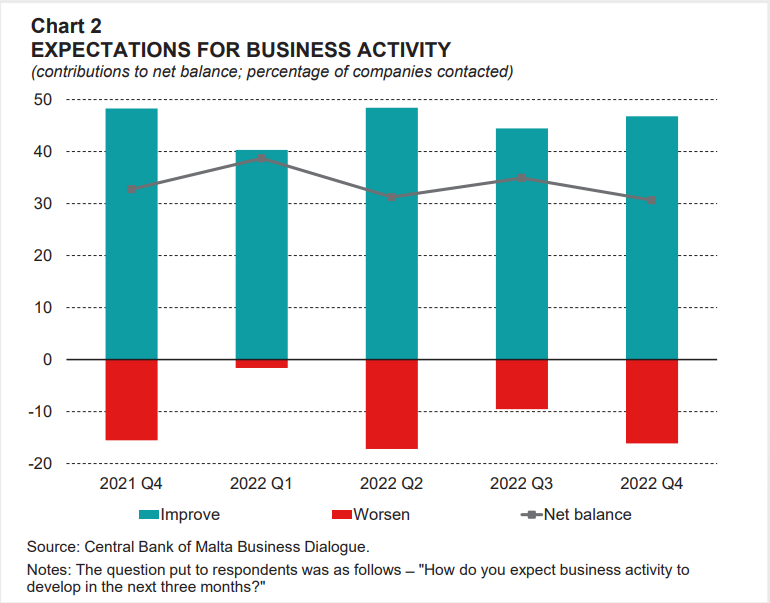

Looking forward to the next three months, firms expect business conditions to be slightly less positive overall. While the number of firms anticipating improved business conditions increased to 47 per cent from 44 per cent, the number of firms expecting conditions to get worse also increased from 10 per cent to 16 per cent.

The most optimistic firms were those in the service sector, with the net balance of firms expecting positive business conditions increasing from 35 per cent to 57 per cent.

Meanwhile, only 13 per cent of firms in the construction and manufacturing industry expect an improvement in business activity over the next three months, a steep decline compared to 75 per cent in the previous quarter.

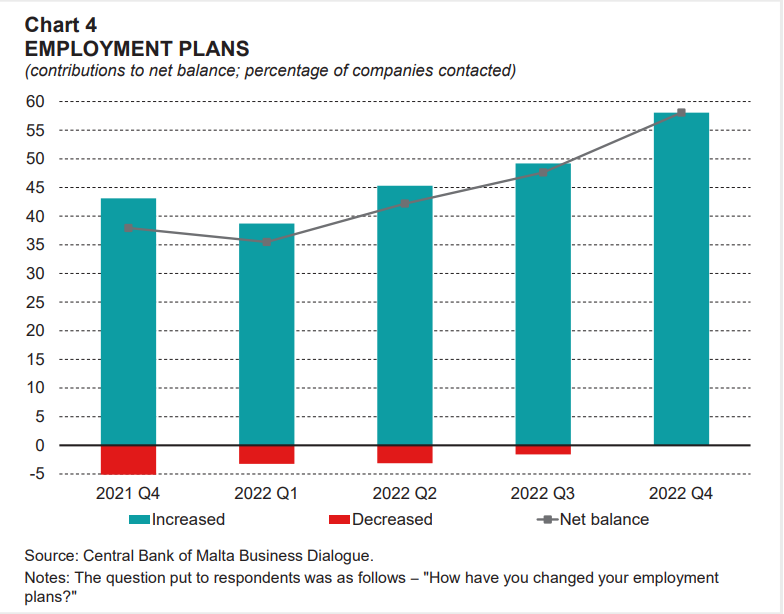

As was noted in the previous quarter, companies are highly concerned about labour shortages and high rates of turnover. Meanwhile, companies in the fields of tech, compliance and finance find it particularly challenging to employ skilled workers. As a remedy, one company reported having relocated part of its operations to another country.

Despite challenges in finding the right workers, firms are still planning to hire. 58 per cent of respondents anticipate higher employment in their companies, 10 per cent more than the previous quarter, and not a single company said it intends to lay-off staff, which is fairly remarkable.

Hiring intentions were more prevalent in the service sector, followed by manufacturing, real estate and construction.

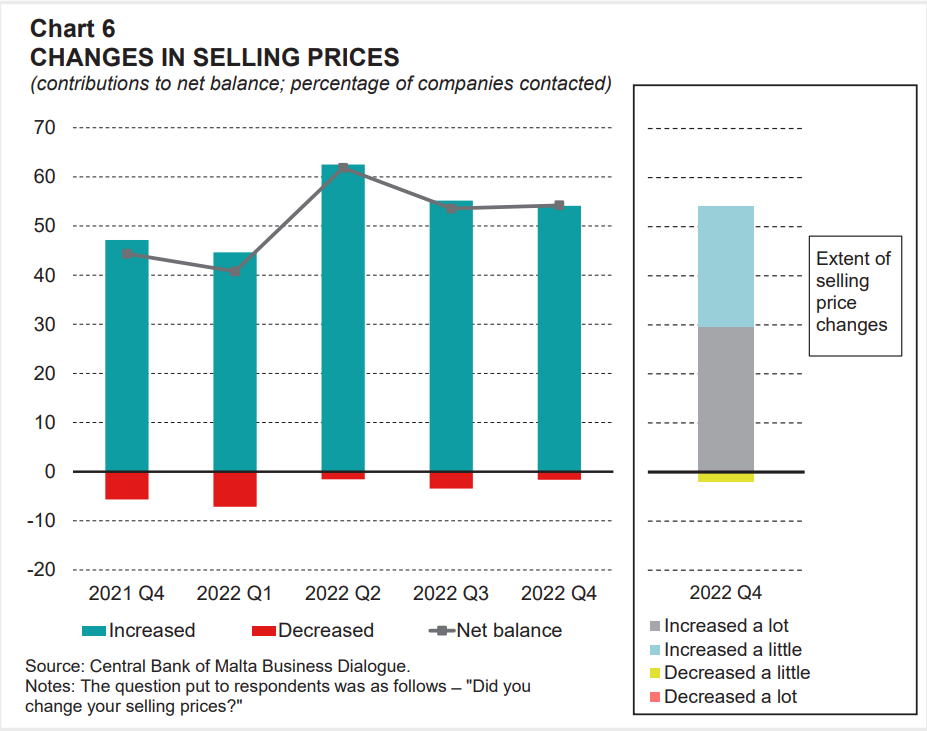

However, despite optimistic intentions on hiring, cost pressures remain elevated for Malta’s businesses. Firms are experiencing high input prices due to global price spikes in several commodities and higher wage demands. The result is higher input costs across all sectors of the economy. While transportation prices dropped for goods from China, containers from mainland Europe remain elevated.

All these compounding effects mean that hardly any company expects their unit costs to decrease in the next quarter.

While some companies argued that consumers are becoming more accepting of price increases, some businesses are still absorbing some of the costs themselves to remain competitive. Fortunately, profitability does not seem to have been severely impacted by these measures and some firms reported that they even managed to increase sales levels, while others found measures to be more efficient or secure better pricing through bulk pruchases.

Unpacking Malta’s new American-style bankruptcy framework

The EU is reforming its insolvency rules to adopt some of the most beneficial elements of the US framework

More than half of all workplace deaths in last two years involved construction

No women died on the job in 2022 and 2023

Government shells out close to €70 million to national bus operator Malta Public Transport in 2023

Buses became free for residents in late 2022, leading to a hefty increase in the public subsidy